The two biggest drivers of wealth and value creation in our lifetimes have been technology and globalisation. One of these is accelerating and the other is reversing.

Anyone investing in or running businesses – especially global businesses – needs to form a view of what this means. This is my attempt.

The history of progress

In the book ‘Zero to One’, Peter Thiel explains the concepts of Vertical and Horizontal progress:

- Horizontal Progress is about copying things that work. Imagine you have a typewriter and you produce 100 more of them. You’ve made horizontal progress. It’s about scaling and replication. In the context of the global economy, this is akin to globalisation. It’s about taking things that work in one place and spreading them everywhere. It’s the China approach of the 20th century: taking what’s been done and doing it more.

- Vertical Progress, on the other hand, is doing new things. It’s going from 0 to 1. Instead of another typewriter, you invent a word processor. This is innovation and breaking the mold, which is basically what we call Technology.

Source: Zero to One by Peter Thiel. Graphic by me.

Zooming out this table sets out how different globalisation and technology eras align:

Source: World Bank Data re level of globalisation. Table by me.

Globalisation and its discontents

Now, let’s talk about the current state of the world. We’re seeing signs of de-globalisation – countries turning inwards, questioning the benefits of a globalised economy, the US questioning spending on overseas wars while there are hardships at home. Trade barriers are going up, and a growing skepticism about global institutions – in particular given their role during Covid.

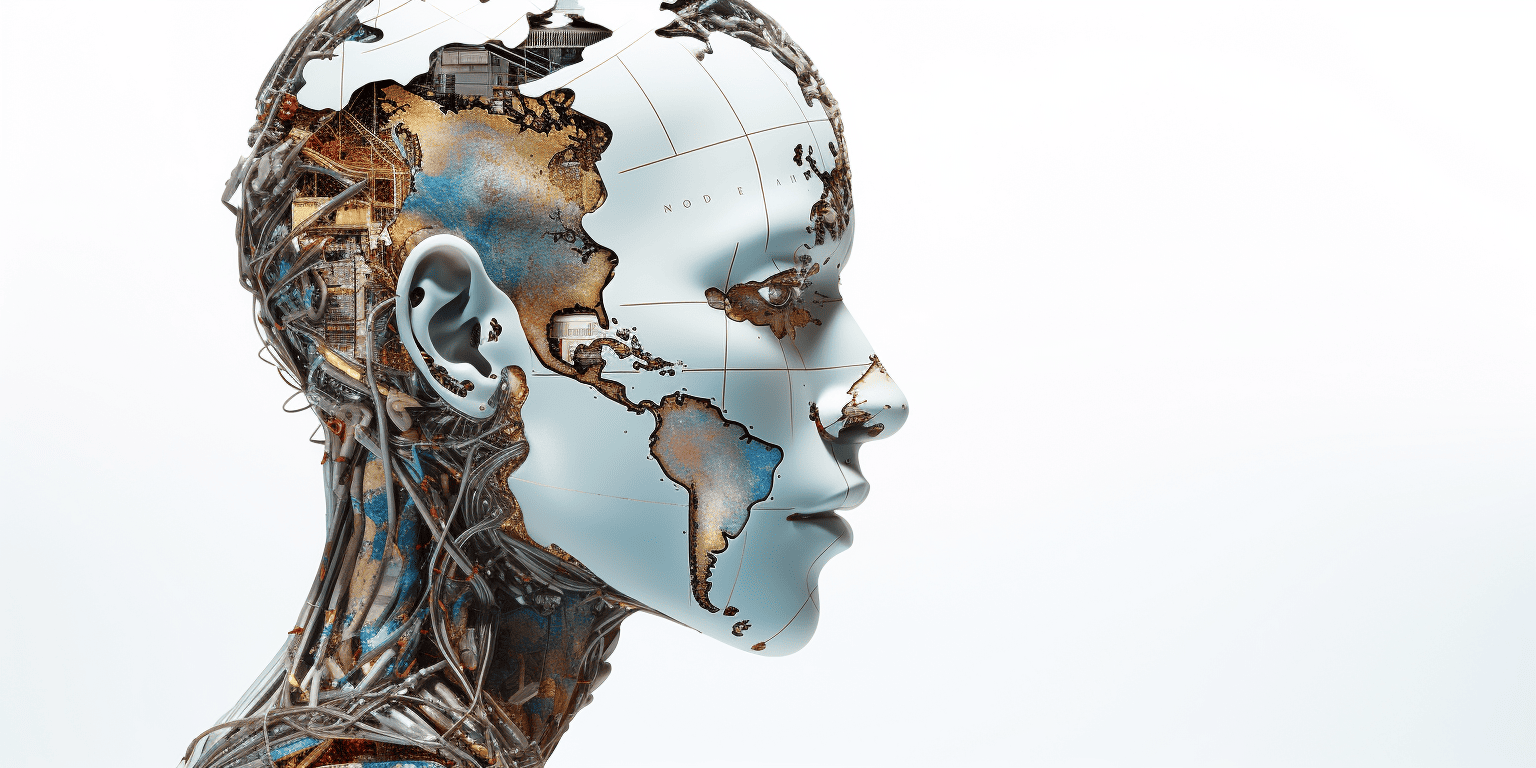

Yet, in this backdrop, certain technologies, especially AI, are accelerating at an unprecedented rate. It’s a fascinating juxtaposition. On one hand, the physical world seems to be decelerating, becoming more insular. But in the digital realm, borders are disappearing, and innovation is accelerating.

So, here’s the question I’m pondering: What does it mean for our future when, on one hand, we’re entering a period of deglobalisation (i.e. Horizontal Regression), while on the other, technologies like AI are advancing at breakneck speeds (Vertical Progress)? How will these opposing forces shape the next chapter of our global story?

