Publications

This is a list of papers I’ve authored (or co-authored) which have been published, in reverse chronological order.

August 2025

The M&A Dance

Orchestrating synergies and value creation in public company acquisitions

This report examines why many public company M&A deals fail to deliver sustainable shareholder value — and how the best acquirers beat the odds. Drawing on data from over 3,000 deals, it analyses the drivers of total shareholder return, the challenges of realising post-merger synergies, and the frameworks that enable disciplined, long-term value creation.

June 2025

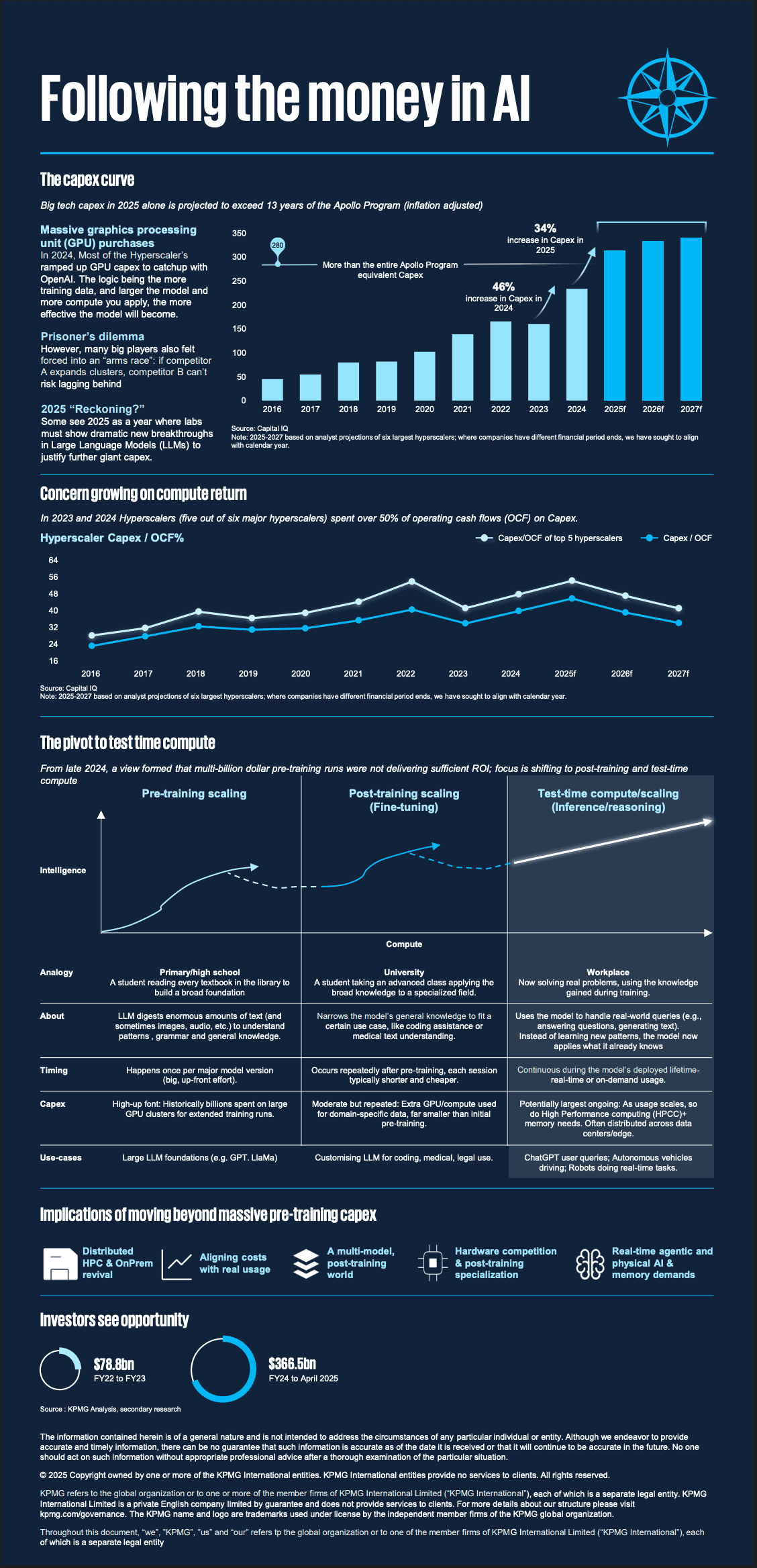

Following the Money in AI

Orchestrating synergies and value creation in public company acquisitions

Examines the unprecedented scale of hyperscaler investment in AI infrastructure — forecast to exceed US$1 trillion between 2025–2027 — and the strategic dilemmas it creates.

