About This Article: Like other entries in my Notes from the Book series, I wrote this primarily for myself. These notes serve as an online journal, where writing helps me learn and publishing sharpens my thoughts while creating an accessible reference. Expect longer quotations, drawn directly from my Kindle highlights, as I aim to capture key insights. Learn more about my workflow for syncing these notes here.

Introduction

Charlie Munger is one of the world’s great investors. However, poor Charlie’s Almanac (a collection of Charlie’s speeches) is less about investing and more a guide to learning how to think for yourself, to understand the world around you.

I read Poor Charlie Almanac in December 2023. I found it so inspiring that I spent a lot of my Christmas break creating visualisations of 88 of these ‘mental models’ so i could remember them. I’ve since found the concepts extremely helpful in navigating a number of different situations (from explaining concepts, to presenting more effectively, to navigating corporate strategic matters).

What’s different about Charlie Munger’s philosophy from almost any other you’ll read about – is that it combines insights from nearly every discipline — i.e. not only business, finance, and economics but also mathematics, physics, history, ethics, and perhaps most importantly psychology.

“I believe in the discipline of mastering the best that other people have ever figured out. I don’t believe in just sitting down and trying to dream it all up yourself. Nobody’s that smart.”

Charlie Munger

Key Concepts: Don’t be the man with (only) a hammer / a latticework of mental models

