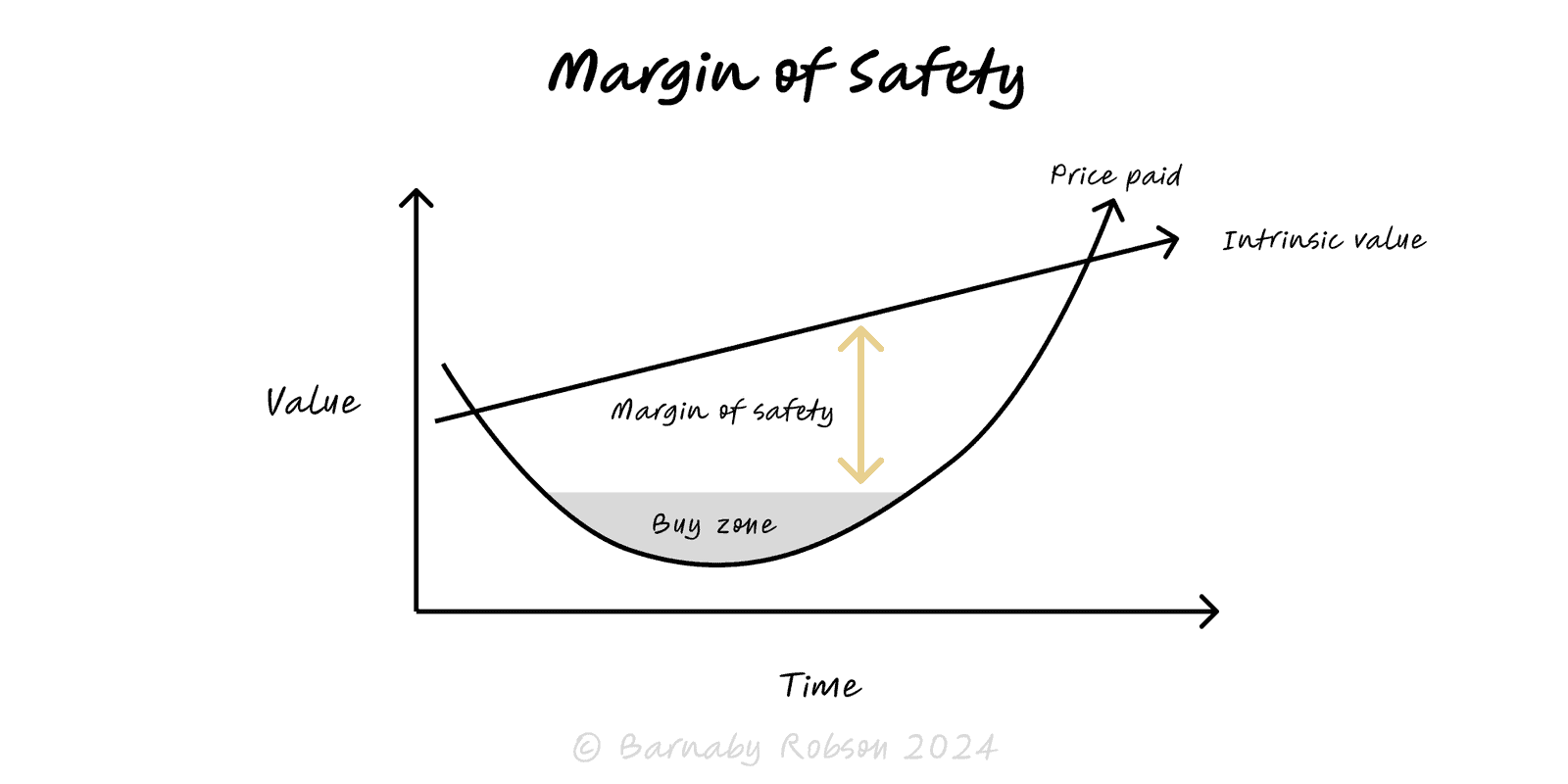

Margin of Safety

Deliberately leave room for error—buy below value, build above load, plan beyond the optimistic case—so mistakes and volatility don’t cause ruin.

Author

Benjamin Graham (investing); adopted by Warren Buffett & Charlie Munger. Engineering origin in safety factors.

Model type