Compound Interest

Compound Interest is a practical lens to frame decisions and reduce error.

Author

Jacob Bernoulli (roots in early calculus and finance)

Model type

Compound Interest is a practical lens to frame decisions and reduce error.

Jacob Bernoulli (roots in early calculus and finance)

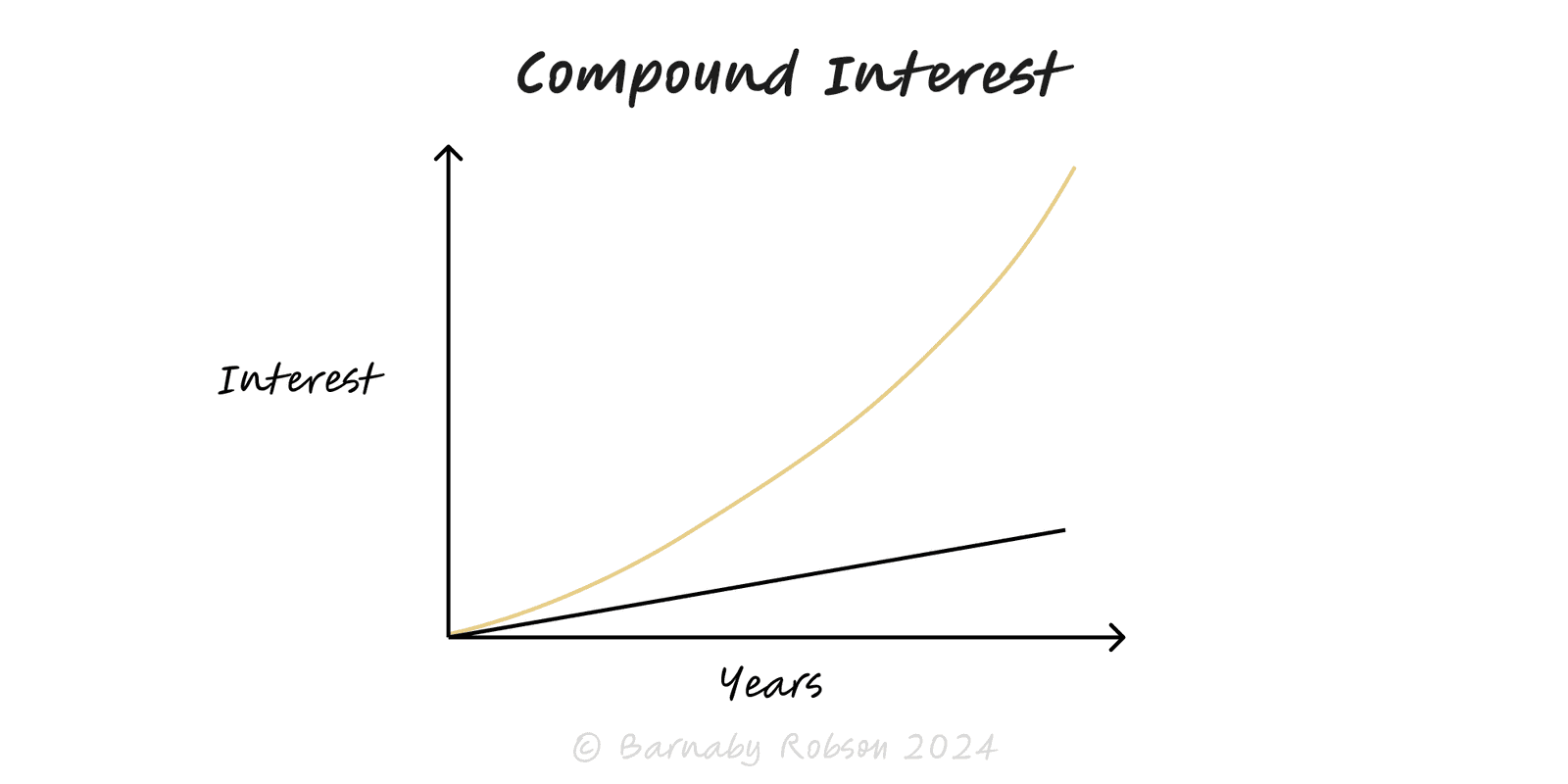

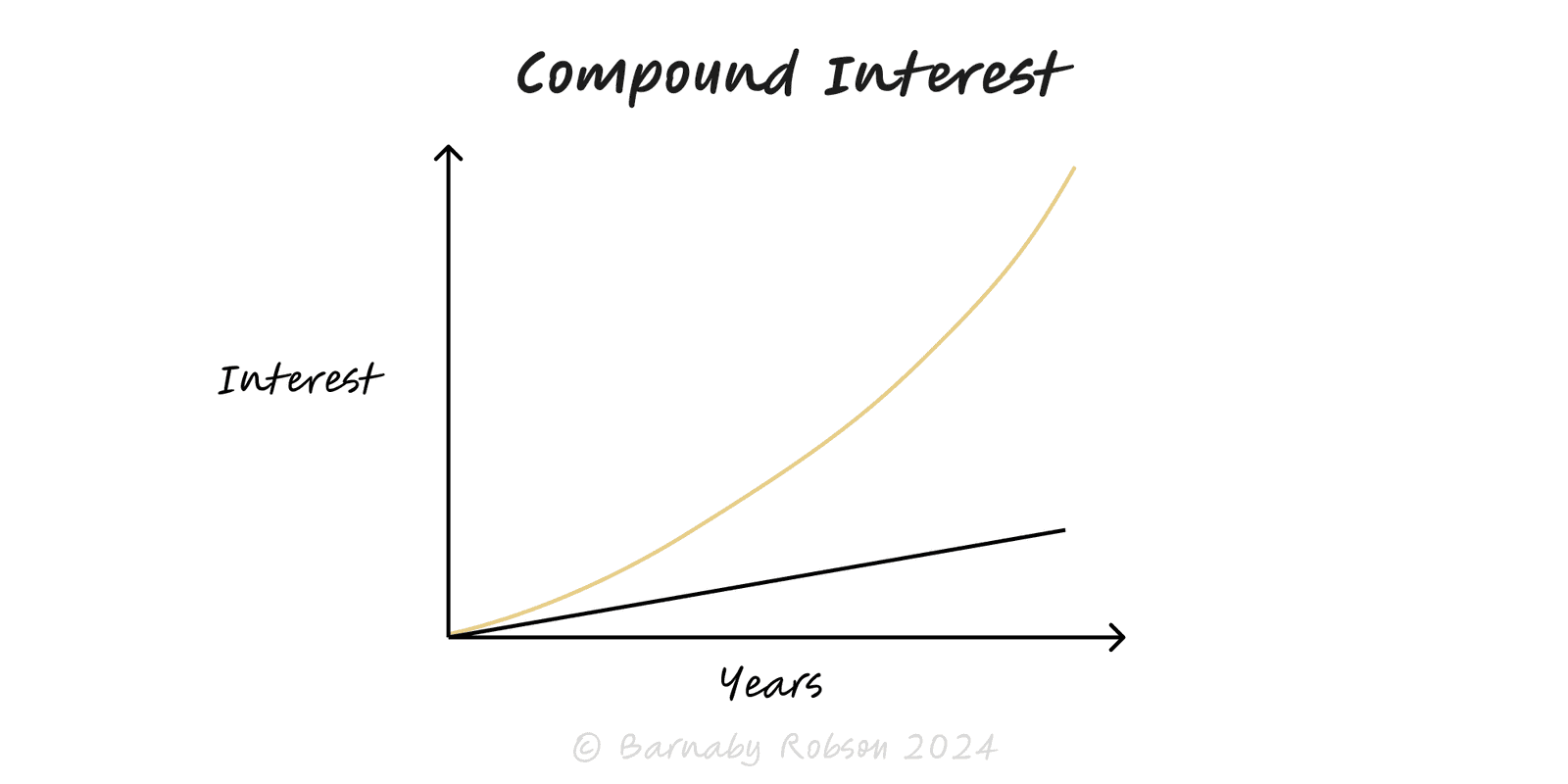

Compound interest is growth on both the original principal and the accumulated returns. With reinvestment, outcomes follow an exponential curve, so rate, time, contributions, and friction (fees, taxes, drawdowns) determine the end result. Used well, compounding is the most reliable engine of wealth and capability growth.

Core formula

Drivers

Rule of 72

Investing and savings – pensions, ISAs, endowments, treasury ladders.

Business finance – retained earnings, reinvested cash flows, interest capitalisation.

SaaS and operations – customer retention and expansion compound revenue (NRR), learning curves compound productivity.

Debt – interest-on-interest works against you on credit balances and leveraged bets.

Set the plan – target capital, time horizon, and realistic after-fee return.

Automate contributions – monthly transfers remove timing excuses and average entry price.

Cut friction – minimise fees and tax drag; use wrappers and low-cost vehicles.

Protect the base – avoid large drawdowns; diversify and size risk so you stay invested.

Lengthen time in market – reduce unnecessary trading; let winners run where thesis holds.