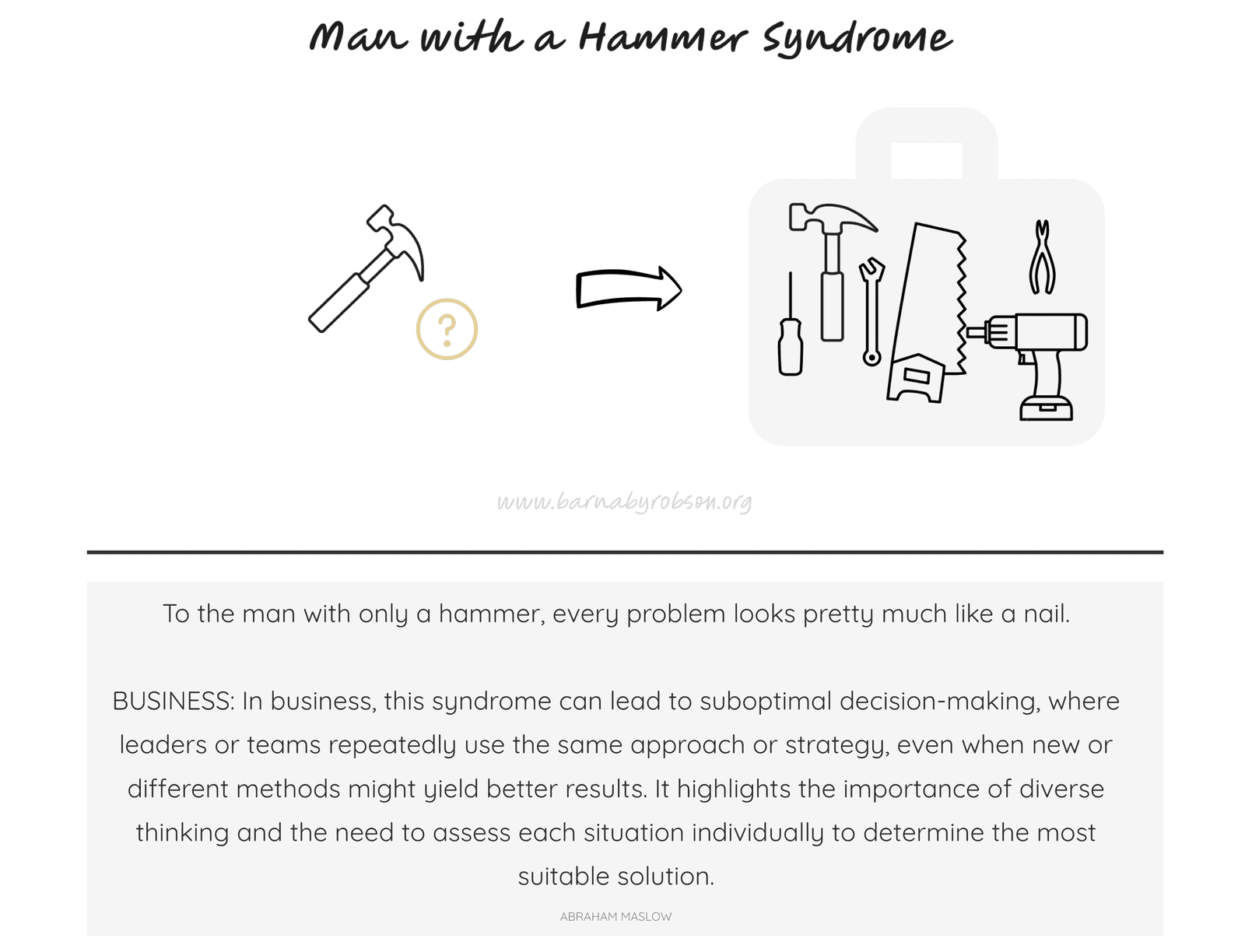

One analogy the book comes to time and time again is the ‘Man with a Hammer tendancy’, taken from the proverb: **

“To a man with only a hammer, every problem tends to look pretty much like a nail.”

Proverb / Abraham Maslow

My visualisation of this is as per the below:

One partial cure for man-with-a-hammer tendency is obvious: If a man has a vast set of skills over multiple disciplines, he, by definition, carries multiple tools and therefore will limit bad cognitive effects from man-with-a-hammer tendency.

To this end the book, sets out mental models can connect in a lattice like manner to solve problems. Each speech a guide to learning how to leverage the wisdom of others embedded in their mental models, to think for yourself to understand the world around you.

“you need is a latticework of mental models in your head. And you hang your actual experience and your vicarious experience that you get from reading and so forth on this latticework of powerful models. And with that system, things gradually get to fit together in a way that enhances cognition.”

