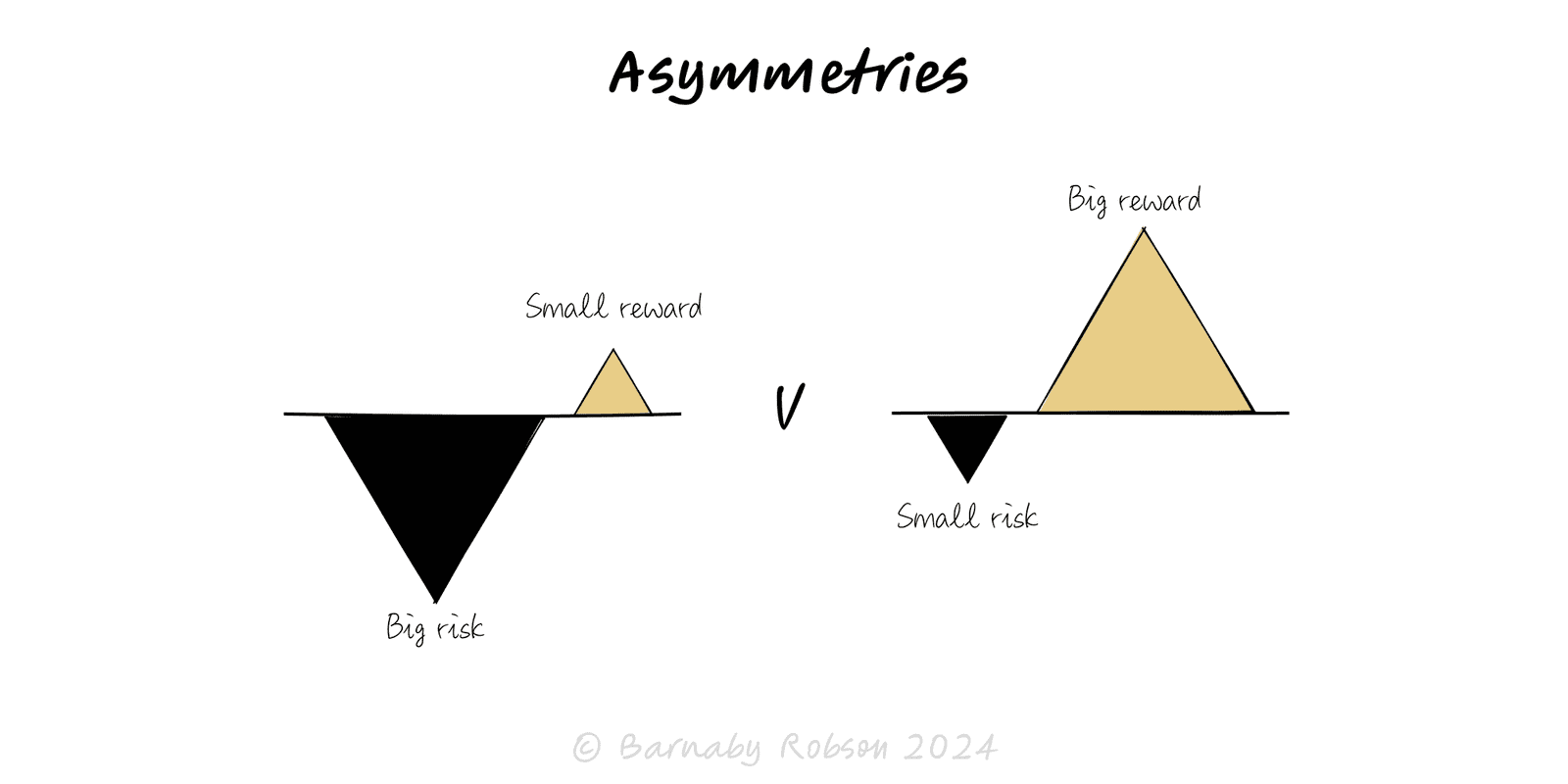

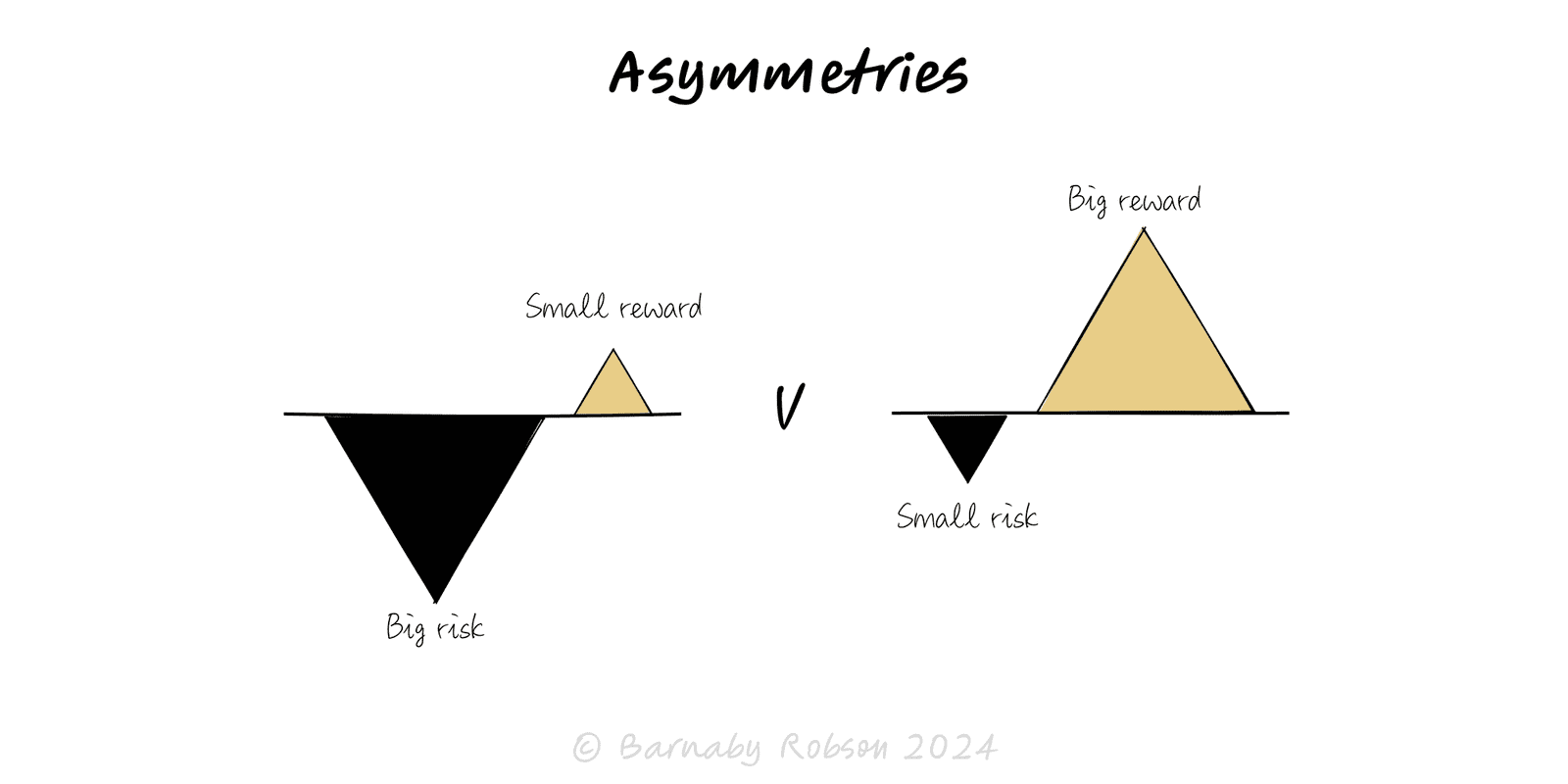

Asymmetries

Exploit one‑sided payoffs or costs (eg, convex bets, reputation effects) where small inputs can create outsized gains.

Author

General usage (economics, game theory); convexity popularised by Nassim Taleb

Model type

Exploit one‑sided payoffs or costs (eg, convex bets, reputation effects) where small inputs can create outsized gains.

General usage (economics, game theory); convexity popularised by Nassim Taleb

An asymmetry exists when the pay-offs, power, information or time horizons of two sides aren’t balanced. Strategy seeks convex situations (“heads I win big, tails I lose small”) and rejects concave ones (“small gains, rare ruin”). You can also manufacture asymmetry—through data, distribution, contracts, product economics, or option-like tests.

Pay-off asymmetry (convexity) – expected value rises with volatility when losses are capped and gains scale.

Information asymmetry – one side knows more (or earlier); channel into better screening, pricing, or timing.

Cost structure asymmetry – near-zero marginal cost and network effects let small teams out-compete bigger ones.

Power & bargaining – scarce assets, switching costs and credible alternatives tilt negotiations.

Horizon asymmetry – longer horizons harvest compounding and allow contrarian entry.

Create asymmetry – reversible probes, free trials, usage-based pricing, partnerships that give distribution or data.

Detect negative asymmetry – exposures with capped upside and large or undefined downside (e.g., short vol, unlimited liability).

Venture bets & product discovery – many cheap experiments; scale the few that spike.

Go-to-market – integrations or marketplaces where partners do the work and you capture demand.

Pricing & contracts – usage tiers, minimums with overage, outcome-based fees, options on renewals.

Negotiation – build BATNAs and switching costs to shift surplus your way.

