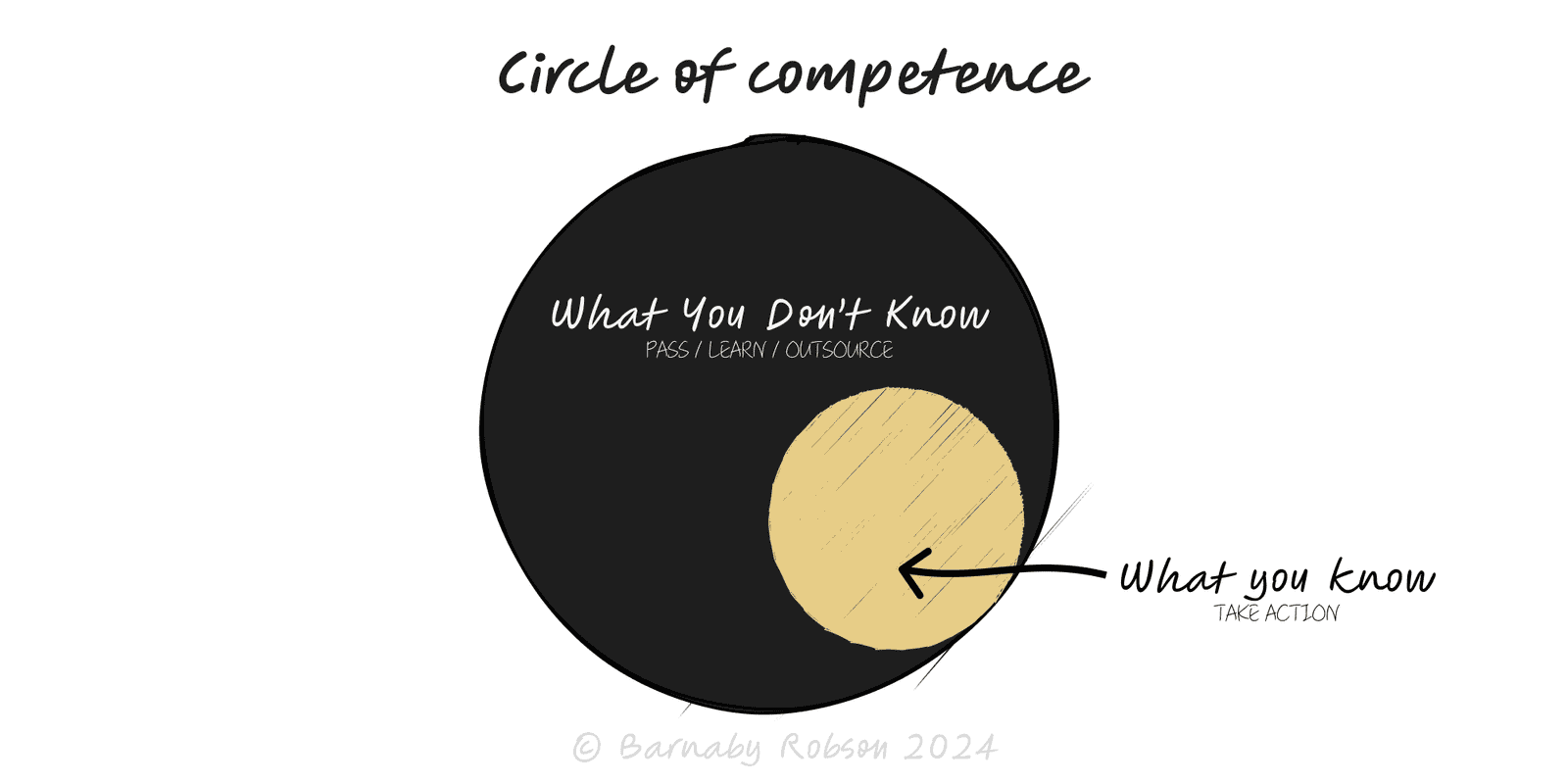

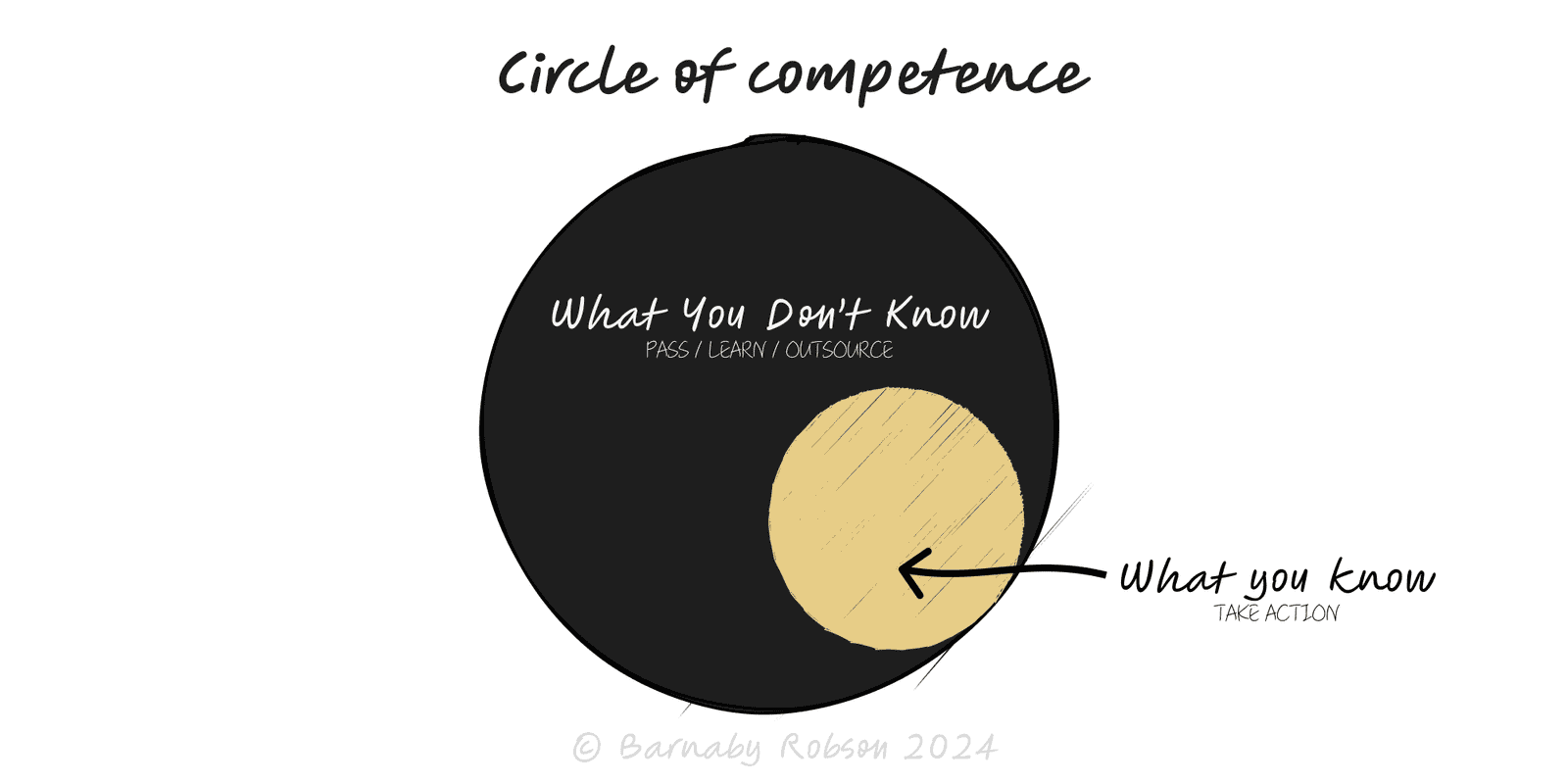

Circle of Competence

Operate where you truly understand cause and effect; stay inside the circle, expand it deliberately, and partner outside it.

Author

Warren Buffett & Charlie Munger

Model type

Operate where you truly understand cause and effect; stay inside the circle, expand it deliberately, and partner outside it.

Warren Buffett & Charlie Munger

Your circle of competence is the set of domains where you can judge quality, risks and causal drivers with reliability. Inside the circle, you move fast and size bets confidently. At the edge, you translate cautiously and price uncertainty. Outside it, you either decline, learn, or partner. The discipline isn’t to stay small forever; it’s to know your boundary and expand by deliberate practice, not by hope or fashion.

Definition – a competence is proven by decisions and outcomes, not by titles or enthusiasm.

Boundary & edge – write what you know cold, what you can infer with caveats, and what you can’t judge.

Information quality – inside the circle you know which signals matter and which are noise.

Advantage – focus compounds: better priors, faster pattern recognition, tighter feedback loops.

Expansion – adjacent learning (shared primitives, customers, tech) grows the circle with less risk.

Partnering – outside the circle, borrow competence via advisors, co-founders, vendors or structure (e.g., small reversible trials).

Tripwires – pre-set limits for when to stop, escalate, or bring in a domain expert.

Investment mandate – define industries you truly understand; pass quickly on the rest.

Product strategy – build where you have customer insight or technical edge; buy/partner elsewhere.

Hiring & delegation – keep decisions in your circle; delegate those in someone else’s.

Sales ICP – prioritise segments where you can deliver consistent value and support.