Charlie Munger

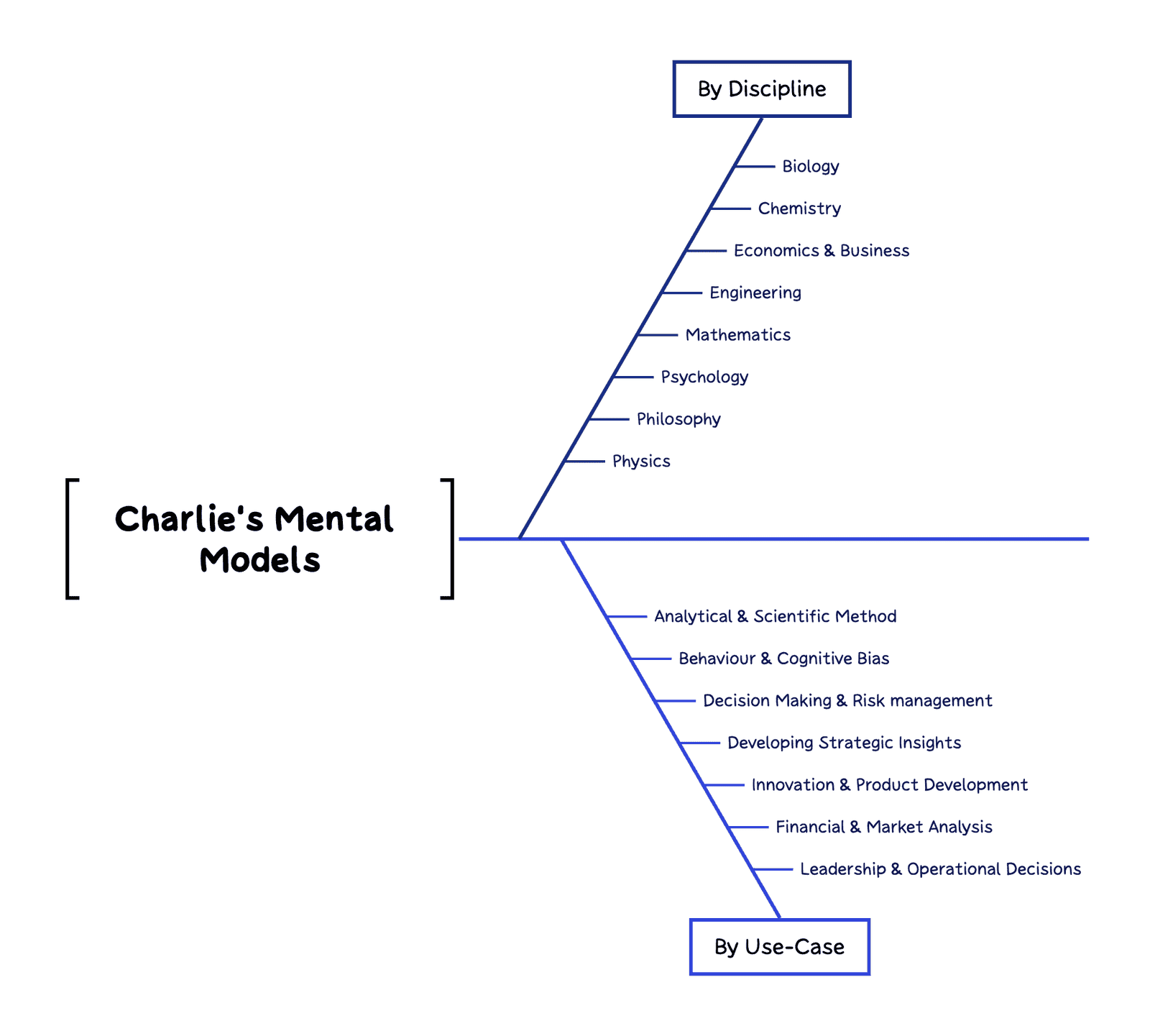

Charlie has spent considerable time learning the models from across multiple disciplines. I had a go at documenting his models – alongside other more recent ones which i’ve found helpful. I’ve found 88 so far (114 if you break-out all 26 types of cognitive bias)

The graphic below visualises how the models can be split by source discipline or use-case.

Charle’s view is you need to learn 100 models.

You’ve got to learn 100 models and a few mental tricks and keep doing it all of your life. It’s not that hard.

Charlie Munger

Remembering 100 models is obviously hard. To this Charlie advocates for using the tools ‘checklist style’.

You’ve got to use those tools checklist-style, because you’ll miss a lot if you just hope that the right tool is going to pop up unaided whenever you need it.

Charlie Munger

To help with this / build an online checklist i can always refer to, I’ve visualised and classified each model by use-case on my website. You can find and search for relevant models on my website at this link:

