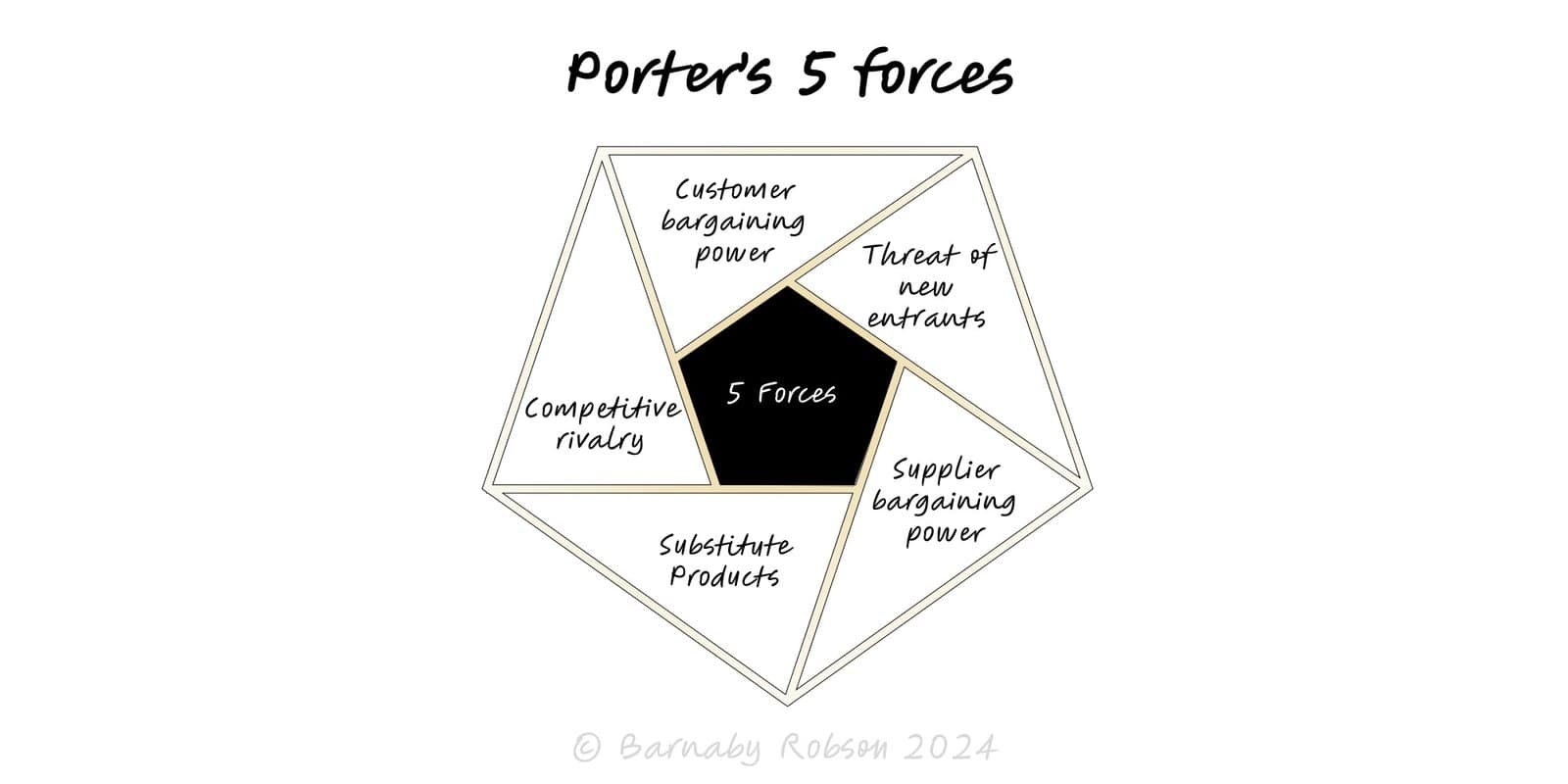

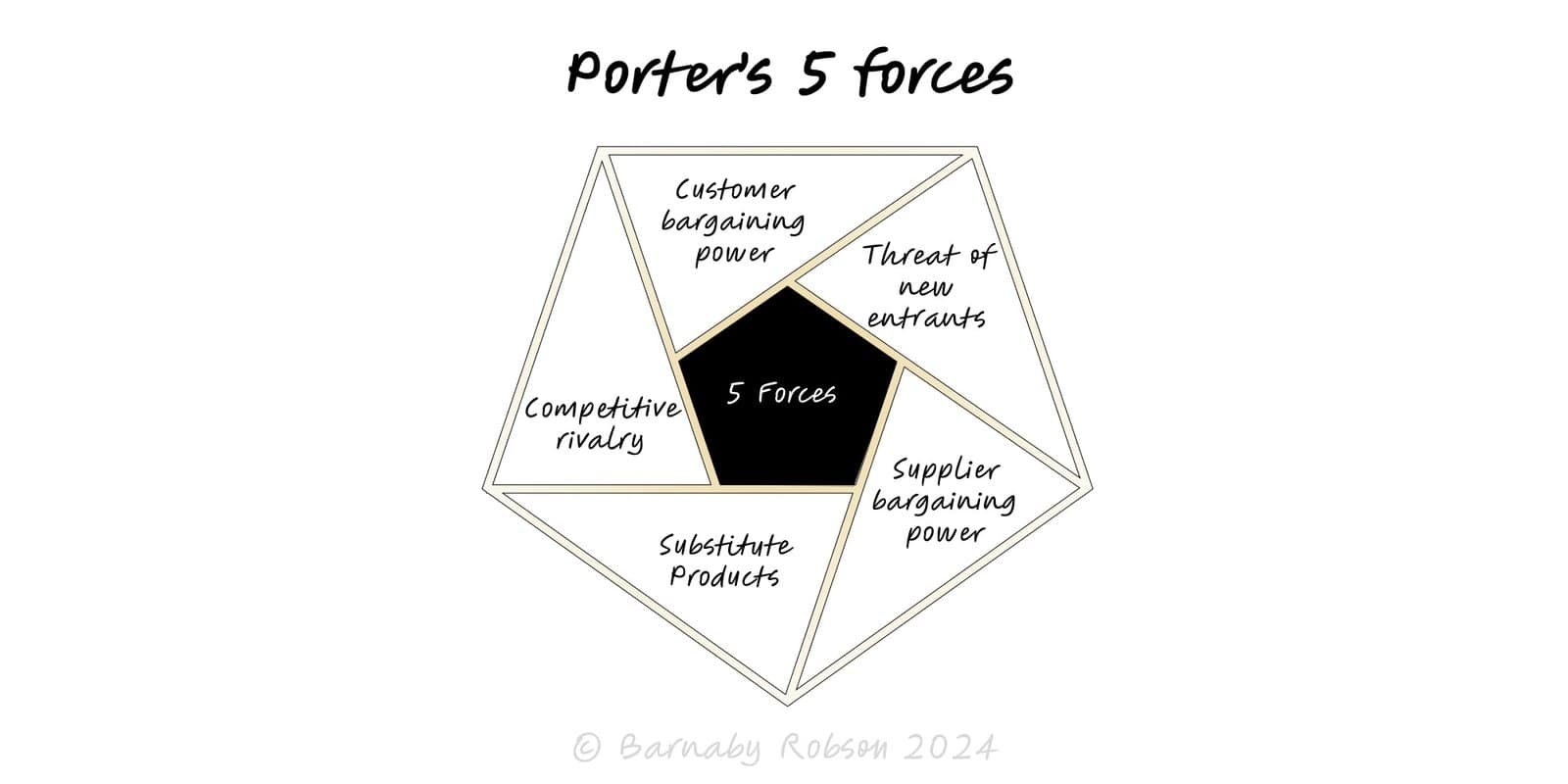

Porter’s five forces

A framework to assess industry structure and profit pools by evaluating five competitive forces and their drivers.

Author

Michael E. Porter (Harvard Business School)

Model type

A framework to assess industry structure and profit pools by evaluating five competitive forces and their drivers.

Michael E. Porter (Harvard Business School)

Introduced in 1979, Five Forces evaluates industry attractiveness by analysing how structural pressures shape long-run profitability. It focuses on external competitive forces rather than internal capabilities, making it a baseline for market entry, strategy, and diligence.

Threat of new entrants

Barriers set price and margin floors. Drivers include scale economies, capital requirements, regulation, access to distribution, switching costs, network effects, brand, IP, and retaliation credibility.

Bargaining power of suppliers

Powerful, concentrated, or differentiated suppliers can raise input prices or reduce quality. Risks increase with scarce inputs, high switching costs, and low supplier dependence on your volumes.

Bargaining power of buyers

Large or price-sensitive buyers force lower prices and better terms, especially with low switching costs, standardised products, high price transparency, or backward integration threats.

Threat of substitutes

Alternative solutions cap prices and margins. Watch cross-elasticities, adjacent technologies, and job-to-be-done overlaps.

Rivalry among existing competitors

Intense rivalry compresses margins. Signals include many similarly sized players, slow growth, high fixed costs, undifferentiated offers, frequent capacity adds, and low switching costs.

Default plays by force

Entrants: raise barriers via scale, brand, data advantages, network effects, switching costs, regulation, or exclusive access.

