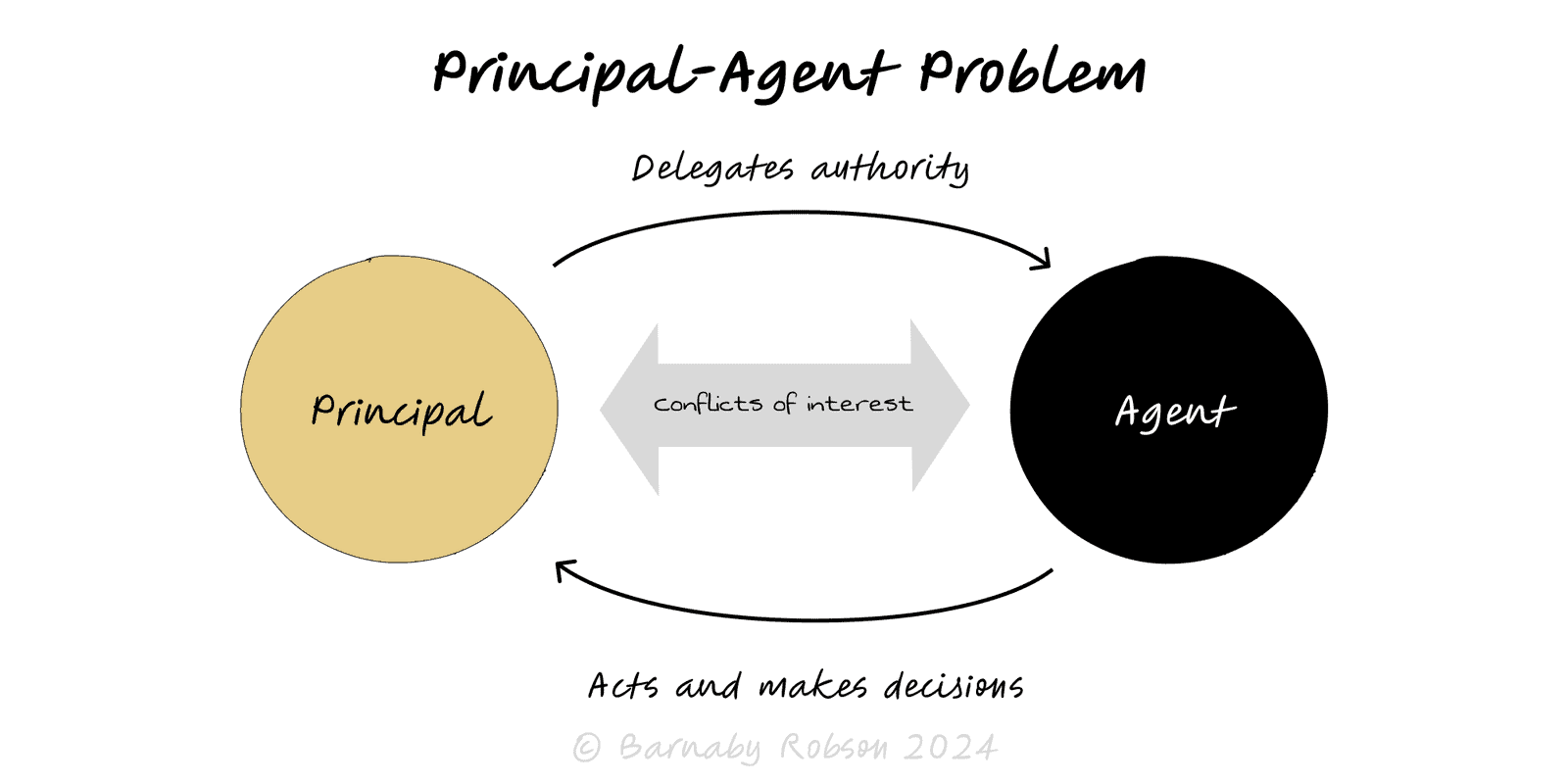

Principal-Agent Problem

When decision rights are delegated, agents optimise their own payoff under information asymmetry. Without smart contracts and governance, effort, risk and horizon drift away from the principal’s goals.

Author

Economics/contract theory (Jensen–Meckling; Akerlof; Holmström)

Model type