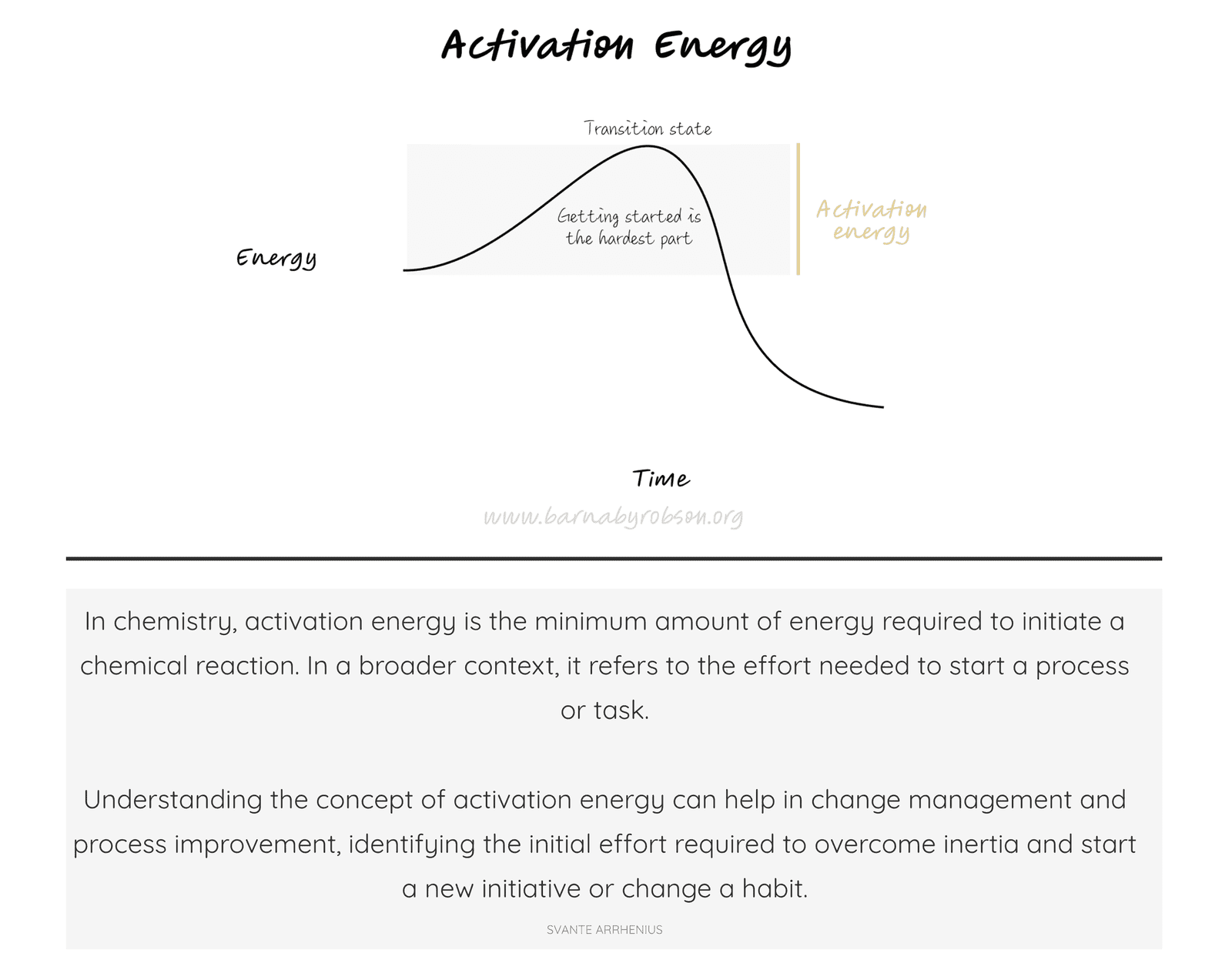

An example of the ‘Activation Energy’ mental model visualisation and related description from the website is shown below:

Key Concepts: Lalapalooza Effects

The term “lollapalooza effect” was popularized by Charlie Munger, to describe the phenomenon where multiple biases, tendencies, or forces act together in a way that leads to a significant, often overwhelming outcome.

“The tendency to get extreme consequences from confluences of psychological tendencies acting in favor of a particular outcome”

Charlie Munger’s definition of Lalapalooza Effects

This concept is key in understanding complex human behaviour and decision-making processes.

Here are some elements that contribute to the lollapalooza effect:

- Multiple Biases: When several cognitive biases combine, their collective influence can be much stronger than any individual bias alone. For example, combining social proof, commitment and consistency, and scarcity can lead to much stronger persuasion.

- Reinforcing Factors: Different factors can reinforce each other, leading to an amplification of the overall effect. For instance, social proof (following the behaviour of others) can be reinforced by authority bias (following the advice of an authority figure), creating a more powerful influence.

- Positive Feedback Loops: These occur when an initial effect causes more of the same effect, leading to exponential growth. In economics, this can be seen in network effects, where the value of a product increases as more people use it.

- Threshold Effects: Sometimes a system will change dramatically once a certain threshold is crossed. For instance, a small increase in incentives might have little effect until a tipping point is reached, after which behavior changes significantly.

- Non-linear Interactions: The combined effect of multiple forces can be non-linear, meaning the outcome is not simply the sum of individual effects but can be much greater. This is often seen in complex systems where small changes in inputs can lead to disproportionately large changes in outputs.

Example in Investing

In investing, the lollapalooza effect can explain why certain stocks or markets experience dramatic movements. If a stock starts gaining attention (social proof), analysts begin to recommend it (authority bias), more investors start buying it (momentum), and the stock’s price rises (positive feedback loop). These factors combined can cause a significant price increase, much larger than any single factor could have achieved on its own.