Portfolio design – barbell allocations; keep core safe and place small high-upside bets.

M&A / alliances – combine assets that create super-additive economics (distribution × product × data).

Map pay-offs – list gain/loss sizes and probabilities; note what scales and what is capped.

Increase convexity – cap downside (limits, liability, kill criteria); expose to upside (revenue share, variable pricing, viral loops).

Add optionality – favour reversible choices; run cheap probes before commitments.

Manufacture advantages – secure distribution, unique data, privileged timing, or scarce complements.

Negotiate from strength – build alternatives, standard terms, and walk-away thresholds.

Size positions – small on convex, diversified bets; tiny or zero on concave exposures.

Monitor skew – track payoff/variance, downside-at-risk, and correlation in stress.

Hidden tail risk – mild gains masking rare, catastrophic losses (short vol, over-levered carry).

Correlation spikes – convex bets that all crash together remove diversification.

Illusory edge – “information advantage” that’s noise or illegal to use.

Asymmetry leakage – partners capture the surplus through terms or platform control.

One-way doors – “options” that aren’t reversible; document exit costs up front.

Ethics & regulation – some asymmetries (e.g., dark patterns, insider info) are off-limits; design fair advantages.

Click below to learn other mental models

Before building, map the space: the key forks, dead ends and dependencies—so you can choose a promising path and run smarter tests.

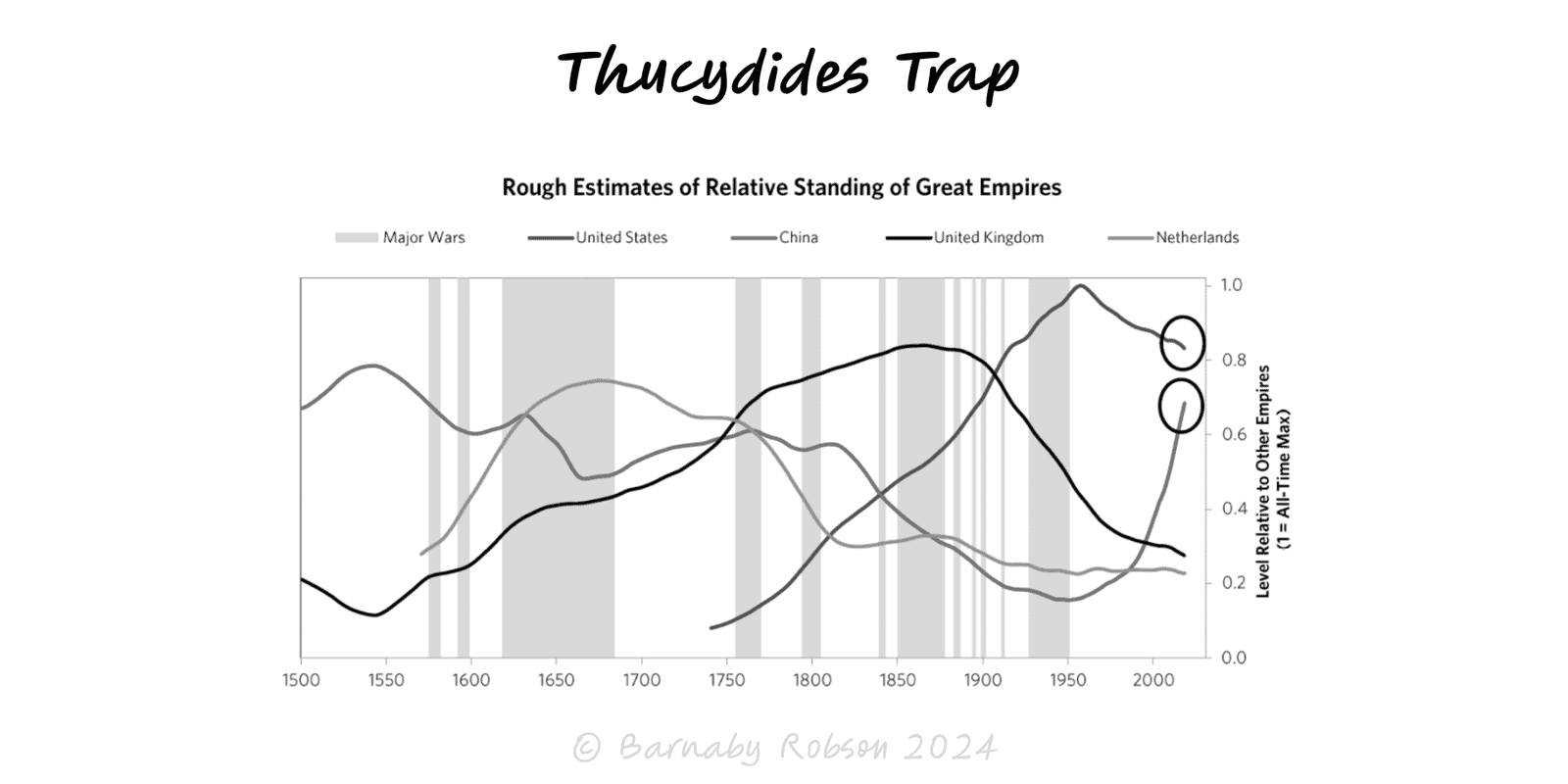

When a rising power threatens to displace a ruling power, fear and miscalculation can tip competition into conflict unless incentives and guardrails are redesigned.

