Supply and Demand

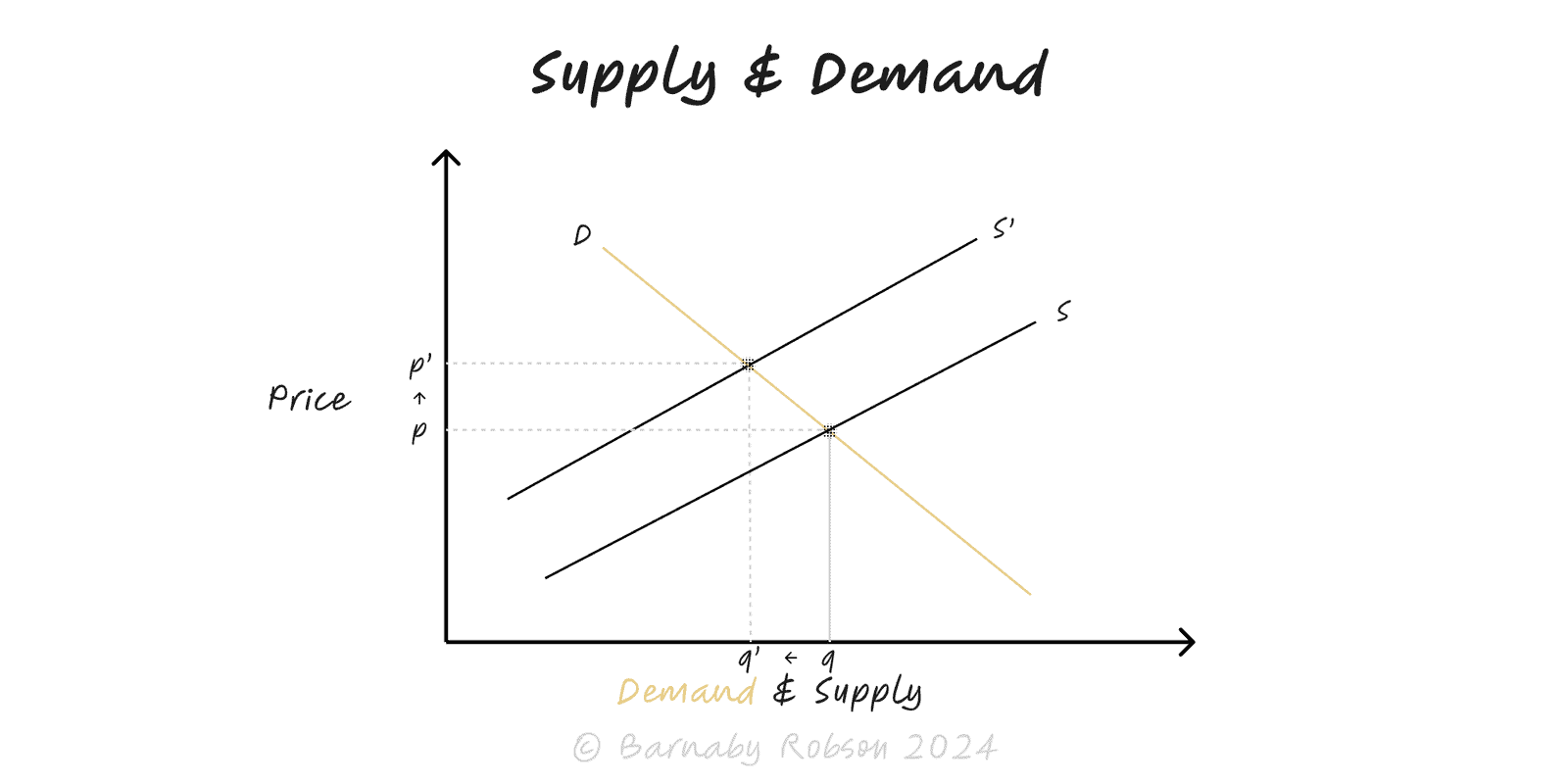

Prices and quantities are set by the interaction of willingness to buy and willingness to sell. Shifts in either curve change the equilibrium; elasticities determine how much price vs volume moves.

Author

Classical and neoclassical economics (Smith, Marshall, Walras)

Model type