Fat Protocol Thesis

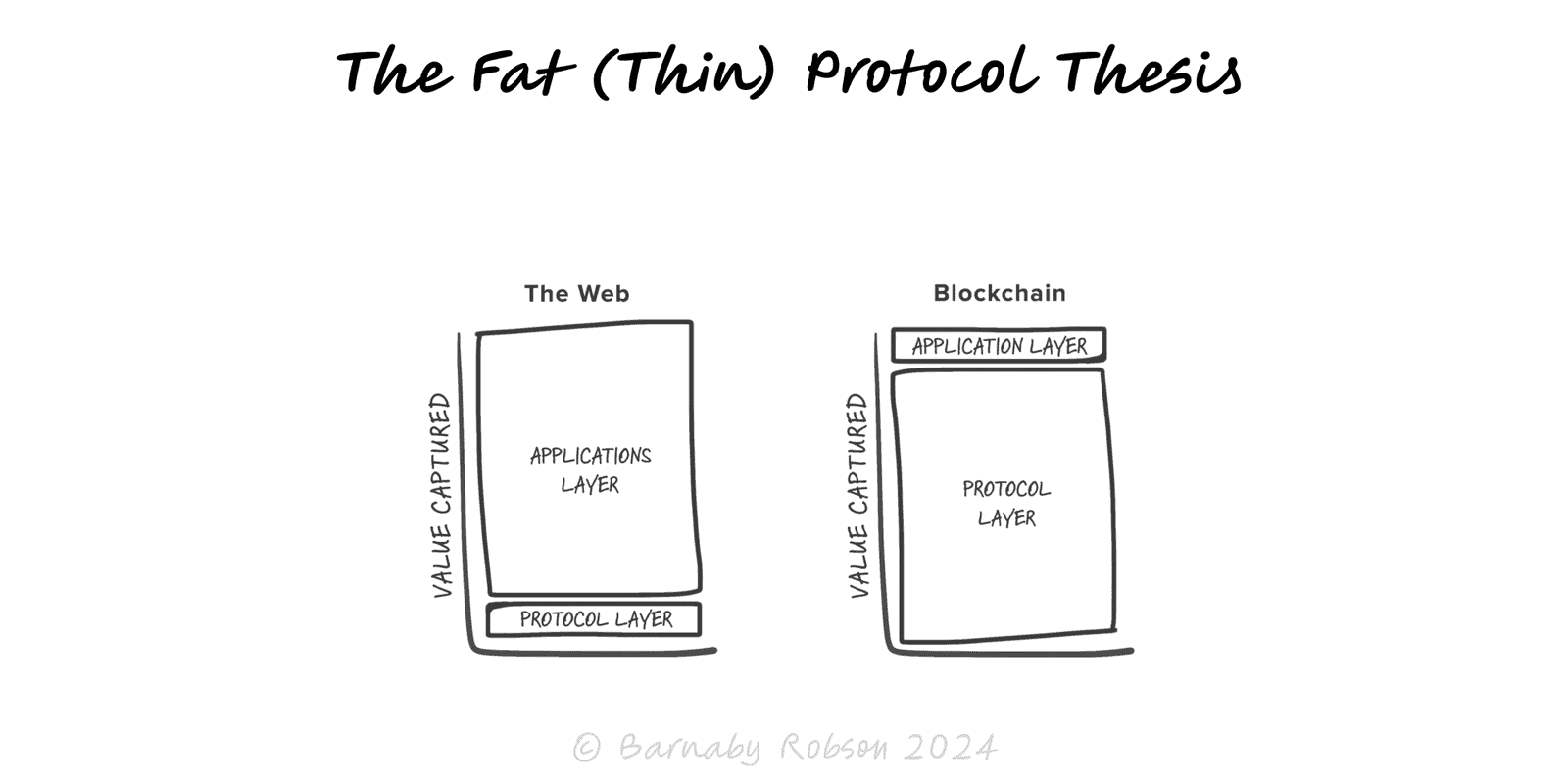

In blockchains, value tends to concentrate at the shared protocol layer rather than the application layer, though modular stacks and wallets can shift where value accrues.

Author

Joel Monegro (Union Square Ventures, 2016)

Model type