Second Order Thinking

Consider the long-term and indirect consequences of decisions, rather than just the immediate or obvious ones.

Author

Common usage (Farnam Street popularised in business)

Model type

Consider the long-term and indirect consequences of decisions, rather than just the immediate or obvious ones.

Common usage (Farnam Street popularised in business)

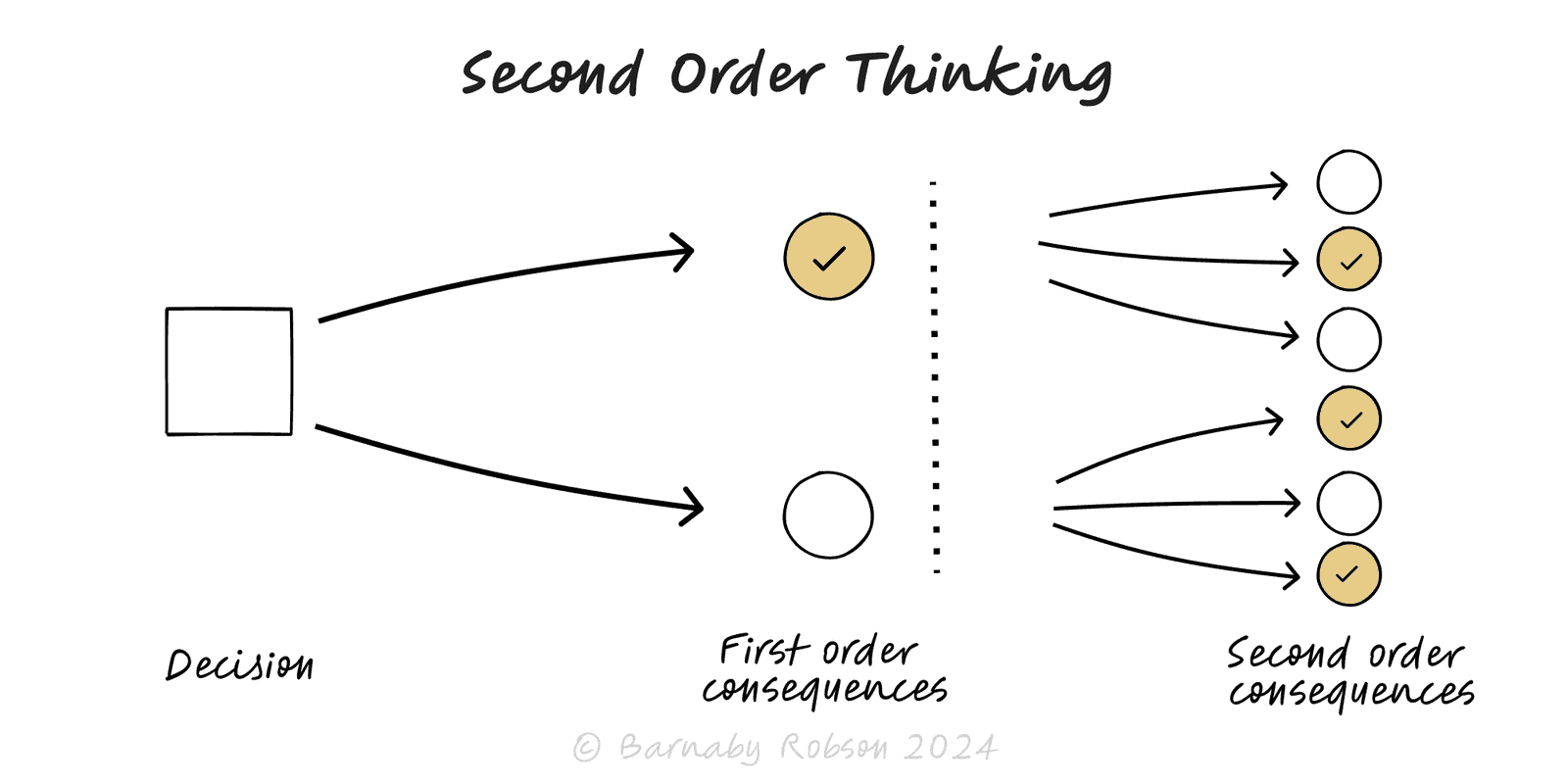

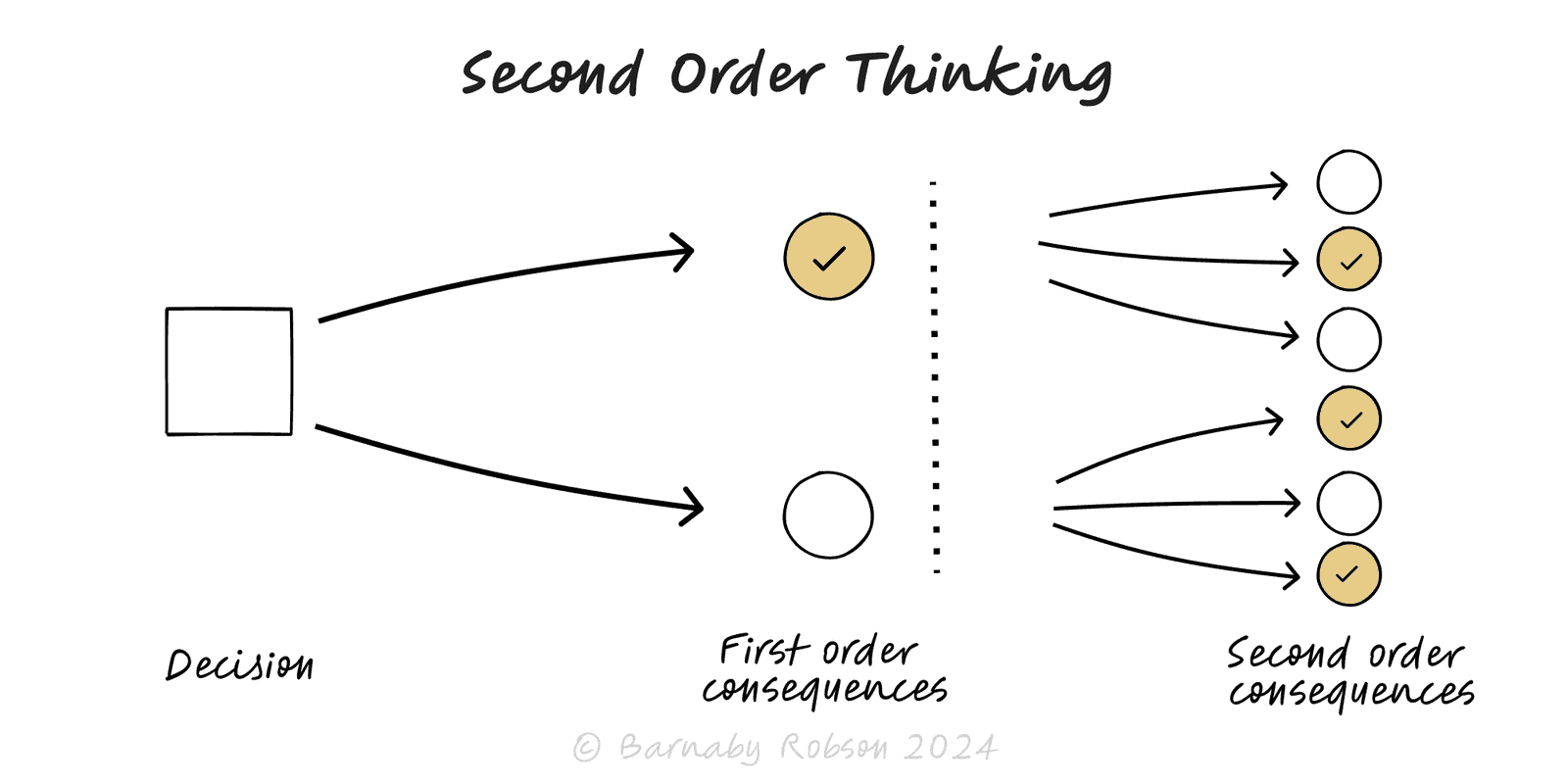

First-order thinking asks “what happens if we do X?”. Second-order thinking asks “and then what?”.

It forces you to model reactions (customers, competitors, regulators, staff), intertemporal effects (today vs later), and general-equilibrium adjustments (prices, capacity, incentives).

First vs second order – immediate effect versus knock-ons and adaptations.

Agent responses – competitors counter, users game rules, suppliers reprice, teams reroute effort.

Intertemporal trade-offs – short-term lift vs long-term decay, habit formation, switching costs.

Equilibrium shifts – new steady state after capacity, prices, and behaviour adjust.

Displacement & leakage – effects move elsewhere (channels, segments, geos).

Non-linearities & thresholds – tipping points, queueing, network effects.

Reflexivity – the narrative changes the territory (Goodhart/metric gaming).

Pricing & promos – boost volume now; second-order: train discount expectation, provoke price war.

Comp & incentives – pay for X; second-order: gaming, cherry-picking, risk-shifting.

Product policy – tighten fraud rules; second-order: false negatives ↑, support load ↑, UX churn.

Ops changes – speed one step; second-order: bottleneck moves downstream (TOC).

Regulatory/contract terms – cap fees; second-order: reduced supply, quality downgrades.