Introduces a ‘return-on-compute’ framework to assess capital allocation, analysing six forces shaping AI economics: shifting compute S-curves, token pricing and cost dynamics, open-source acceleration, emerging bottlenecks, demand from agentic and physical AI, and China’s parallel supply chain. Offers strategic takeaways for converting today’s AI CapEx into sustainable future cash flows.

Introduces a ‘return-on-compute’ framework to assess capital allocation, analysing six forces shaping AI economics: shifting compute S-curves, token pricing and cost dynamics, open-source acceleration, emerging bottlenecks, demand from agentic and physical AI, and China’s parallel supply chain. Offers strategic takeaways for converting today’s AI CapEx into sustainable future cash flows.

March 2025

The Asia Data Center Landscape

Market forces and value creation from strategic carve-outs

The global data centre market is booming, driven by soaring data consumption and AI adoption, with a projected CAGR of 12% over the next decade. While the U.S. and Europe lead in terms of GW of data centre capacity, Asia Pacific is surging ahead. Key markets like Hong Kong and Singapore are already thriving, while emerging hubs like Thailand and India are rapidly catching up.

This growth is fueling a trend of strategic carve-outs, where telecoms and conglomerates are divesting non-core data centre assets to unlock significant value and reinvest in core businesses. This report provides a comprehensive analysis of the Asian data centre market, exploring the factors driving growth and the strategic considerations for successful carve-outs.

This growth is fueling a trend of strategic carve-outs, where telecoms and conglomerates are divesting non-core data centre assets to unlock significant value and reinvest in core businesses. This report provides a comprehensive analysis of the Asian data centre market, exploring the factors driving growth and the strategic considerations for successful carve-outs.