Suppliers: multi-source, redesign specs, backward integrate, or aggregate demand.

Buyers: differentiate, bundle, raise switching costs, forward integrate selectively, price fence.

Substitutes: reposition to different job-to-be-done, bundle, improve convenience, or move to usage-based models.

Rivalry: differentiate on product or channel, shift basis of competition, capacity discipline, selective consolidation.

1. Market entry and exit decisions, including greenfield vs acquisition.

2. Commercial due diligence and equity stories.

3. Pricing power and margin resilience assessment.

4. Portfolio weighting and country or category prioritisation.

5. Antitrust narratives and regulatory submissions.

6. Platform strategy diagnostics for two-sided markets.

1. Treating the model as static. Revisit as industry clockspeeds and tech change.

2. Mis-scoping the industry. Segment granularity matters more than broad SIC labels.

3. Confusing firm-level capability with industry structure. Use Five Forces with a capabilities or moat view.

4. Ignoring complementors and ecosystem power in platform markets.

5. Applying old metrics to new models. Two-sided platforms, SaaS, and marketplaces hinge on multi-homing, take rates, and network effects.

6. Overlooking regulation, switching-cost engineering, and bundling that can structurally alter forces.

Click below to learn other mental models

Before building, map the space: the key forks, dead ends and dependencies—so you can choose a promising path and run smarter tests.

When a rising power threatens to displace a ruling power, fear and miscalculation can tip competition into conflict unless incentives and guardrails are redesigned.

Aim for vertical progress—create something truly new (0 → 1), not just more of the same (1 → n). Win by building a monopoly on a focused niche and compounding from there.