Table of contents

Introduction

When I don’t quite know what I think about something, it helps to write down my thoughts and arguments. This is what this article is – me arguing with myself. It’s meandering, self-serving, and frankly you might be better off reading something else.

I did add lots of memes though, so you could just skip to those.

In Two Minds

It’s late 2025, Bitcoin has been hovering around USD 100k for most of the year, (before dipping to USD 80k in November), we have a pro-crypto US administration and things should be looking great for crypto, right? Yet, I am deeply disappointed in many of the crypto realities.

Let me explain.

A Little History

What first drew me into crypto was – if I’m being honest – the amazing returns.

A first wave – 2017: First shoots of mass (speculative) interest

It was 2017. Bitcoin was marching to USD 20k. Tokens were appreciating 50% in a day. Traditional Finance (TradFi) felt so mundane and boring in comparison.

I set up a Binance account and was overwhelmed by the abundance of tokens promising a new financial and computing paradigm. I’d spent 15 years helping clients diligence and value private companies, but I couldn’t figure out how to value the tokens. The issue being that most valuations were founded on a project having some amazing tech which was going to be super useful and change the world in the future… it was near impossible to figure out what differentiated each project, and how big the market would be for whatever it was they were building.

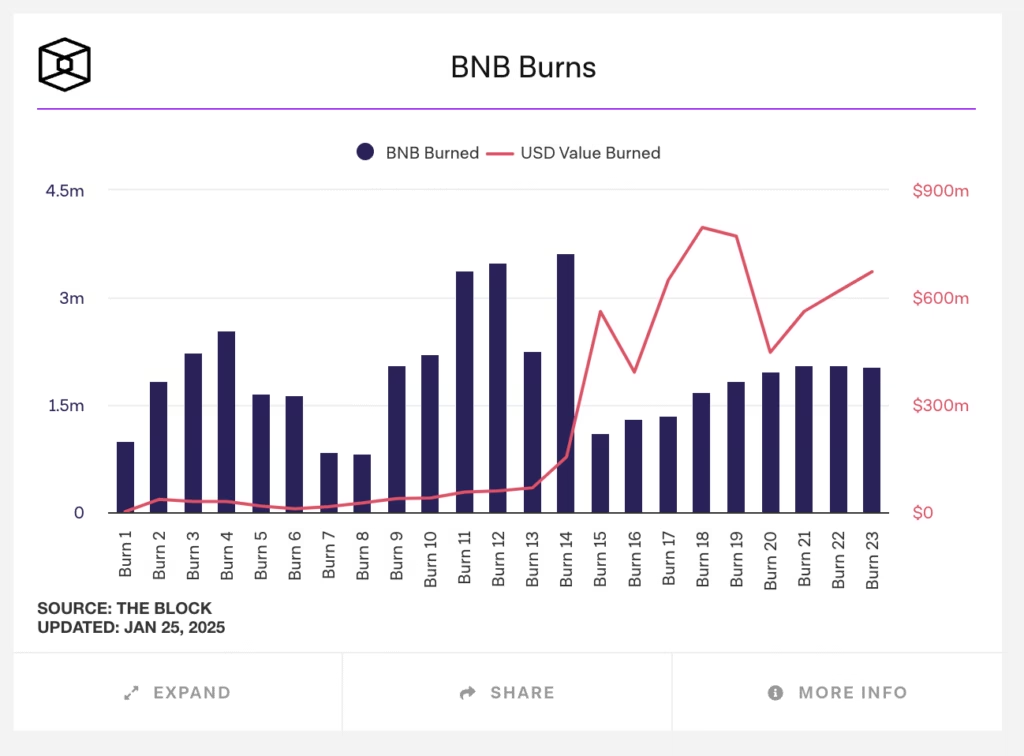

The only project/token that made sense to me was Binance’s own “utility” token (BNB), which cut trading fees, and shared profits from Binance’s trading platform with token holders though buying back and burning tokens (i.e. just like share buy backs). So that’s where I put my money.

But overall I was lost in the technology hyperbole and confusing tokenomics. As it turned out I wasn’t alone, there was a lot of ‘hot air’ and not much had actually been built. By January 2018, the market had crashed. Most tokens proceeded to fall 95+% (many never recovered). I licked my wounds, lost interest and mostly forgot about crypto.

A second bigger wave – 2020: DeFi, Freedom Technology and… epic Scams

Two plus years later, In late 2020, I checked my long forgotten Binance account and to my surprise my $BNB was up, and bigly!

Early the next year I started seeing and advising on a lot of crypto M&A. One of these deals required me to dive deep into the world of crypto exchanges – both TradFi exchanges (like Binance and Coinbase) and the new exciting world of Decentralised Finance (DeFi) Exchanges (DEX).

