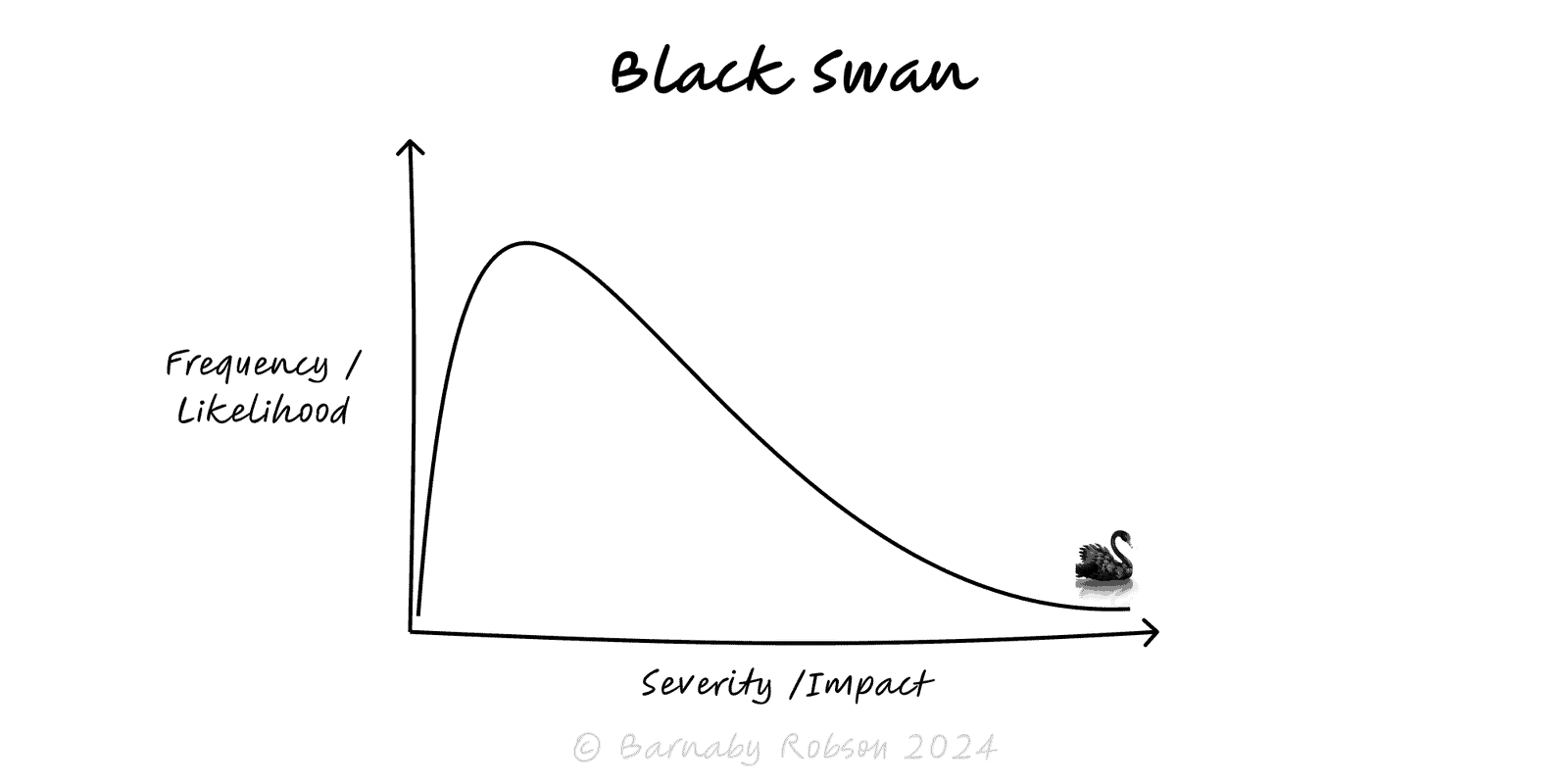

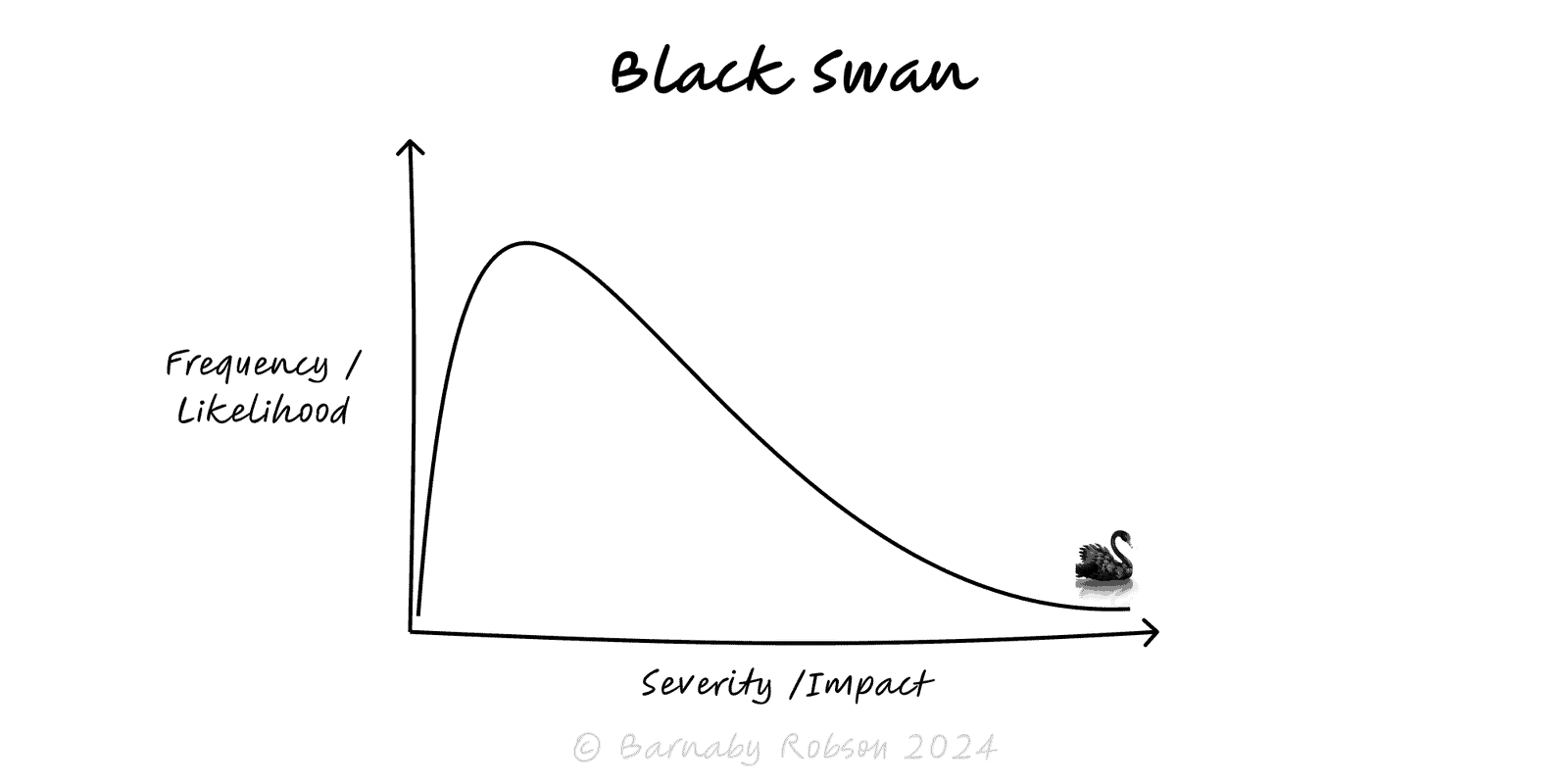

Black Swan

Nassim Taleb’s term for rare, high‑impact, retrospectively ‘obvious’ events.

Author

Nassim Nicholas Taleb

Model type

Nassim Taleb’s term for rare, high‑impact, retrospectively ‘obvious’ events.

Nassim Nicholas Taleb

A Black Swan is an event that is (1) an outlier, (2) carries extreme impact, and (3) is made explainable in hindsight. Taleb’s point is less about forecasting and more about positioning: when outcomes follow heavy-tailed distributions, models and averages understate risk. Robust systems cap ruin; antifragile ones keep cheap exposure to upside shocks.

Mediocristan vs Extremistan – in Mediocristan (e.g., height) variance is bounded; in Extremistan (e.g., wealth, market moves, virality) tails dominate results.

Heavy tails – probability mass sits in the extremes; normal (Gaussian) assumptions break.

Unknown unknowns – models miss mechanisms we don’t know; back-tests look safe until they don’t.

Narrative fallacy & silent evidence – we invent tidy causes afterwards and ignore near-misses.

Fragility – tight coupling, leverage, and debt create concave pay-offs (small gains, rare ruin).

Convexity – capped downside + open upside benefits from volatility (options, asymmetric bets).

Investing & treasury – size for drawdowns, carry liquidity, prefer convex exposure for upside shocks.

Operational resilience – supply-chain dual sourcing, buffers, isolation of critical services.

Security & reliability – assume breach/incident; add circuit breakers, rate limits, chaos testing.

Product & growth – seek positive Black Swans (network effects, virality) with small, scalable probes.

Policy & safety – fail-safes for low-frequency, high-severity risks (recall plans, kill-switches).