Personal development – plan adjacencies to expand (shared customers, data, tech stack).

Map your decisions – list the last 20–30 material calls; mark which you’d make again with the same info.

Draw the boundary – create three lists: “Know”, “Know with caveats”, “Don’t know”. Write one-line reasons.

Set rules – when outside, either (a) decline, (b) run a small reversible test, or (c) add a partner with authority.

Choose adjacencies – pick 1–2 areas that share primitives (customers, channels, tech). Define a 90-day learning plan and a tiny live project.

Instrument judgement – track hit rate, forecast calibration, and post-mortems by domain. Promote or demote areas based on evidence.

Codify escalation – define thresholds for expert review, second opinions, or committee.

Review quarterly – update the map; retire stale “competence” and add earned ones.

Dunning–Kruger – confidence without track record; require calibration checks.

Stale circle – past competence that no longer fits due to tech, regulation or scale.

Hiding behind narrowness – refusing to grow into clear adjacencies.

Mission creep – “we’ll figure it out” bets with no reversible path or expert input.

Boundary blur – assuming similar words mean similar economics; verify primitives.

Ignoring second-order effects – decisions inside the circle with external consequences you don’t understand.

Click below to learn other mental models

Before building, map the space: the key forks, dead ends and dependencies—so you can choose a promising path and run smarter tests.

When a rising power threatens to displace a ruling power, fear and miscalculation can tip competition into conflict unless incentives and guardrails are redesigned.

Aim for vertical progress—create something truly new (0 → 1), not just more of the same (1 → n). Win by building a monopoly on a focused niche and compounding from there.