I had missed DeFi summer (summer 2020), but 6 weeks of paid research in early 2021 caught me up on the new concepts like airdrops, liquidity pools, automated market makers, etc.

One key takeaway was a lot of underling financial infrastructure had been build in the bear market from 2018 – 2020, which seemed to provide actual utility to Blockchain networks (see my 2021 research here). What I liked about DeFi (and DeFi tokens) was that they made sense in my TradFi financial brain – the same way BNB did. You could analyse the trading volumes, calculate returns and see how much value might accrue to token holders.

But there was one rather large catch – because the underlying protocols were open source and could easily be “forked” (i.e. copied) at basically nil cost – copy-cats with more attractive tokenomics could appear in days, taking liquidity to new platforms. It felt like there were no “moats”.

Actually two catches – Ethereum – the most decentralised blockchain platform – was becoming egregiously expensive to transact on – meaning DeFi was very price uncompetitive to TradFi despite all the innovation.

Freedom technology

If you spend 5 minutes reading the bitcoin white paper, and perhaps have an enquiring mind and basic understanding of how the world works, you should get red pilled.

I could go off on a rant here, about what I feel about governments, corporations and changes in society since the early 2000s – and the absolute woke tyranny many have been living under. But I’m going to chicken-out and quote Javier Milei at the WEF in January 2025 instead. Not my words, don’t cancel me…

“If you’re white, you must be racist; if you’re a man, you must be a misogynist or part of the patriarchy; if you’re rich, you must be a cruel capitalist; if you’re heterosexual, you must be heteronormative, homophobic, or transphobic.”

Javier Milei

and

“…wokeism’s first strategy is to discredit those of us who challenge these things first by labeling us and then by silencing us.”

Javier Milei

GameFi and the metaverse

I haven’t quite figured out now to transition from talking about freedom tech to talking about GameFi and the metaverse, but that’s where I went next.

If summer 2020 was DeFi summer, summer 2021 was all about NFTs, GameFi and the Metaverse. What I liked about GameFi was the potential to draw in ‘normies’.

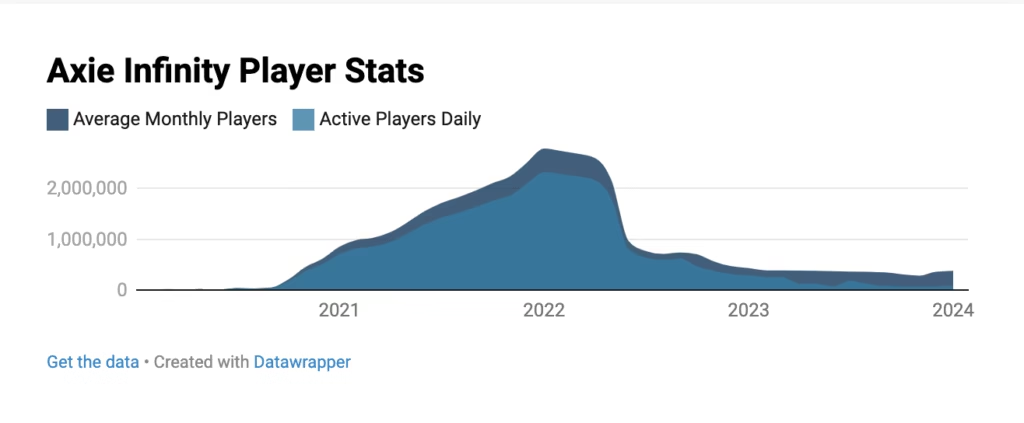

The problem with GameFi was fundamentally that the experience wasn’t as good as what you can get in the traditional VR/Gaming space. As it turned out most people were playing to earn tokens (play to earn) rather than for fun. Investing in GameFi taught me some hard lessons in Reflexivity – i.e. that a rising price of a coin can bring in new users, directly influence its perceived value and further drive the price up, creating a self-reinforcing feedback loop. But this feedback loop can rapidly reverse as soon as market sentiment changes. Axie Infinity the largest GameFi Project saw its daily active users collapse from over 2 million to c. 100k when its token value fell.

2022’s Epic Scams

The mission of crypto – “To establish a trustless and transparent digital ecosystem that empowers individuals and fosters innovation through decentralised technologies” – has put the industry under attack from three parties: Hackers, Governments, and Scammers.

In 2022, the scammers (rug pullers and thieves) took center stage. The most egregious of all the scammers was FTX – a large centralised crypto exchange (large donor to the Democratic Party) that stole money from customers. A full breakdown of ‘what happened’ is set out in this collapse of FTX paper.

The regulatory backlash was epic. For a while it felt like the eye of Sauron was going to kill the industry. It become increasingly hard to on/off ramp (i.e. get money from fiat into your crypto wallet) as payment rails were blocked. A number of crypto lenders and service providers collapsed. We hit full-on bear market.

