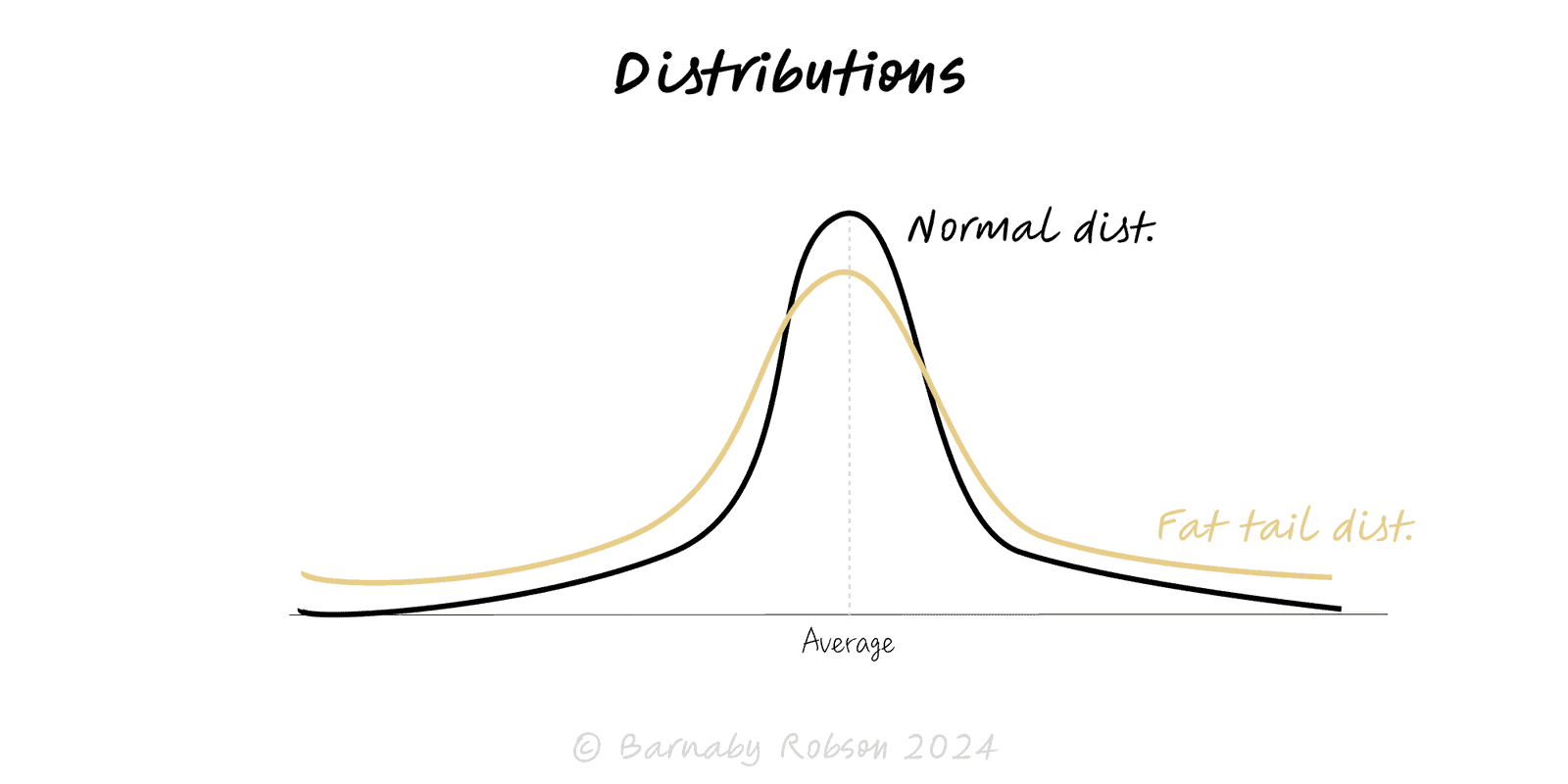

Normal (Gaussian) – additive noise, many small independent effects (CLT). Symmetric, thin tails.

- Heuristics: mean ≈ median; “68–95–99.7%” within 1–2–3σ.

Lognormal – multiplicative growth (price × price × …), non-negative, right-skewed.

- Heuristics: use geometric mean, medians and percentiles; extremes matter.

Exponential – memoryless waiting times between independent events (simple queues, decay).

Poisson – counts of independent rare events per interval (arrivals/defects at low rate).

Power-law (Pareto) – P(X > x) ∝ x^−α above a threshold x_min; few huge values dominate.

- For α ≤ 2 variance is infinite; for α ≤ 1 even the mean diverges (sample averages are unstable).

Mixtures & regime shifts – many domains are blends (e.g., normal body but heavy tail of spikes).

Thin vs heavy tails – thin tails make extremes rare; heavy tails make them decisive.