Reinvest systematically – dividends, coupons and windfalls back into the plan.

Review annually – rebalance to risk, update assumptions, keep costs low.

Worked mini-examples

Savings: £10,000 at 7 percent for 10 years, annual compounding → £19,672.

Monthly investing: £500 per month at 6 percent for 15 years → roughly £146k contributed £90k.

Fee drag: 8 percent gross for 30 years at 1.5 percent fees vs 0.2 percent fees

8 − 1.5 = 6.5 percent net → ~6.6× P

8 − 0.2 = 7.8 percent net → ~9.1× P

Small fee differences compound to very large gaps.

Volatility drag – −50 percent then +50 percent ≠ break-even (you end down 25 percent). Focus on geometric returns.

Inflation – think in real terms; 7 percent nominal at 3 percent inflation is ~4 percent real.

Leverage and margin – magnify both gains and losses; guard against forced selling.

Sequence-of-returns risk – early bad years hurt more when withdrawing; adjust draw and risk near retirement.

Stopping reinvestment – spending income breaks the flywheel.

Chasing rate – reaching for yield can raise default risk and ruin compounding.

Click below to learn other mental models

Before building, map the space: the key forks, dead ends and dependencies—so you can choose a promising path and run smarter tests.

When a rising power threatens to displace a ruling power, fear and miscalculation can tip competition into conflict unless incentives and guardrails are redesigned.

Aim for vertical progress—create something truly new (0 → 1), not just more of the same (1 → n). Win by building a monopoly on a focused niche and compounding from there.