January 2025

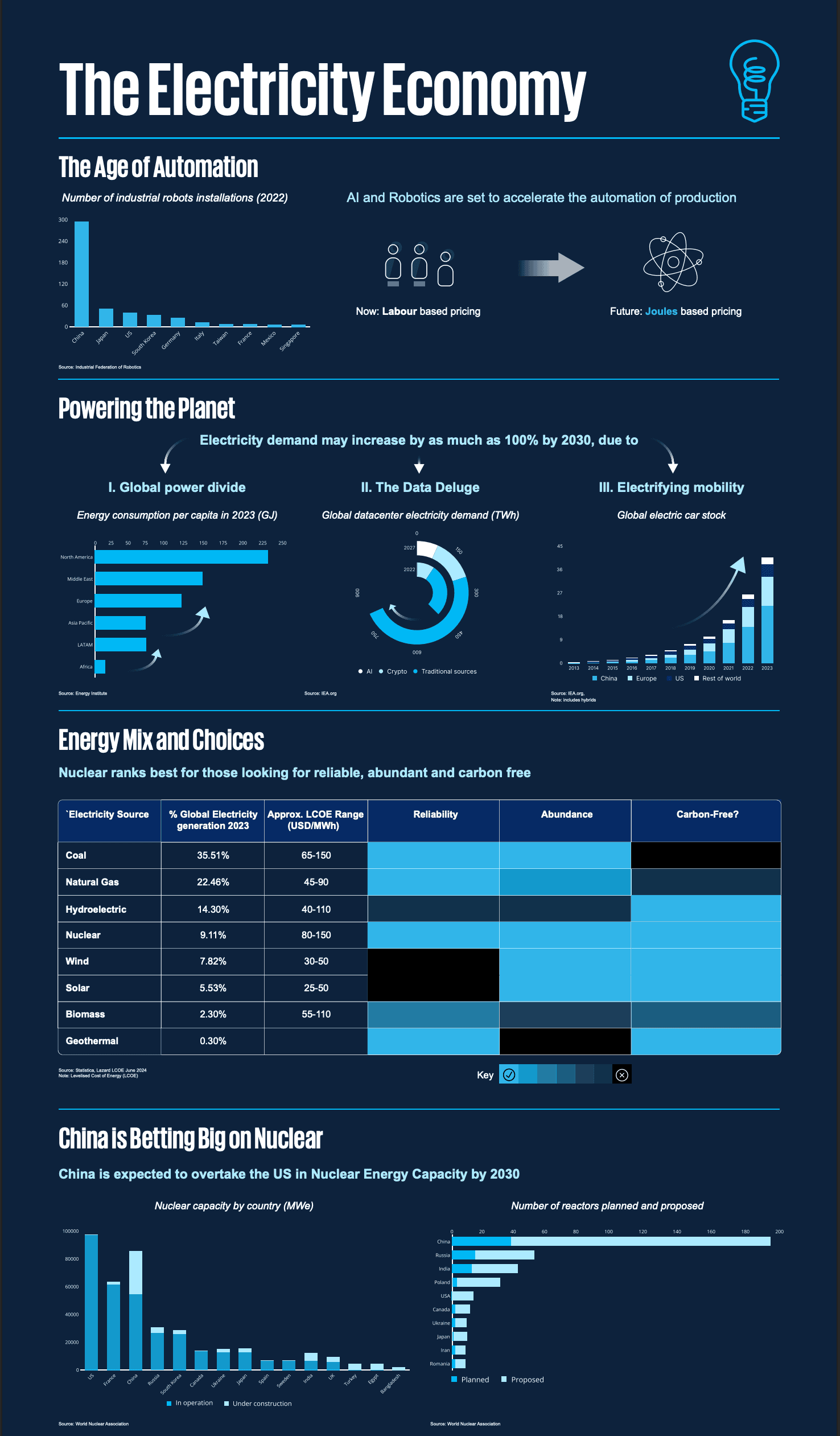

The Electricity Economy

Electricity as the new driver of global competitiveness

Explores the rising strategic importance of cheap, secure and reliable electricity as a driver of global competitiveness amid surging demand from emerging markets, data centres and transport electrification. Highlights nuclear power — particularly small modular reactors (SMRs) — as a critical baseload solution, and analyses growing M&A activity in the nuclear sector, including the increasing role of institutional and strategic investors.

December 2024

Virtual Assets 2025

2024 Review and 2025 Outlook

2024 witnessed a boom in the virtual asset industry, fueled by favorable policy changes and macroeconomic trends. Institutional investment surged, spot ETF approvals came through, and global political support strengthened, leading to a surge in crypto prices and capital inflow. This positive momentum, combined with strong 2024 performance, positions the virtual asset market for wider mainstream adoption in 2025.

This report provides an overview of the major developments in the virtual assets sector in 2024 and shares insights on potential developments in the coming year.

This report provides an overview of the major developments in the virtual assets sector in 2024 and shares insights on potential developments in the coming year.

December 2024

Virtual Assets 2024

2023 Review and 2024 Outlook

Price recovery, legal victories and regulatory advances in 2023 enabled the virtual assets sector to recover and build for the future.

This review and outlook provides a guide to the major developments in the sector during 2023, and shares insights on the possible paths that virtual assets will take in the year ahead.

This review and outlook provides a guide to the major developments in the sector during 2023, and shares insights on the possible paths that virtual assets will take in the year ahead.

December 2022

Asia Pacific Insurance Sector Opportunities

This report provides an in-depth overview of the insurance sector in the Asia Pacific and the opportunities for M&A as we move into a post-Covid landscape.

The region has a population of more than 4 billion and is the fastest growing insurance market globally, with emerging markets in particular expected to see higher growth in the coming years. The Asia Pacific insurance environment is also continuing to evolve as the pandemic has exposed gaps in healthcare provision, encouraging new customers to purchase more healthcare coverage, and driving a shift from investment to protection products.

