Competitive Advantage

A durable edge that lets you create more value or deliver it at lower cost than rivals — and keep it via isolating mechanisms.

Author

Strategy field (Michael Porter; Rumelt; Peteraf; Brandenburger & Stuart)

Model type

A durable edge that lets you create more value or deliver it at lower cost than rivals — and keep it via isolating mechanisms.

Strategy field (Michael Porter; Rumelt; Peteraf; Brandenburger & Stuart)

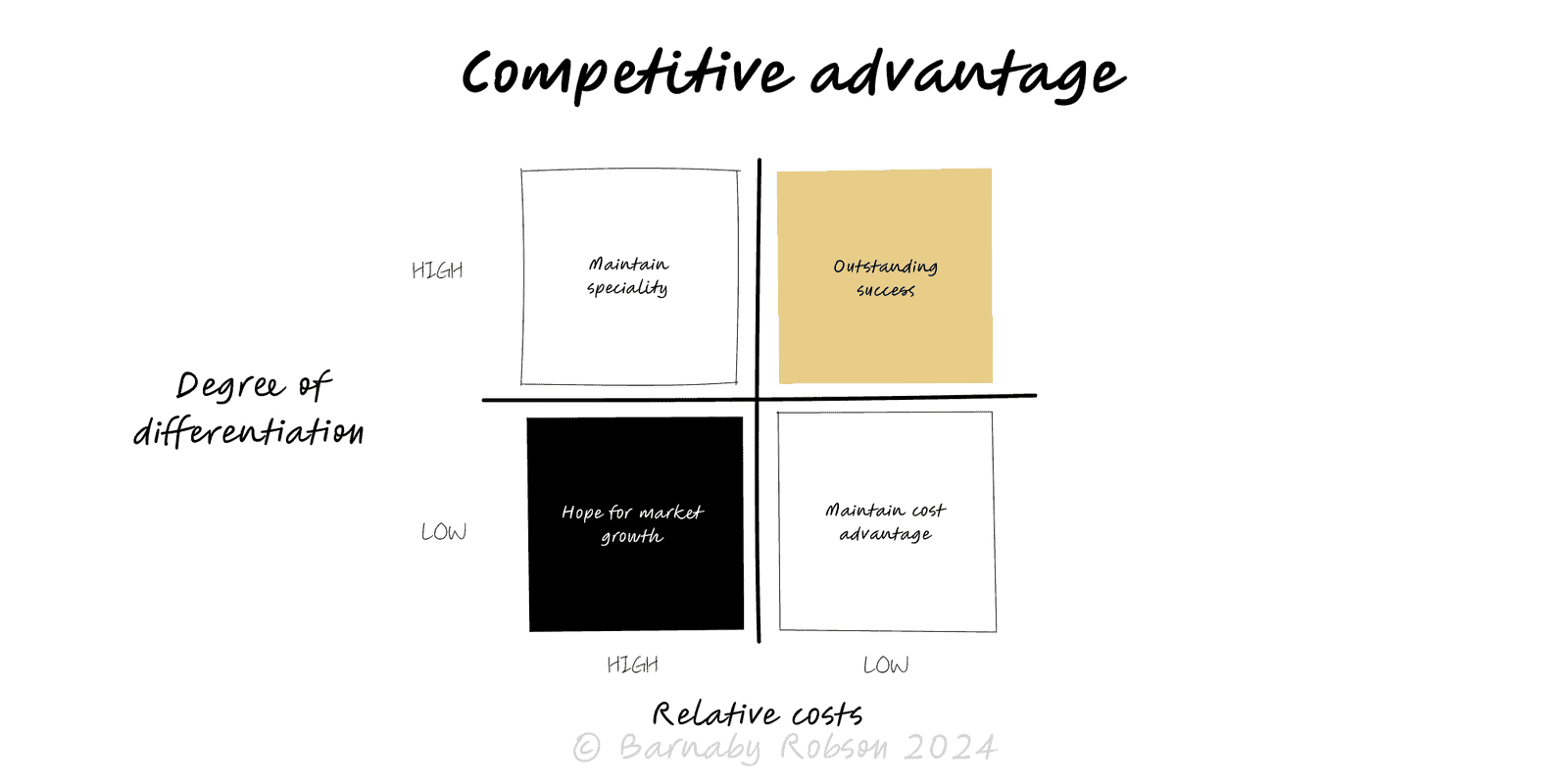

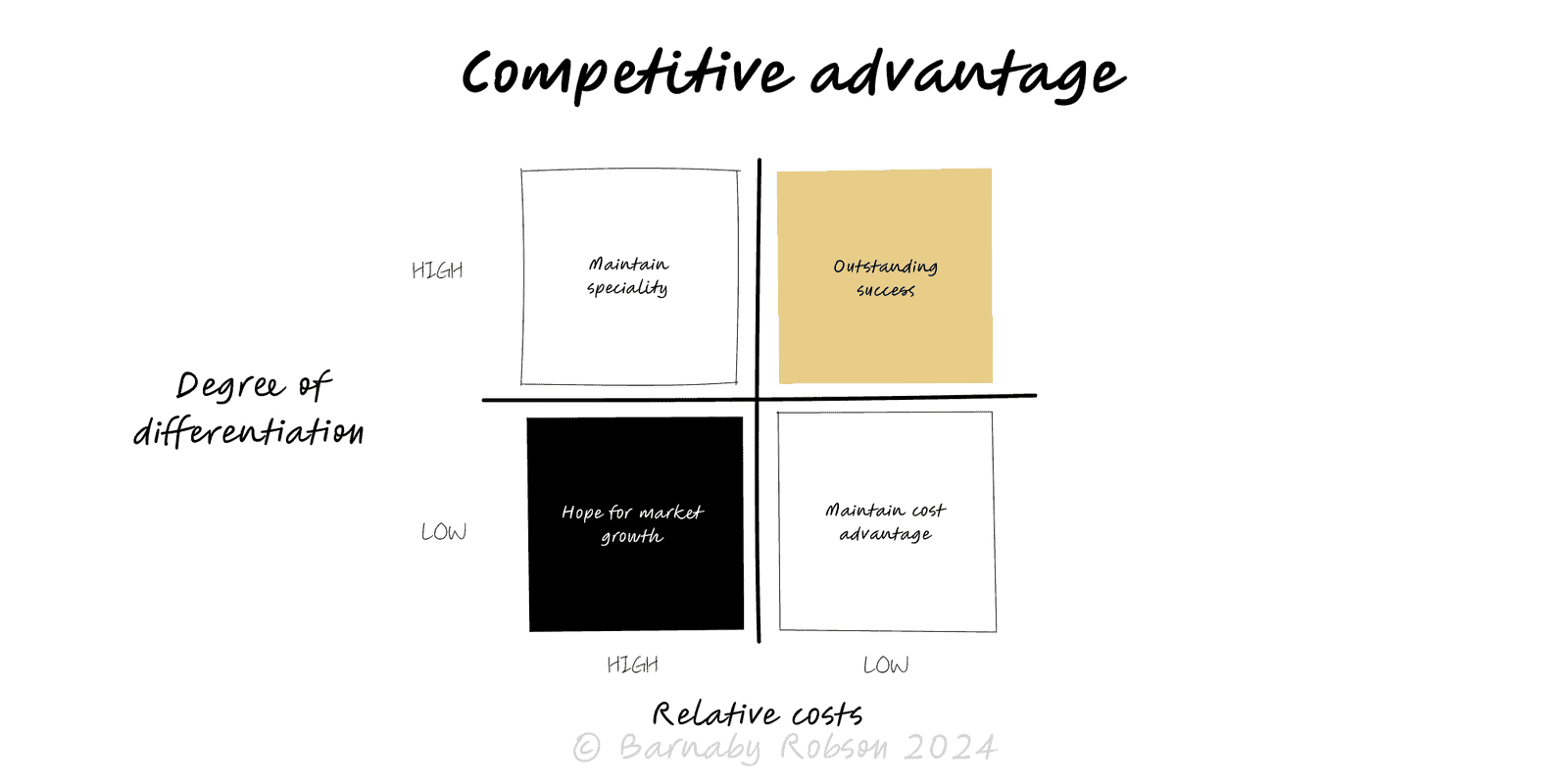

You have competitive advantage when, for a given segment, your willingness-to-pay minus cost beats competitors. There are two basic routes: raise WTP (differentiation) or lower cost (efficiency) — ideally both for your target. Advantage endures only if it is hard to copy, so design choices, assets and incentives that slow imitation matter as much as the initial win.

Value economics – Advantage exists when your value spread (WTP − Cost) is larger than peers for the same customer job.

Positioning – Choose where to compete (segment, need, channel) so your activities fit that choice.

Routes to advantage –

Isolating mechanisms (defensibility) – switching costs, network effects, scale & scope economies, IP & regulation, unique data, know-how, distribution power, counter-positioning.

Activity fit – a system of mutually reinforcing choices is harder to copy than a single feature.

Measurement – persistence of ROIC > WACC, superior contribution margins, and retention vs peers.

New venture positioning and go-to-market.

Product & pricing strategy (value maps, willingness-to-pay research).

Resource allocation and portfolio reviews (double-down where the moat deepens).

M&A and partnerships (buy/ally to strengthen isolating mechanisms).

Defence against fast followers and platform risk.

Define the segment and job-to-be-done – who, use case, alternatives; write the competitor set.

