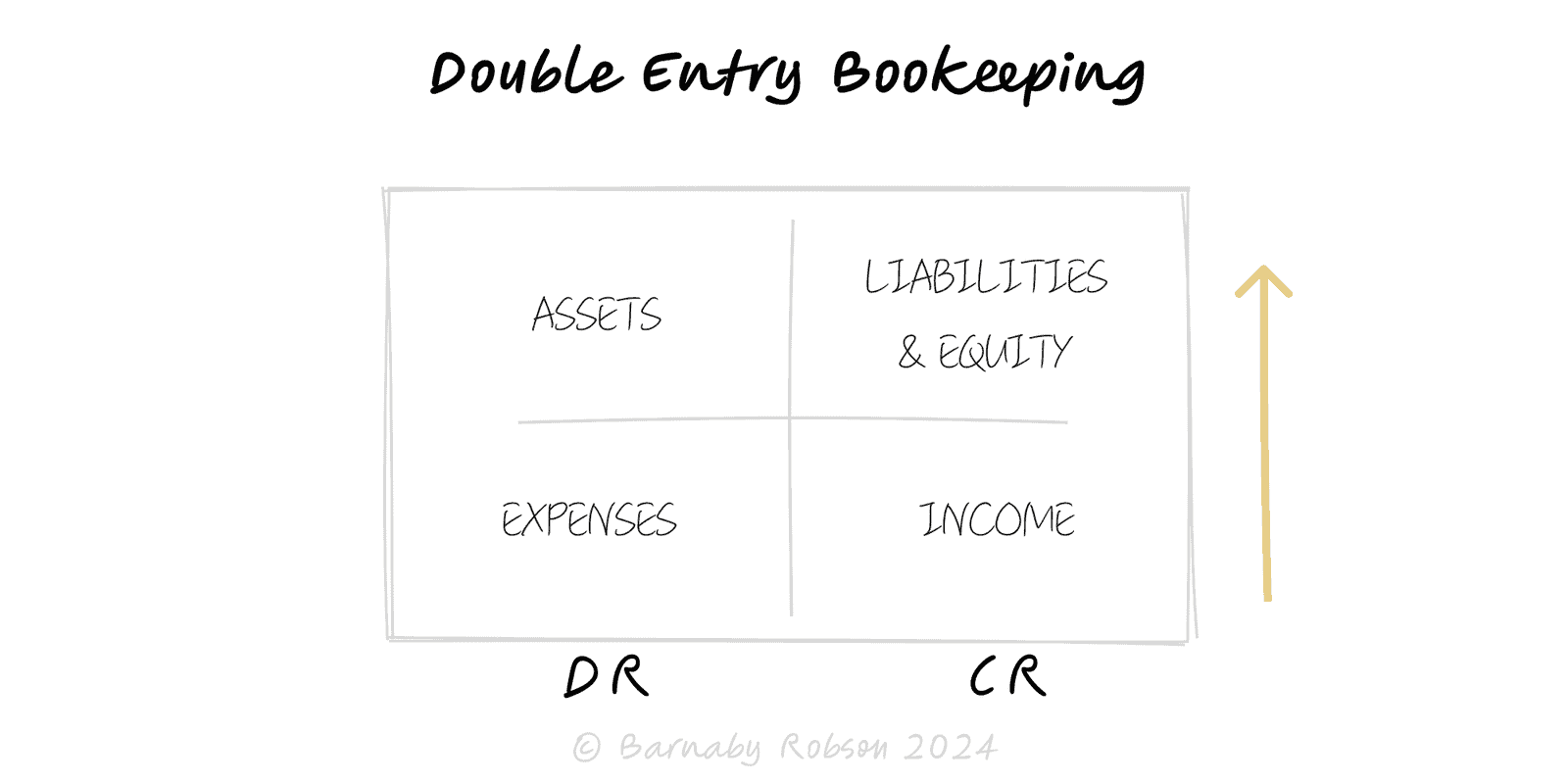

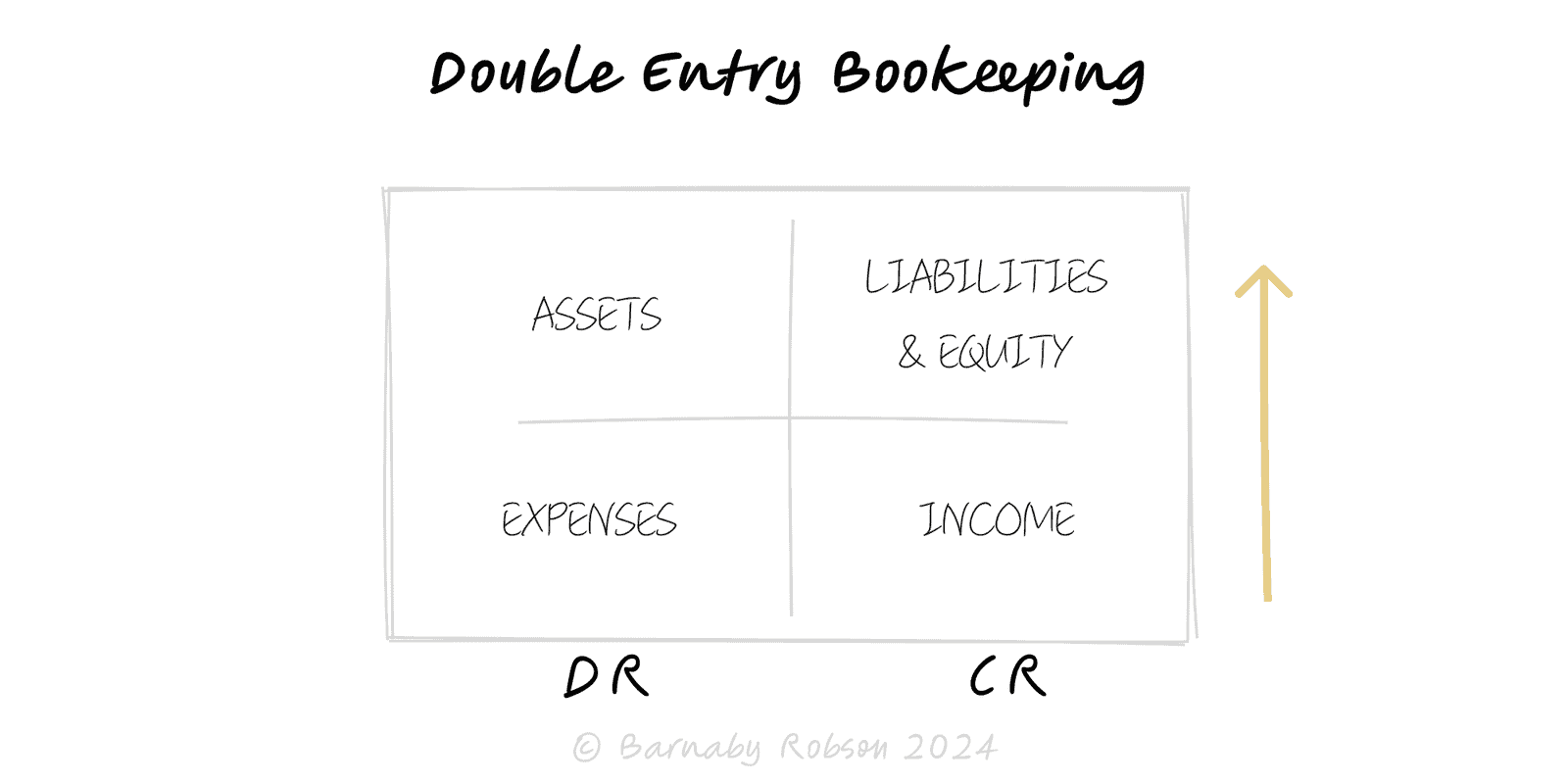

Double-Entry Bookkeeping

Every transaction records equal debits and credits; ensures the books balance and errors surface.

Author

Luca Pacioli (1494) – modern accounting practice

Model type

Every transaction records equal debits and credits; ensures the books balance and errors surface.

Luca Pacioli (1494) – modern accounting practice

Double-entry is the backbone of reliable finance. Each transaction affects at least two accounts such that

Assets = Liabilities + Equity remains true. The method creates an audit trail, enables accrual accounting, and scales from a sole trader to listed companies.

Accounting equation – must hold after every entry: A = L + E.

Debits & Credits (D/C)

Flow – Source docs → Journal (entries) → Ledger (T-accounts) → Trial balance → Adjusted TB → Statements.

Accruals/deferrals – recognise revenue when earned and costs when incurred (matching principle).

Subledgers & control accounts – AR/AP detail rolls up to GL control accounts.

Contra accounts – e.g., Accumulated Depreciation (credit) against Equipment (debit).

Closing entries – reset income/expense to retained earnings at period end.

Self-check – total debits must equal total credits; differences surface via the trial balance.

Financial control & auditability – clean, traceable numbers for management, lenders, and regulators.

Performance management – accruals enable real P&L by period, independent of cash timing.

Fraud/error detection – mismatches and unreconciled balances flag issues.

Systems integration – the universal pattern behind ERPs and APIs (orders → invoices → GL).