“Today we have ninety-year-old laws, wielded by seventy-year-old people, to prevent twenty-somethings from using twenty-first century technology”

Balaji Srinivasan

The Third Wave – 2024/2025: A New Dawn?

Cutting of red tape

Trump winning the oval office and appointing David Sachs – a crypto advocating venture captialist – as AI and crypto czar felt like a seminal moment. A pro-industry, deregulatory approach to cryptocurrency was now the agenda. We had legal certainty, Bitcoin ETFs, Strategic Bitcoin Reserves and an end to regulatory crackdowns. And the institutional money was coming!

New shithousery – meme coins and Trump tokens

When I sat down with my team on our Crypto outlook for 2025, what I didn’t have on my bingo card was Trump launching a crypto token.

I am probably (read definitely) more fond of Trump than the average European, but for me he lost a lot of credibility with the Trump and Melania tokens. What was also noticeable, that as the Trump token rose, other shitcoins fell – i.e. it wasn’t new money coming into the crypto market, but money being recycled.

I think meme coins are/were bad for crypto – they made it more of wild west casino than it already was. 99% of new retail converts from 2024/2025 got burnt on meme coins and many will never return.

Trust is earned in drops and lost in buckets.

Kevin Kelly

Black Friday

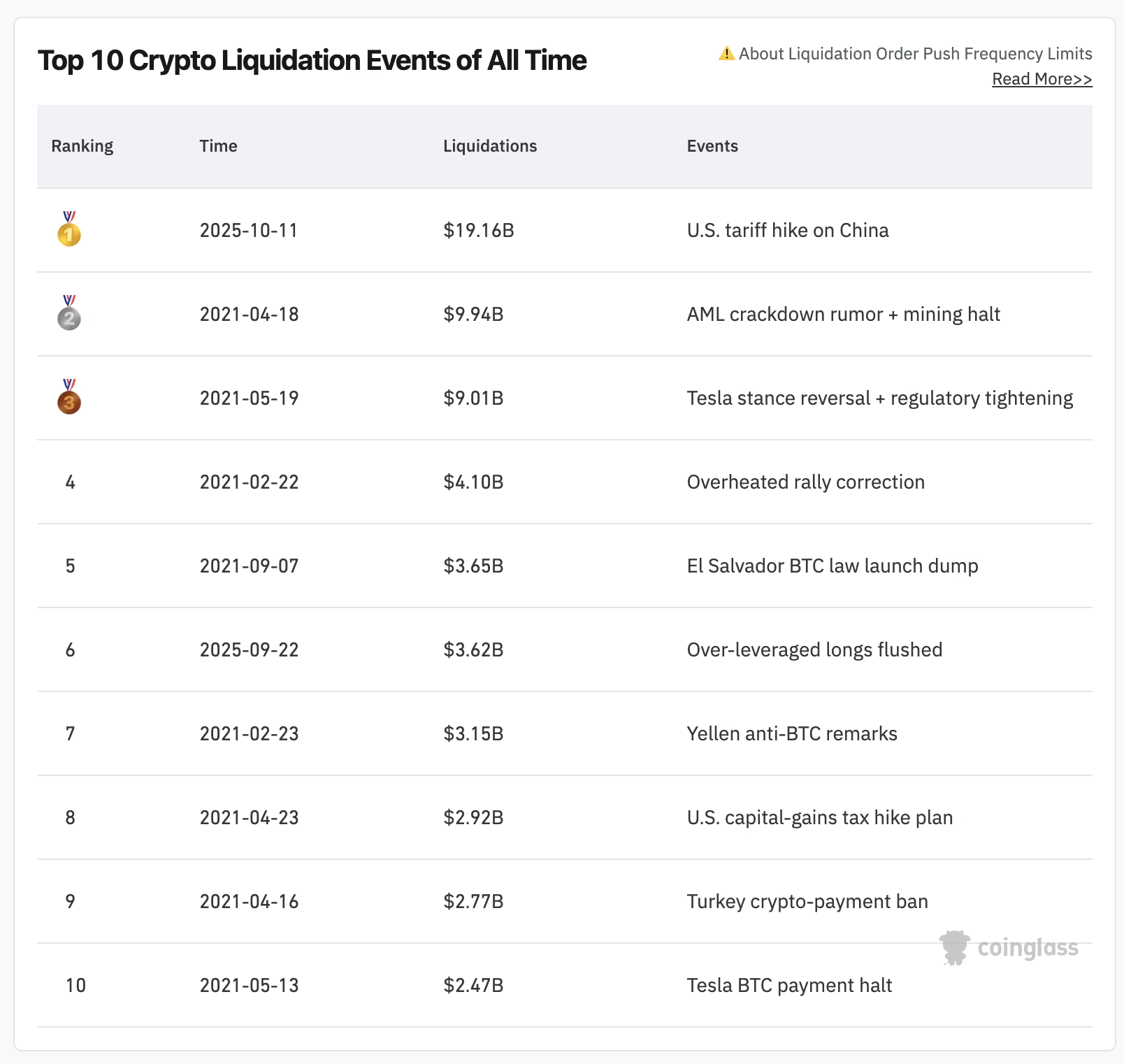

In October 2025, we witnessed crypto’s “Black Friday” which nobody is talking about.