Map value – estimate WTP and delivered cost for you and 2–3 key rivals; plot a simple value map (WTP on Y, Cost on X).

Choose a direction – commit to cost leadership, differentiation, or a focused variant; list 3–5 activity choices that reinforce it.

Design isolating mechanisms – embed switching costs (workflow, data, training), create complements, seed network effects, lock distribution, protect IP/process know-how.

Quantify the edge – show the unit economics and ROIC spread; set a target advantage half-life (how long before imitation erodes it).

Build a flywheel – identify the feedback loop that strengthens your moat with scale/learning/data.

Defend & adapt – pre-empt imitation (contracts, standards, roadmap), monitor copycat signals, and refresh the activity system annually.

Competing to be “the best” instead of different; leads to feature parity and margin wars.

No proof in the numbers – stories without ROIC or retention deltas.

Thin moats – brand talk without WTP evidence; “network effects” without multi-sided density.

Straddling – trying to serve incompatible segments with one system; activity fit breaks.

Over-relying on luck or timing – early lead without isolating mechanisms fades fast.

Ignoring cost of capital – above-average margins that don’t clear WACC aren’t advantage.

Cannibalising the core without a plan; eroding the very activities that create the moat.

Click below to learn other mental models

Before building, map the space: the key forks, dead ends and dependencies—so you can choose a promising path and run smarter tests.

When a rising power threatens to displace a ruling power, fear and miscalculation can tip competition into conflict unless incentives and guardrails are redesigned.

Aim for vertical progress—create something truly new (0 → 1), not just more of the same (1 → n). Win by building a monopoly on a focused niche and compounding from there.