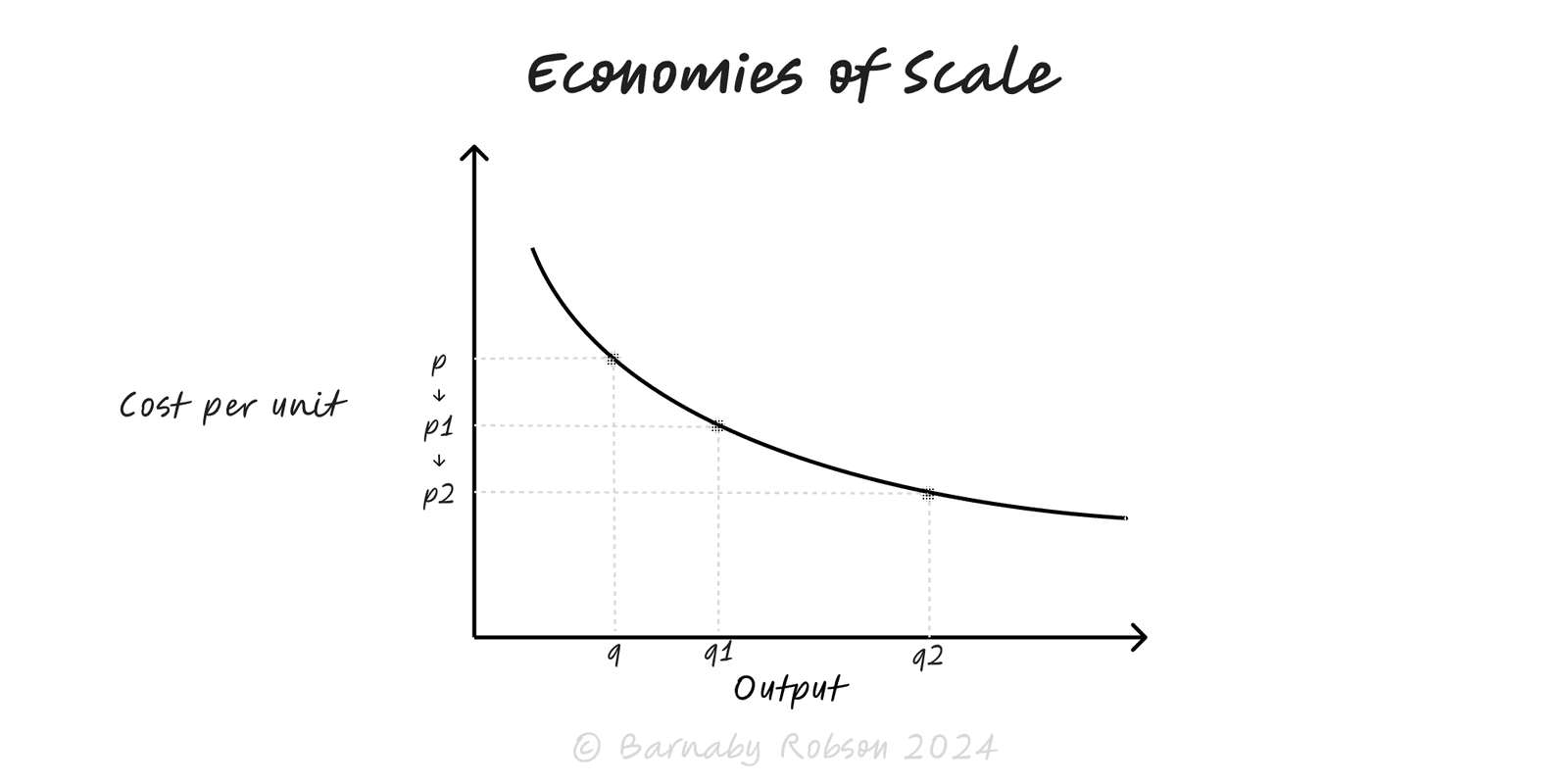

Economies of Scale

Produce more to lower average cost by spreading fixed costs, improving specialisation and buying better—until coordination costs bite.

Author

Microeconomics (Marshall et al.); experience curve popularised by Bruce Henderson (BCG)

Model type