Investing & markets – beat earnings; second-order: mean reversion, competitor entry, multiple compression.

M&A integration – centralise a function; second-order: edge teams slow, shadow IT grows.

State the first-order effect – what you expect immediately; include size and timing.

Map stakeholders – customers, competitors, partners, regulators, internal teams.

Write “then what?” chains – 2–3 steps out for each stakeholder; note direction, magnitude, timing.

Quantify & bound – identify biggest second-order terms; model ranges, not points.

Design for robustness – choose options that still work after adaptation; add guardrails to curb gaming.

Set tripwires – leading indicators that tell you a second-order effect is landing (e.g., discount re-purchase lag).

Review & iterate – compare outcomes to the chain; update playbook.

Analysis paralysis – infinite branching; cap depth at two rounds and act.

Ignoring base rates – start from how similar moves played out elsewhere.

Linear thinking – missing thresholds and capacity constraints.

One-agent tunnel vision – forgetting competitor and channel responses.

Wrong horizon – optimising the week and destroying the quarter (or vice versa).

Click below to learn other mental models

Before building, map the space: the key forks, dead ends and dependencies—so you can choose a promising path and run smarter tests.

When a rising power threatens to displace a ruling power, fear and miscalculation can tip competition into conflict unless incentives and guardrails are redesigned.

Aim for vertical progress—create something truly new (0 → 1), not just more of the same (1 → n). Win by building a monopoly on a focused niche and compounding from there.