Map tail exposure – where could a single failure create outsized loss? Note coupling, leverage, and concentration.

Cap ruin – hard limits, redundancy (N+1), insurance, ring-fencing, conservative liquidity/tenor.

Barbell – keep most resources in safe assets/processes; place small, diversified convex bets for upside shocks.

Stress beyond Gaussian – scenario ranges, power-law tails, historical episodes and synthetic shocks.

Design for isolation – reduce blast radius with modularity, circuit breakers, and clear hand-offs.

Practice the failure – drills, game days, table-tops; pre-authorise playbooks for speed under stress.

Exploit upside – cheap options on breakthroughs: partnerships, optionality in contracts, scalable infra if a spike arrives.

Calling everything a Black Swan – many “surprises” were predictable; fix detection and incentives.

Gaussian comfort – treating heavy-tailed domains as normal hides tail risk.

Leverage + correlation – financing and exposures that crash together erase diversification.

Back-test theatre – models tuned to the past fail in regime shifts.

Short vol by accident – steady small gains masking catastrophic downside (e.g., carry trades, rigid SLAs).

Over-hedging – protection that destroys long-run EV; prefer targeted caps and cheap convexity.

Click below to learn other mental models

Before building, map the space: the key forks, dead ends and dependencies—so you can choose a promising path and run smarter tests.

When a rising power threatens to displace a ruling power, fear and miscalculation can tip competition into conflict unless incentives and guardrails are redesigned.

Aim for vertical progress—create something truly new (0 → 1), not just more of the same (1 → n). Win by building a monopoly on a focused niche and compounding from there.