THE DAILY PROPHET – HE WHO MUST NOT BE NAMED RETURNS:“It is with great regret that I must confirm that the wizard styling himself Lord — well, you know who I mean — is alive and among us again,” said Fudge, looking tired and flustered as he addressed reporters.

JK Rowling, Harry Potter

It was 10x worse than the FTX collapse (over USD 20bn in liquidations in hours). At least with FTX, we knew who the villain was. This time, one month later people are still piecing it together.

This is the first time since Mt Gox and FTX that crypto nearly broke itself entirely — but unlike those, the villain wasn’t a fraud; it was the market structure.

Events of Friday 10 October 2025:

Background

- Hyperliquid had become the new centre of leveraged trading Throughout 2025, high-performance DeFi pulled the fastest money on-chain. Hyperliquid offered CEX-like speed, deep perp markets and no KYC friction. A huge share of quant funds and “degen leverage” migrated there months before October.

- This migration mattered: By early Q4, the most aggressive leverage in the entire system lived on Hyperliquid, not Binance or Bybit. That shifted the crash’s “epicentre” onto DeFi rails for the first time.

- Binance, meanwhile, quietly introduced a different systemic risk USDe was heavily promoted across Earn, LaunchPool and unified accounts as a “safe yield stablecoin”. Many users unknowingly held USDe as collateral, relying on Binance’s internal price rather than the on-chain peg.

- The WLFI problem sat underneath it all World Liberty Financial (WLFI) — a Trump-linked collateral token — had become widely used in cross-margin accounts. It created a structural fragility: WLFI down → collateral vanishes → forced BTC/ETH selling.

Events of the day

- 20:50 UTC – Trump posts the 100 percent tariff announcement Bots react instantly; BTC snaps lower; WLFI resumes its collapse; order books thin out across all venues.

- Hyperliquid moves first and fastest With the highest concentration of leverage, it becomes the primary liquidation engine. Its instant, no-delay matching wipes out positions at machine speed, triggering billions in forced sells.

- On-chain transparency reveals an “insider-shaped” whale A fresh wallet funded ~$80M USDC, built a ~$400M short over 36 hours, then stopped trading one minute before the tariff post. It profits ~$190–200M as the cascade hits.

- Binance breaks at the oracle layer Thin liquidity causes USDe to wick to ~$0.65 on Binance despite trading ~$1 on-chain. wBETH collapses ~90 percent locally. These internal misprices trigger phantom liquidations for users who thought they held safe collateral.

- Exchange Insurance fund depletion triggers Auto-Deleveraging (ADL) (i.e. ADL means positions in the money get closed) – Binance’s ADL forcibly closes the most profitable shorts — including institutional hedges — to cover bankrupt longs. Those institutions suddenly become unhedged and must dump spot BTC, accelerating the freefall.

- Spot + perps sell-off converge into a single downward spiral: WLFI contagion → USDe mispricing → phantom liquidations → ADL hedge-kills → spot selling → deeper leverage wipeouts on Hyperliquid. All correlations snap to 1.

- Final tally: ~$19.3B liquidated, over 1.6M accounts wiped out, BTC from ~$122k to ~$104k, and Hyperliquid — for the first time — processes more liquidations than Binance and Bybit combined.

The scale of the carnage was visible in DeFi as the platforms are open and transparent. Half of the top wallets on Hyperliquid lost 50% of their worth in minutes. What we still don’t know is the true scale of losses on Binance and other centralised exchanges. There are fears a number of large actors are ‘walking dead’.

The Malaise (The Vibe Shift)

So, where does that leave us now?

Fatigue has been growing all of 2025, and it feels like the true damage of 10 October wasn’t financial — it was psychological. Most retail investors looking for fast money were already in deep depression after a year of crushing losses on shitcoins, vaporous meme coins, the sad realisation that ‘alt season’ wasn’t going to happen this time, and that they were being preyed on by sophisticated actors. Black Friday was the straw that broke the camels back – leveraged retail and the funds and influencers, who believed they could manage their risk or otherwise had an edge got liquidated – they too discovered they were also playing a negative sum game and the casino always wins.

We’re half awake in a fake empire

The National

The “Old Crypto” is dead.

I read a thread by @punk6529 on Twitter that perfectly captured the feeling (I urge you to read this in full – it is some of the best writing i have seen in 2025).