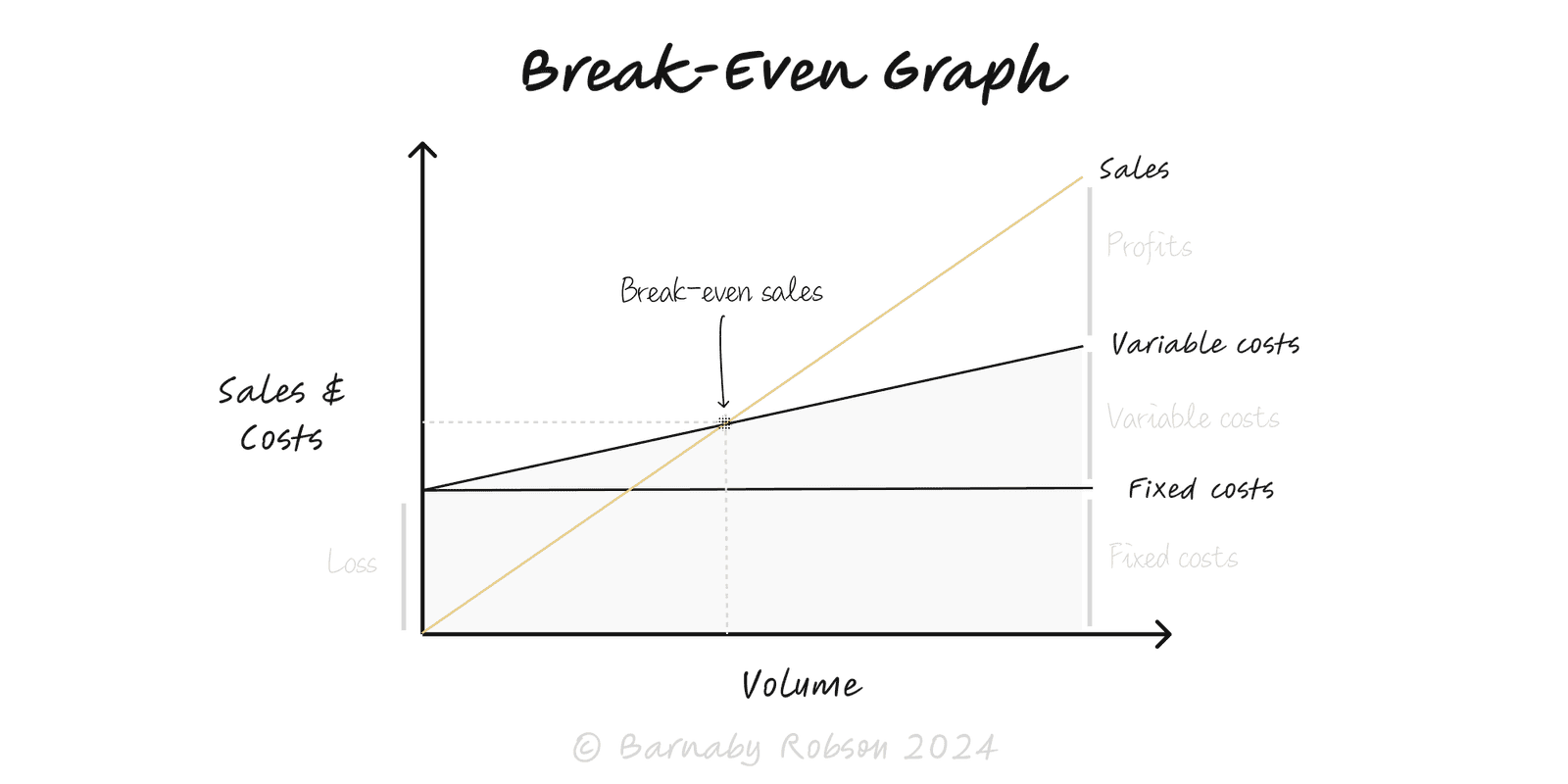

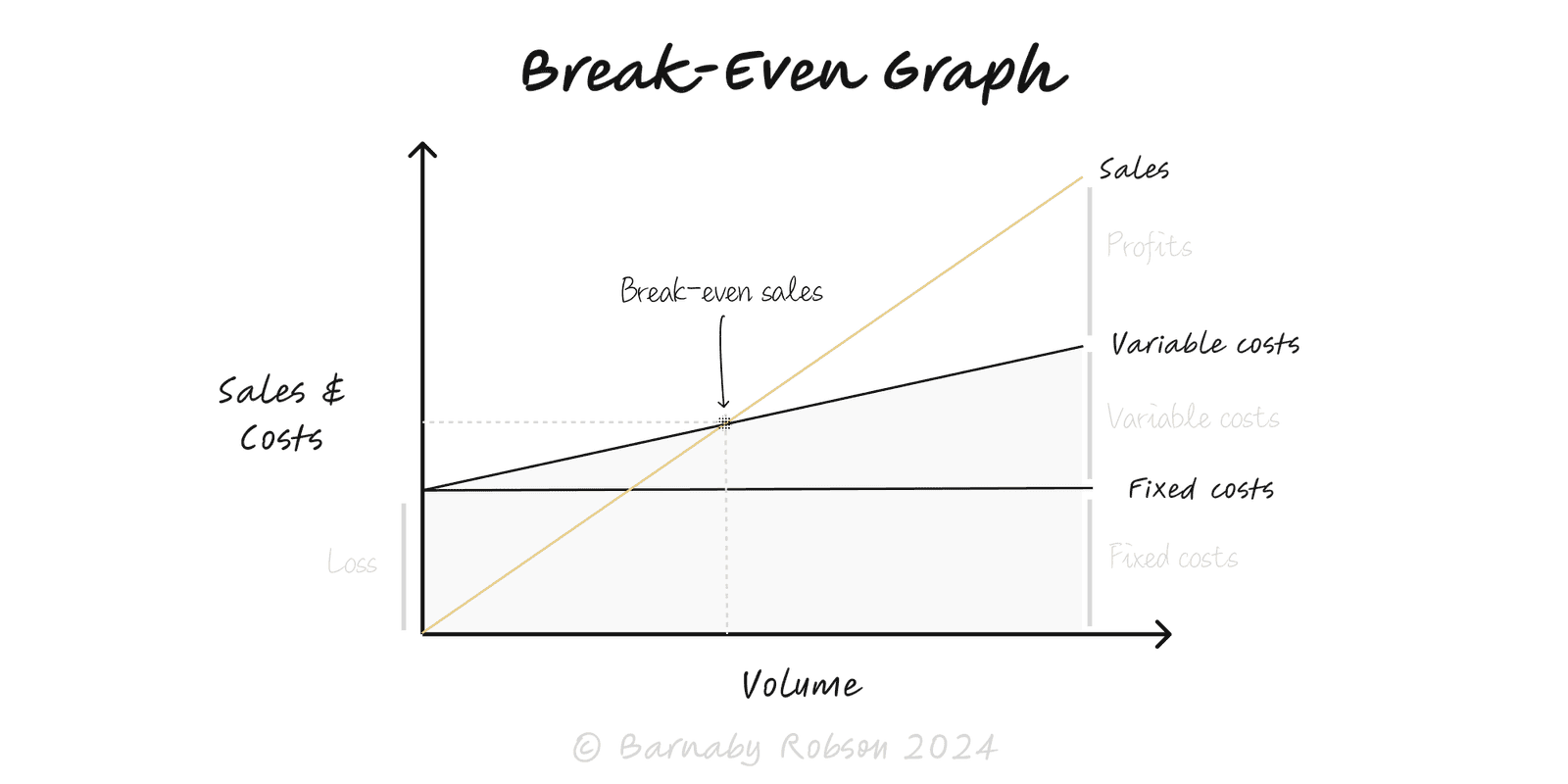

Break-Even Graph

Visualises the volume at which revenue equals total cost; clarifies pricing, fixed vs variable costs, and margin of safety.

Author

Managerial accounting (cost–volume–profit analysis)

Model type

Visualises the volume at which revenue equals total cost; clarifies pricing, fixed vs variable costs, and margin of safety.

Managerial accounting (cost–volume–profit analysis)

The break-even graph is the classic cost–volume–profit view. It plots total revenue and total cost against units sold. Their intersection is the break-even point (no profit, no loss). With a few inputs you can test prices, cost changes and sales targets, and see how fast profit grows after break-even (operating leverage).

Inputs

Contribution margin: CM = P − V (per unit) and CM% = (P − V) / P.

Break-even units: BE_units = F / (P − V).

Break-even revenue: BE_rev = BE_units × P.

Margin of safety: (Expected sales − BE_units) / Expected sales.

Operating leverage: profit grows faster than revenue once past break-even; sensitivity ≈ Contribution / Operating profit.

Graph: a straight revenue line from the origin with slope P, and a total cost line starting at F with slope V. The crossing is break-even.

Pricing and discount policy – see the volume needed after a price change.

New product / channel – sanity-check unit economics before launch.

Cost-out programmes – estimate how much F or V must fall to reach break-even sooner.

Capacity and sales targets – ensure break-even is reachable within realistic demand.

Subscription/SaaS – adapt to “per-period” units (active subscribers), include churn and CAC payback.

Classify costs – split fixed vs variable within the relevant output range; note any step-fixed costs.