Key Concepts: Five helpful notions

In the talk (Practical thought about Practical Thought?) Charlie sets out five helpful notions in problem solving. I think these are notions that are good to keep in mind, so posting these below:

- It is usually best to simplify problems by deciding big no-brainer questions first.

- Scientific reality is often revealed only by math

- It is not enough to think problems through forward. You must also think in reverse, much like the rustic who wanted to know where he was going to die so that he’d never go there. Indeed, many problems can’t be solved forward. And that is why the great algebraist Carl Jacobi so often said, “Invert, always invert,” and why the Pythagoreans thought in reverse to prove that the square root of two was an irrational number.

- The best and most practical wisdom is elementary academic wisdom. But there is one extremely important qualification: You must think in a multi-disciplinary manner

- Really big effects, lollapalooza effects, will often come from large combinations of factors.

Key Concepts: Checklists & Charlie’s Investment checklist

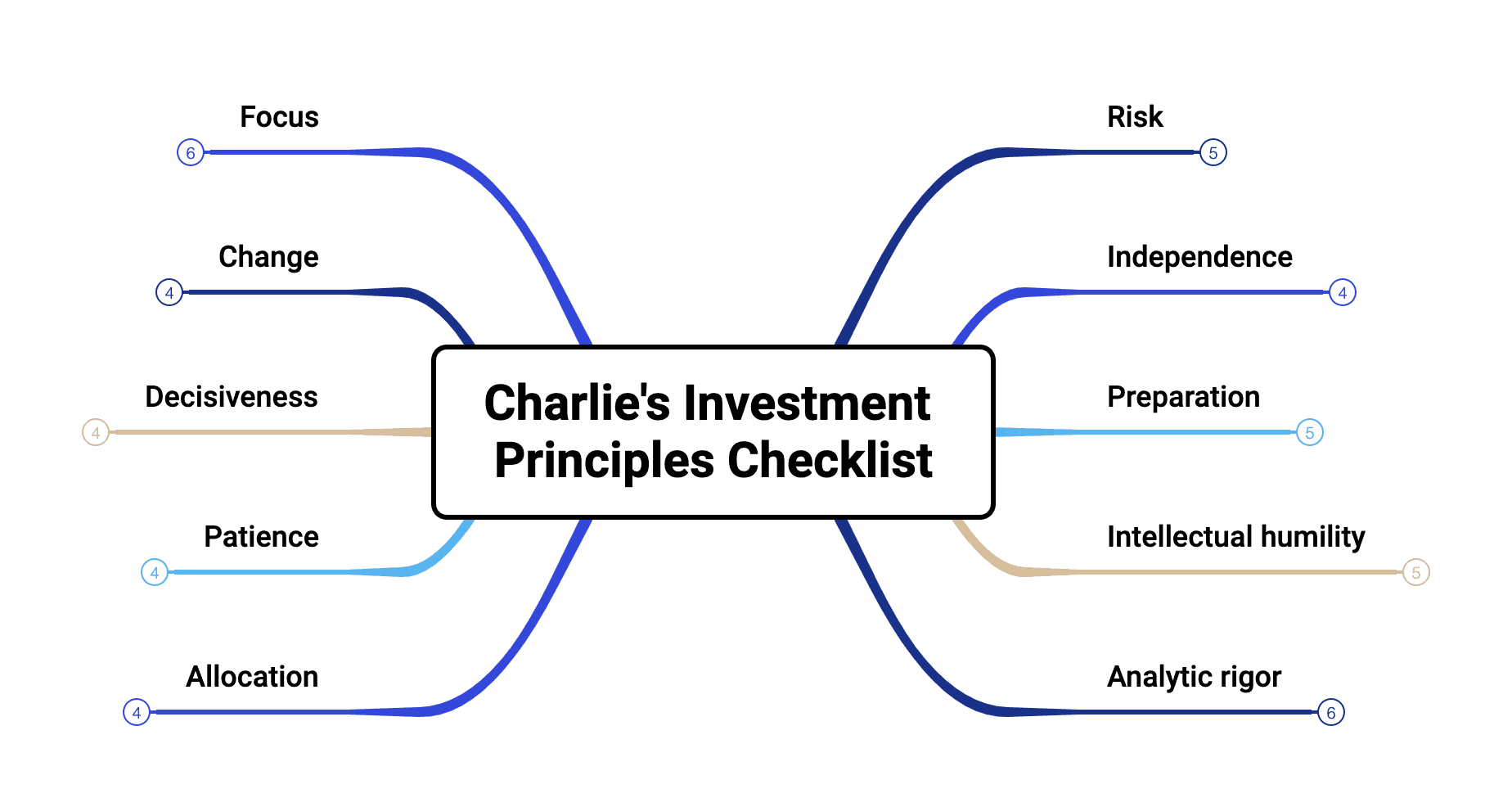

A key piece of advice Charlie imparts is the need for checklists – physical or mental. The book sets out Charlie’s investment principles checklist style – across the 10 topics in the graphic

The detailed list of underlying investment principles by category is set out at the bottom in Appendix 1.