Chart of accounts (CoA) – design clear, hierarchical codes for Assets, Liabilities, Equity, Income, Expenses; document usage.

Policies – cash vs accrual, capitalisation thresholds, depreciation methods, revenue recognition, FX, VAT/GST.

Authoring the entry – from a source document, identify the accounts touched and whether each D or C.

Post & reconcile – journal to GL; reconcile bank, AR/AP, payroll, tax, and intercompany monthly.

Adjusting entries – accruals, prepayments, depreciation, bad-debt provisions.

Close – run trial balance, investigate variances, post corrections, produce statements (P&L, Balance Sheet, Cash Flow).

Controls – segregation of duties, numbered docs, approval workflows, change logs, and periodic reviews.

Mixing cash and accrual concepts – leads to distorted margins.

Unreconciled control accounts – AR/AP not tying to subledgers.

Cut-off errors – revenue/expenses in the wrong period.

Misclassification – capex expensed (or vice versa); VAT/GST posted to P&L.

Suspense reliance – parking too much in suspense instead of fixing root causes.

FX & multi-entity slippage – unposted revaluations or out-of-balance intercompany.

Click below to learn other mental models

Before building, map the space: the key forks, dead ends and dependencies—so you can choose a promising path and run smarter tests.

When a rising power threatens to displace a ruling power, fear and miscalculation can tip competition into conflict unless incentives and guardrails are redesigned.

Aim for vertical progress—create something truly new (0 → 1), not just more of the same (1 → n). Win by building a monopoly on a focused niche and compounding from there.