At the same time, a number of jurisdictions across Asia Pacific have been opening up to foreign investment in recent years, creating more opportunities for M&A going forward.

The region has a population of more than 4 billion and is the fastest growing insurance market globally, with emerging markets in particular expected to see higher growth in the coming years. The Asia Pacific insurance environment is also continuing to evolve as the pandemic has exposed gaps in healthcare provision, encouraging new customers to purchase more healthcare coverage, and driving a shift from investment to protection products.

At the same time, a number of jurisdictions across Asia Pacific have been opening up to foreign investment in recent years, creating more opportunities for M&A going forward.

November 2022

The Collapse of FTX

Reviews the brief but eventful history of the cryptocurrency exchange that filed for bankruptcy protection on 11 November.

The failure of the company, in particular the revelations about how it was being run, has delivered a shock to the virtual assets sector. Our report explores the reasons behind FTX’s rapid downfall, and looks at the implications for regulators, operators, users and investors across the virtual assets space. While the demise of FTX has raised questions about the crypto sector, it also offers an opportunity for stakeholders to create a more transparent market.

The failure of the company, in particular the revelations about how it was being run, has delivered a shock to the virtual assets sector. Our report explores the reasons behind FTX’s rapid downfall, and looks at the implications for regulators, operators, users and investors across the virtual assets space. While the demise of FTX has raised questions about the crypto sector, it also offers an opportunity for stakeholders to create a more transparent market.

October 2021

Crypto Insights Part 1

DeFi consists of financial services enabled by public blockchains and smart contracts executing rules set by developers and governance token-holders, with no ability for a central party to intervene or manipulate users’ assets. This is a new way of building, based on constantly developing innovative technologies pushed forward by a large community of tech-savvy market participants.

This backdrop attracts two potentially opposing forces – accelerated innovation and regulatory attention. In this instalment, we offer a background to decentralised finance and key factors which we believe will impact its evolution.

This backdrop attracts two potentially opposing forces – accelerated innovation and regulatory attention. In this instalment, we offer a background to decentralised finance and key factors which we believe will impact its evolution.

October 2021

Crypto Insights Part 2

In the second report of the Crypto Insights series, KPMG examines the Decentralised Exchanges (DEXs) that enable token trading. Crypto projects run on tokens which allow liquidity to flow into the most productive and in-demand protocols. A key challenge for early DEXs was liquidity, however this has by and large been solved by an innovation called ‘Automated Market Makers’ (AMM).

In this instalment on DEXs, we discuss the competitive landscape, the AMM innovation and mechanics, advantages and challenges of AMMs, and the future of DEXs.

In this instalment on DEXs, we discuss the competitive landscape, the AMM innovation and mechanics, advantages and challenges of AMMs, and the future of DEXs.

September 2019

The Rise of the Tech Giants

This article analyses how technology platforms and apps such as Alibaba’s Alipay and Tencent’s WeChat Pay are reshaping the payments landscape in China, and the subsequent impact this is having on banks and consumers. We also discuss whether other viable competitors to Alipay and WeChat Pay could emerge as challengers in the payments space.

September 2017

Finance in Indonesia

This paper pulls together in-market insights from

working with regulators, state owned and private financial

institutions and a range of fintech providers, and sets out

what we see as the hot topics for finance in Indonesia. In the

paper, I give perspectives on opportunities, and

recommendations for improving the finance climate.

working with regulators, state owned and private financial

institutions and a range of fintech providers, and sets out

what we see as the hot topics for finance in Indonesia. In the

paper, I give perspectives on opportunities, and

recommendations for improving the finance climate.

January 2017

Retail Payments in Indonesia

A publication which sets out the Indonesian ePayments landscape and infrastructure, and summarizes past and planned regulatory developments, and an early view on which players may prevail.

April 2016

Insurance in Indonesia

A publication looking at the market landscape for Insurance in Indonesia – covers Life, Non-Life, Reinsuance, Broking, Distribution and Products.

April 2015

New Indonesian ‘Branchless Banking’ and Microfinance Laws

A publication looking at the opportunities in MicroFinance in Indonesia.