Estimate P and V – include discounts, returns, freight, payment fees; use current mix.

Compute CM, BE_units, BE_rev; add margin of safety against your forecast.

Plot the graph – show revenue and total cost; mark break-even and a few demand scenarios.

Run scenarios – price ±x%, variable cost ±x%, mix shifts, capacity limits; note new BE points.

Decide actions – raise price, change mix, reduce V (supplier, packaging, process), reduce F (leases, tooling), or increase qualified demand.

Review monthly – update with actuals; watch drift in discounts, returns and utilisation.

Misclassifying costs – many “fixed” costs are step-fixed (they jump when capacity is added).

Ignoring mix – multi-product lines need a weighted average CM; mix changes shift break-even.

Leaving out on-costs – shipping, payment fees, commissions, warranty, returns.

SaaS specifics – treat the unit as an active subscriber; incorporate churn and CAC payback (months to recover acquisition cost).

Non-linear realities – price elasticity, capacity ceilings and learning effects bend the straight lines; use the graph as a guide, then model ranges.

Top-line fixation – high volume at low CM can be worse than lower volume at healthy CM%.

Click below to learn other mental models

Before building, map the space: the key forks, dead ends and dependencies—so you can choose a promising path and run smarter tests.

When a rising power threatens to displace a ruling power, fear and miscalculation can tip competition into conflict unless incentives and guardrails are redesigned.

Aim for vertical progress—create something truly new (0 → 1), not just more of the same (1 → n). Win by building a monopoly on a focused niche and compounding from there.