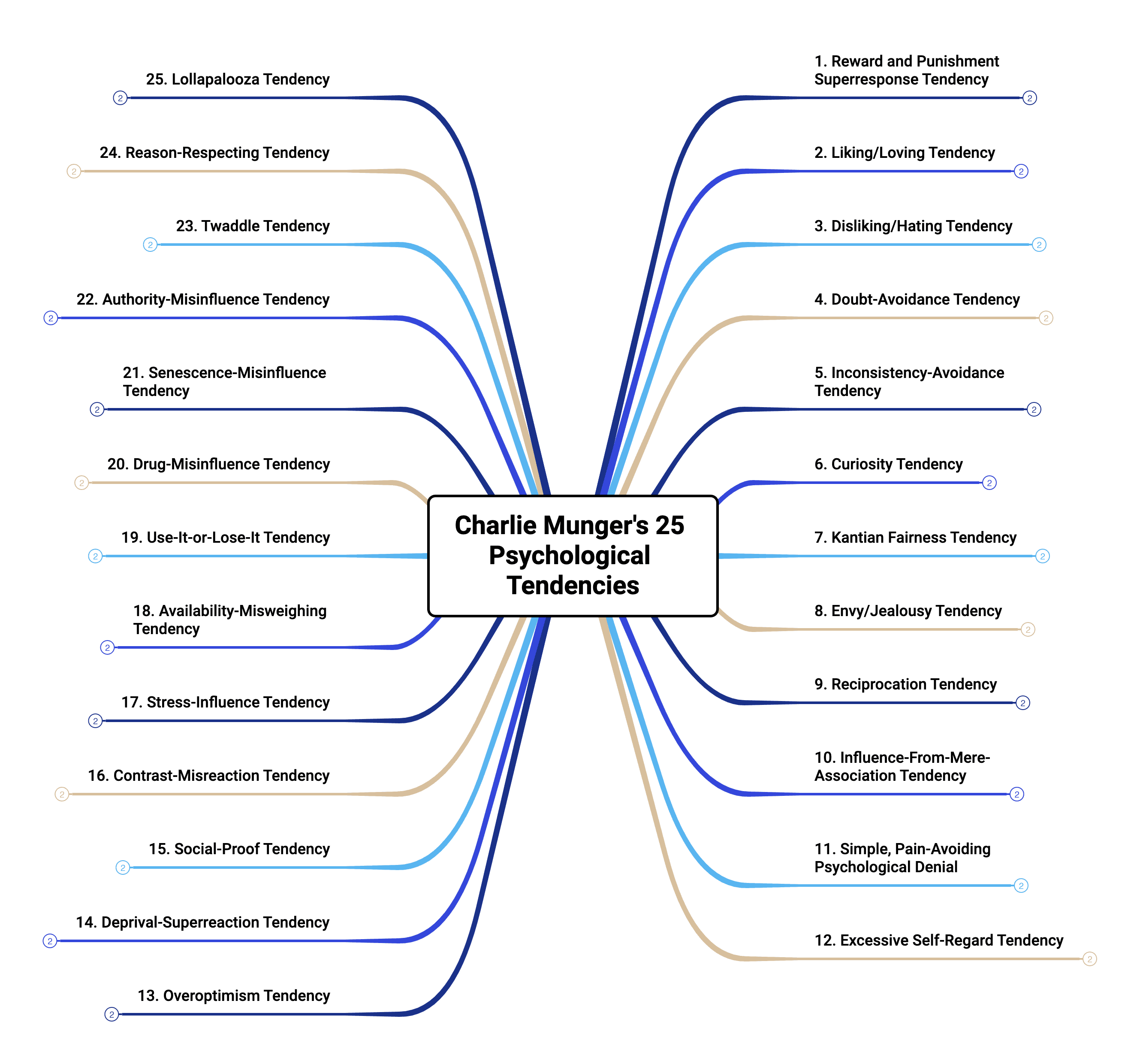

Key Concepts: 25 psychological tendencies you need to watch out for

In the final essay entitled “the Psychology of Human Misjudgement” Charlie sets out his long standing interest in standard thinking errors and his vast ignorance of Psychology on graduating.

He describes on entering the workforce (as a lawyer) seeing multiple examples of “exreeme irrationality”. He describes how he sought good judgement by “collecting instances of bad judgement, the pondering ways to avoid such outcomes”.

This collection of instances of bad judgement in turn led to a list of 25 psychological tendencies which are often intertwined in bad judgement.

He lists all 25 tendencies in the book. I have visualised these below and provided a fuller description of each in Appendix 2.

Conclusion

This book is for me a must-read – for anyone – It’s far more than an investment book, it’s a philosophy on how to live life, make good judgements and maximise the opportunities life brings your way.

Appendix 1 – Detailed list of Charlie’s investment principles

Risk

All investment evaluations should begin by measuring risk, especially reputational.

- Incorporate an appropriate margin of safety.

- Avoid dealing with people of questionable character. Insist upon proper compensation for risk assumed.

- Always beware of inflation and interest rate exposures.

- Avoid big mistakes; shun permanent capital loss.

Independence

“Only in fairy tales are emperors told they are naked.”

- Objectivity and rationality require independence of thought.

- Remember that just because other people agree or disagree with you doesn’t make you right or wrong—the only thing that matters is the correctness of your analysis and judgment.

- Mimicking the herd invites regression to the mean (merely average performance).

Preparation

“The only way to win is to work, work, work, work, and hope to have a few insights.”

- Develop into a lifelong self-learner through voracious reading; cultivate curiosity and strive to become a little wiser every day.

- More important than the will to win is the will to prepare.