The Age of Autonomy

Our new era: exploring new frontiers in technology, while unwinding centuries of globalisation.

Technological Renaissance:

Artificial intelligence, robotics, blockchain and quantum computing are all zero to one shifts which are driving fundamental change.

- AI opens new realms of possibility. It can generate creative, original outputs, drastically extending the range of tasks machines can perform. But it’s also integral to future autonomous systems – be that AI agents, autonomous driving or unmanned factories.

- Blockchain, while often relegated to discussions about cryptocurrencies, holds the promise of true autonomy. As trust in monolithic institutions erodes, blockchain offers a decentralised paradigm, a counter-narrative to centralised finance. It’s a step towards a future where systems operate on consensus rather than authority.

- Quantum computing will allow certain types of complex problems to be solved exponentially faster. The fields it is most like to benefit are drug discovery and materials science – with huge follow on implications.

Elon Musk embodies this spirit of Technological Renaissance. His endeavours, from Tesla’s electrification and autonomous driving push, to SpaceX’s spacefaring ambitions, to X-Ai / OpenAi, are not only commercial successes; they are all corporations accelerating human capability. And while he may not be crafting blockchain solutions, his advocacy underscores its disruptive potential.

Beyond the economic and technological implications, advancements in technology are likely to redefine our societal norms. From how we work, communicate, to even how we perceive trust and authenticity. The ripple effects will be profound.

Global Fragmentation:

The geopolitical landscape is also undergoing a profound transformation. The age of unfettered globalisation is over. We are in a new era of regionalism and strategic realignments. Examples include:

- The U.S.-China dynamic increasingly mirrors the Thucydides Trap, a historical pattern where a rising power threatens an established one. Countries will increasingly be asked to one or the other side.

- The US’ trajectory under Trump is one of isolationism, underpinned by self-sufficiency in semiconductors and energy, sectors like robotics and new energy stand to benefit.

- Meanwhile China’s trajectory under Xi has echoes of Japan’s post-Plaza Accord phase and is marked by similar demographic and economic challenges. Changes in Chinese capital flows towards ASEAN, the Middle East, Africa, and Latin America, show a strategic pivot.

- The BRICS narrative too is evolving. While India seeks a middle path, other members, alongside much of Africa, seem to gravitate towards China.

Changes to tax regimes may accelerate corporate deglobalisation

The BEPS 2.0 framework, slated for 2023 implementation, marks a pivotal change in global taxation for multinational corporations. Designed to address tax challenges in the digital economy, it aims to ensure MNCs are taxed where they generate revenues and enforces a minimum 15% tax on profits in each jurisdiction. This could reshape MNC strategies, potentially increasing their tax burdens and prompting a reevaluation of operations in certain markets due to economic viability concerns.

Economic Paradox:

The interplay between rapid technological advancement and geopolitical fragmentation creates a complex economic puzzle. While innovations like AI signal a future of exponential growth, the pullback from globalisation introduces headwinds. De-globalisation and tariffs tend to result in rising costs, causing sustained inflation and tighter monetary policy (i.e. higher interest rates and less QE).

For those steering capital, the challenge is twofold: understanding these macro shifts and identifying the micro opportunities they bring. Here’s where I think discerning capital allocators might focus:

- Emerging Technology: The technological renaissance is undeniable, and with it comes many investment opportunities. Companies at the forefront of AI, blockchain, and new energy solutions are poised for significant growth. The key is to identify those that have a clear path to scalability and a sustainable competitive advantage.

- New Energy Paradigm: Wars in the Middle East and between Russia and Ukraine have driven home the need for energy security. As nations become less reliant on oil and LNG, the traditional power dynamics, heavily influenced by oil politics, might see a recalibration. Nuclear power, especially with recent innovations in Small Modular Reactors (SMRs) and fission, is emerging as a reliable and clean energy source. Solar power, battery technology, and other renewables are becoming a mainstay as costs come down and efficiencies rise. As these technologies mature and scale, they’ll shape an energy paradigm that’s both sustainable and economically viable.

- Capital Flows & Neutral Grounds: As the geopolitical landscape becomes increasingly polarised between the US and China blocks, there emerges a unique opportunity for neutral states. These countries, strategically positioned between the two giants, could play a pivotal role in the global order. By not aligning definitively with either block, they can serve as mediators, facilitators, and even as economic hubs, drawing investment and capital from both sides. Their role might be reminiscent of the non-aligned movement during the Cold War, but with a distinctly economic flavour this time

- Localised Solutions: With the trend towards self-sufficiency and localisation, companies that offer localised solutions – be it in manufacturing, agriculture, or energy – are likely to thrive. This includes firms enabling robotics or 3D printing for localised manufacturing, or those pioneering new agricultural technologies for regional food security.

As we navigate the 21st century, the interplay between technological promise and geopolitical realities will shape our world in ways we can’t fully predict. The challenge lies not just in harnessing the power of innovation but in doing so in a world that’s increasingly fragmented. How we adapt to this challenge will drive individual and business success in the coming decades.

References and borrowed ideas

This Essay was inspired by the book Zero to One by Peter Thiel. I highly recommend readers explore the book which, though published in 2014, is in many ways more relevant today than ever.

Data on exports of goods and services as a percentage of Global GDP (best proxy for tracking levels of globalisation) is available from the World Bank Here: https://data.worldbank.org/indicator/NE.EXP.GNFS.ZS. The data shows for China, the US and India, the peak was c. 2006 – 2010

Disclaimer:

Note: The following are personal views based on current trends and observations. They are not to be construed as financial advice.