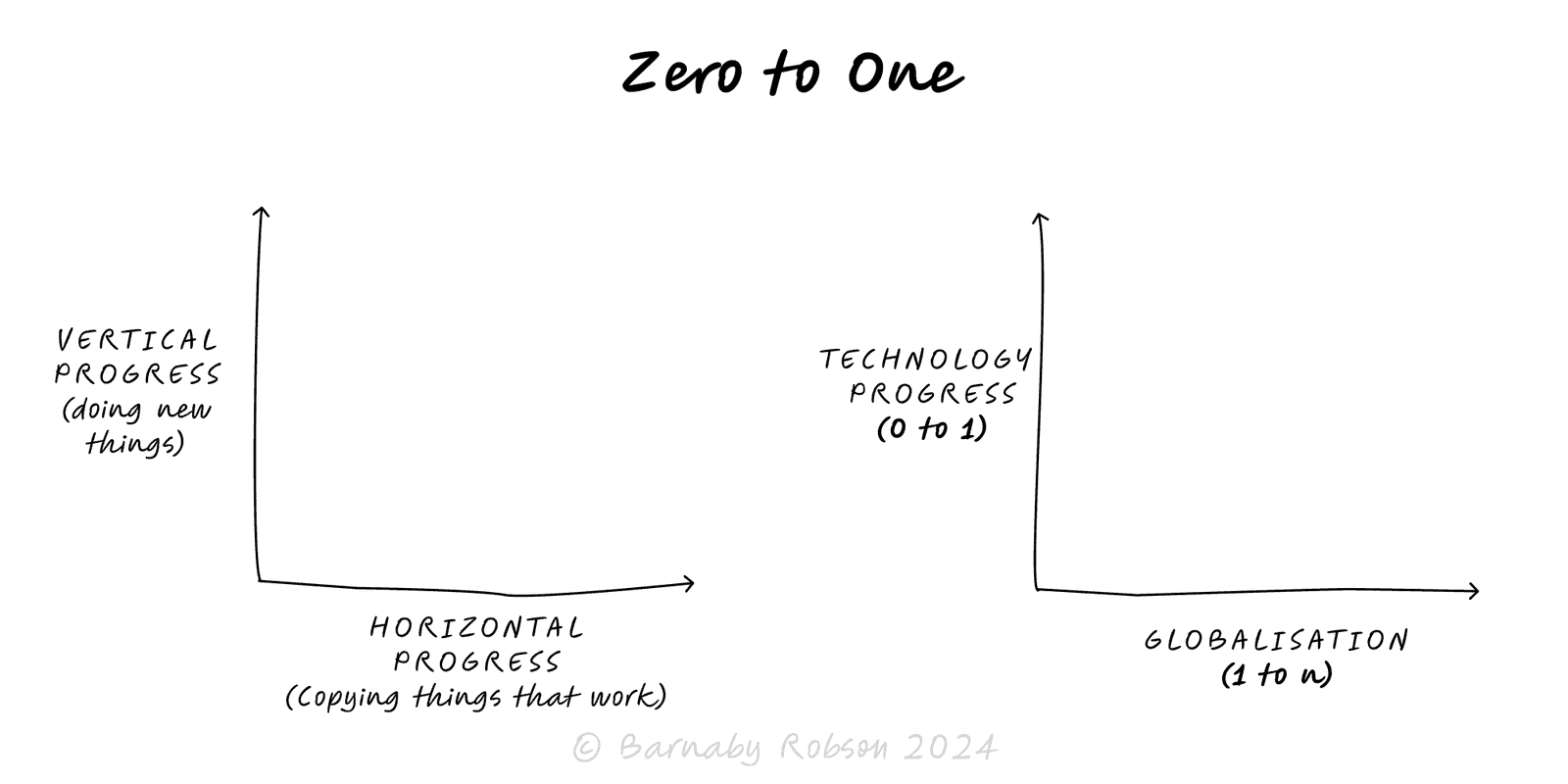

Aim for vertical progress—create something truly new (0 → 1), not just more of the same (1 → n). Win by building a monopoly on a focused niche and compounding from there.