- Develop fluency in mental models from the major academic disciplines.

- If you want to get smart, the question you have to keep asking is “Why, why, why?”

Intellectual humility

Acknowledging what you don’t know is the dawning of wisdom.

- Stay within a well-defined circle of competence.

- Identify and reconcile disconfirming evidence.

- Resist the craving for false precision, false certainties, etc.

- Above all, never fool yourself, and remember that you are the easiest person to fool.

Analytic rigor

Use of the scientific method and effective checklists minimizes errors and omissions.

- Determine value apart from price, progress apart from activity, wealth apart from size.

- It is better to remember the obvious than to grasp the esoteric.

- Be a business analyst, not a market, macroeconomic, or security analyst.

- Consider the totality of risk and effect; look always at potential second-order and higher-level impacts.

- Think forward and backward: Invert, always invert.

Allocation

Proper allocation of capital is an investor’s number one job.

- Remember that the highest and best use is always measured by the next best use (opportunity cost).

- Good ideas are rare—when the odds are greatly in your favor, bet (allocate) heavily.

- Don’t fall in love with an investment—be situation-dependent and opportunity-driven.

Patience

Resist the natural human bias to act.

- “Compound interest is the eighth wonder of the world” (Einstein); never interrupt it unnecessarily.

- Avoid unnecessary transactional taxes and frictional costs; never take action for its own sake.

- Be alert for the arrival of luck. Enjoy the process along with the proceeds, because the process is where you live.

Decisiveness

When proper circumstances present themselves, act with decisiveness and conviction.

- Be fearful when others are greedy and greedy when others are fearful.

- Opportunity doesn’t come often, so seize it when it does.

- Opportunity meeting the prepared mind—that’s the game.

Change

Live with change and accept unremovable complexity.

- Recognize and adapt to the true nature of the world around you; don’t expect it to adapt to you.

- Continually challenge and willingly amend your best-loved ideas.

- Recognize reality even when you don’t like it-especially when you don’t like it.

Focus

Keep things simple and remember what you set out to do.

- Remember that reputation and integrity are your most valuable assets-and can be lost in a heartbeat.

- Guard against the effects of hubris and boredom.

- Don’t overlook the obvious by drowning in minutiae.

- Be careful to exclude unneeded information or slop: “A small leak can sink a great ship.”

- Face your big troubles, don’t sweep them under the rug.

Appendix 2 – Description of the 25 psychological tendencies to be mindful of

1. Reward and Punishment Superresponse Tendency

Incentives drive behavior significantly more than most people realize. Properly structured rewards and penalties can greatly influence actions and outcomes.

2. Liking/Loving Tendency

People naturally tend to favor and support those they like, often ignoring faults and distorting facts to maintain positive relationships.

3. Disliking/Hating Tendency

Similarly, people will tend to dislike and oppose those they hate, ignoring their virtues and distorting facts to justify their negative feelings.

4. Doubt-Avoidance Tendency

Faced with uncertainty, humans tend to make quick decisions to eliminate doubt, a trait evolved for survival but can lead to poor decision-making in modern contexts.

5. Inconsistency-Avoidance Tendency

People prefer to remain consistent with past decisions and beliefs, often resisting change even in the face of new evidence.

6. Curiosity Tendency

Curiosity drives exploration and learning, leading to advancements in knowledge and technology, particularly when fostered by a supportive culture.

7. Kantian Fairness Tendency

A sense of fairness, often modeled after Kant’s categorical imperative, guides human interactions and societal norms, promoting reciprocal and courteous behavior.

8. Envy/Jealousy Tendency

Envy and jealousy are deeply rooted in human nature, often driving competitive behavior and conflict over resources or status.

9. Reciprocation Tendency

Humans have a strong impulse to reciprocate both favors and slights, facilitating cooperation but also escalating conflicts.

10. Influence-From-Mere-Association Tendency

People are influenced by associations, often linking their preferences and behaviors to things they associate with positive or negative experiences.

11. Simple, Pain-Avoiding Psychological Denial

People often deny or distort reality to avoid psychological pain, leading to avoidance of difficult truths and problems.

12. Excessive Self-Regard Tendency

Humans tend to overestimate their abilities and qualities, often leading to overconfidence and flawed self-assessments.

13. Overoptimism Tendency

People are generally overoptimistic, believing that desired outcomes are more likely than they objectively are, influencing decision-making and risk assessment.

14. Deprival-Superreaction Tendency

Losses are felt more intensely than gains of the same magnitude, leading to strong emotional reactions and potentially irrational behavior.

15. Social-Proof Tendency

Humans tend to follow the actions and beliefs of others, especially in uncertain or stressful situations, creating herd behavior.

16. Contrast-Misreaction Tendency

Judgments are often influenced by contrasting objects or experiences, leading to misperceptions and poor decisions based on relative rather than absolute values.

17. Stress-Influence Tendency

Stress affects decision-making and behavior, often leading to breakdowns or irrational actions when individuals or groups are under pressure.

18. Availability-Misweighing Tendency

People overemphasize information that is readily available or vivid, often neglecting more relevant but less accessible data.

19. Use-It-or-Lose-It Tendency

Skills and knowledge degrade without practice, emphasizing the importance of continuous learning and application.

20. Drug-Misinfluence Tendency

Substances can significantly alter behavior and cognition, often leading to negative outcomes if misused.

21. Senescence-Misinfluence Tendency

Aging naturally leads to cognitive decline, though active mental engagement can mitigate some effects.

22. Authority-Misinfluence Tendency

People tend to follow leaders and authority figures, sometimes to their detriment if the leader is wrong or misguided.

23. Twaddle Tendency

Humans are prone to engaging in trivial or nonsensical talk, which can impede serious work and productivity.

24. Reason-Respecting Tendency

People have a natural inclination to seek and respect logical explanations, enhancing learning and compliance when reasons are provided.

25. Lollapalooza Tendency

Extreme outcomes often result from the confluence of multiple psychological tendencies acting together, amplifying their individual effects.