Every year I spend time collating what I the feel are the key themes which could drive investment flows for the year ahead – this is a aggregation of what I’m seeing at work (I advise on M&A and see real time capital allocation shifts), and my reading of the news, and interpretation of economic and other data.

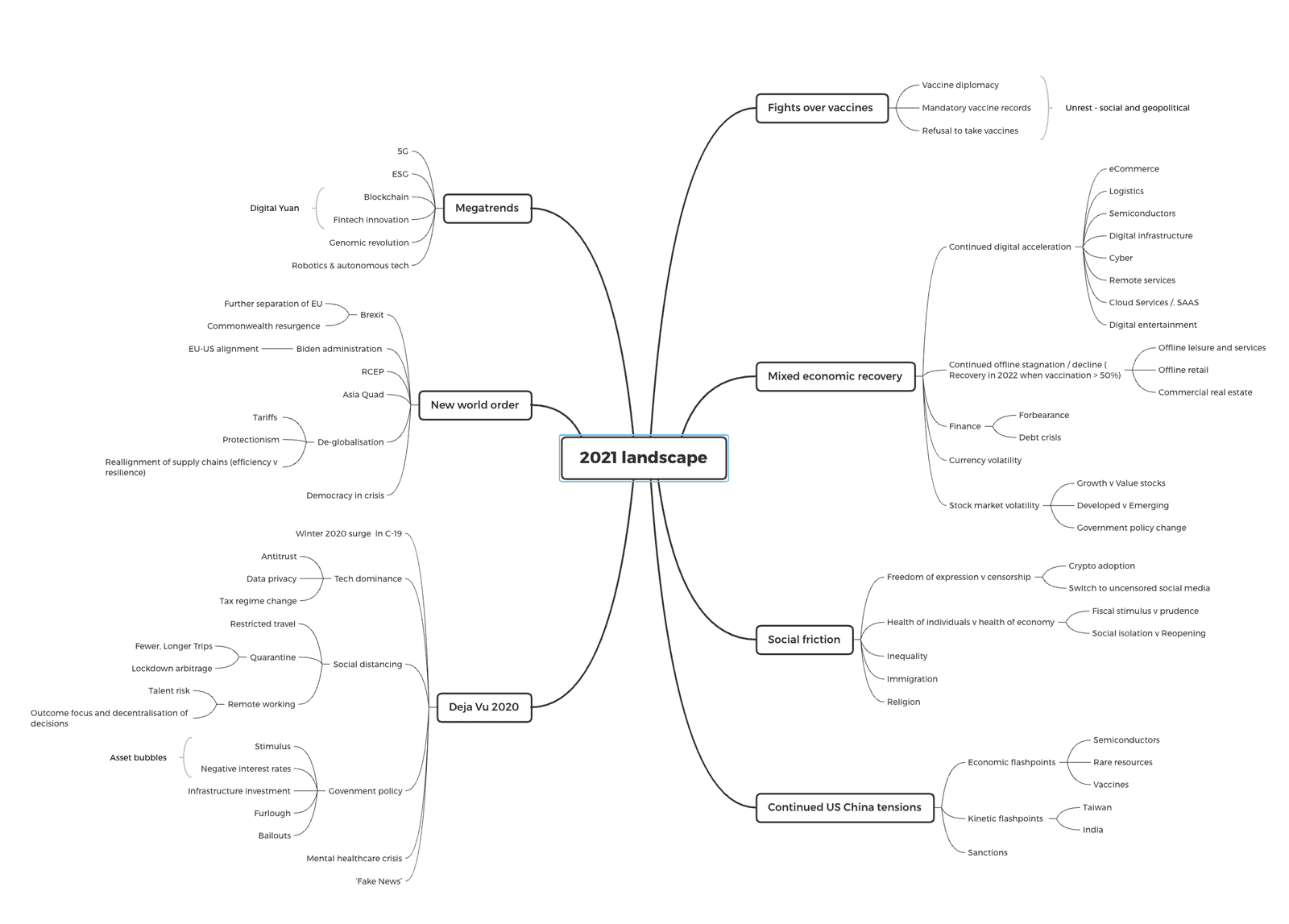

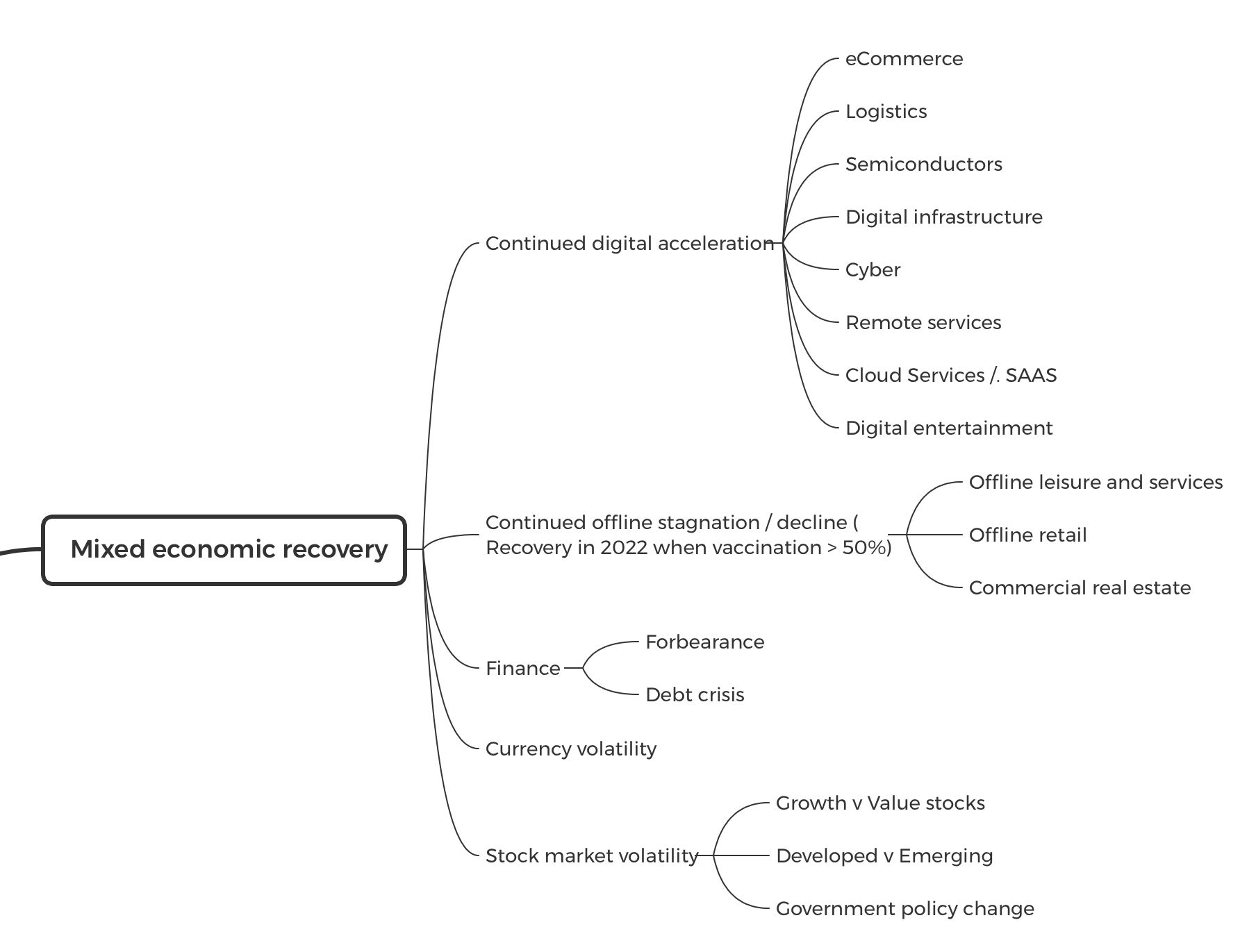

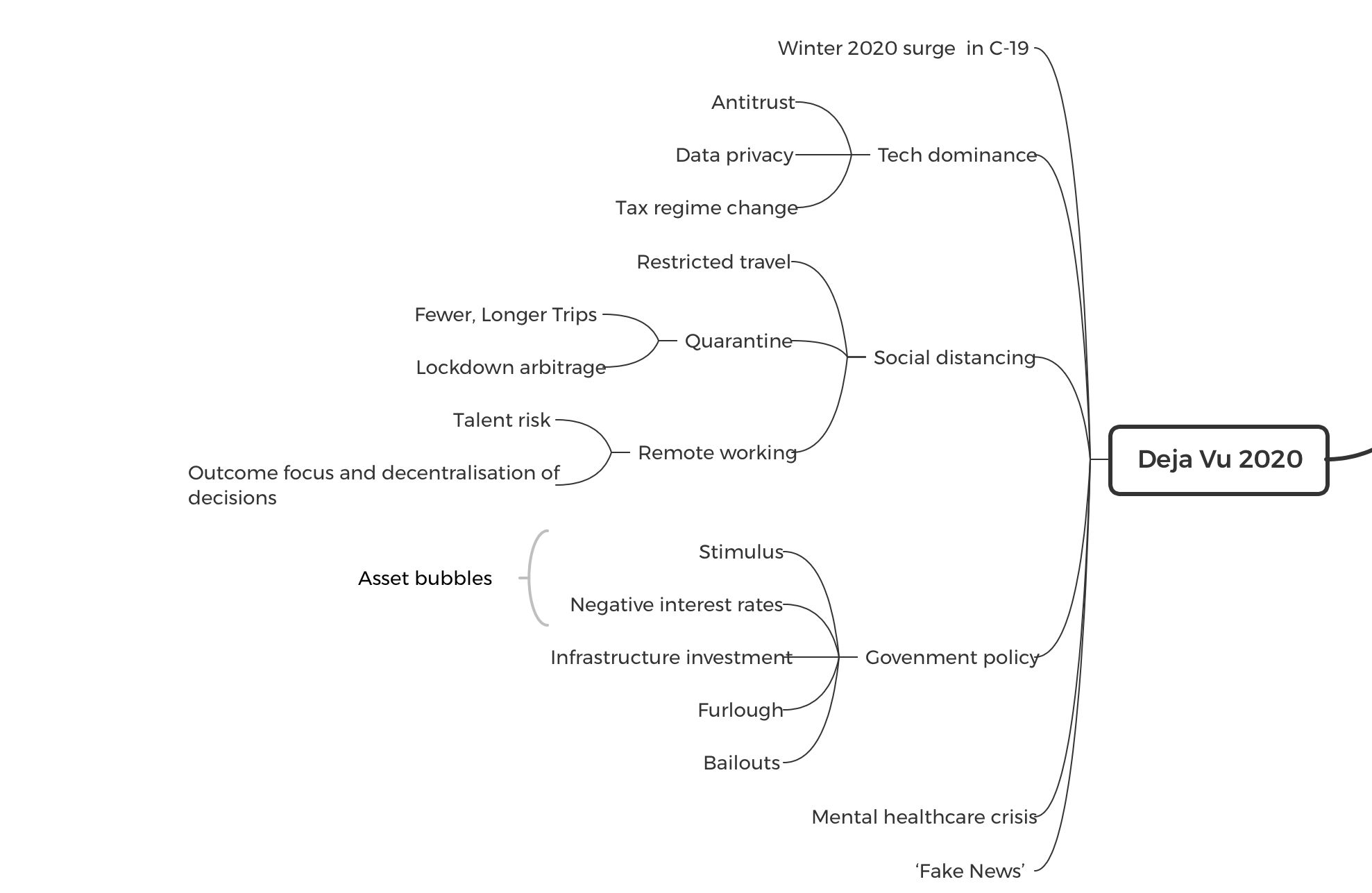

I find mind-maps the most helpful tools to organise and connect thoughts. The graphic above was generated in XMind (https://www.xmind.net/), my favourite mind mapping software (it’s multi device – iphone, ipad, mac with cloud sync).

This articulates my views for 2021 as of December 2020. I expand on the seven core themes below, and also give a view on how things are playing out on 1 June 2021 when I posted this.

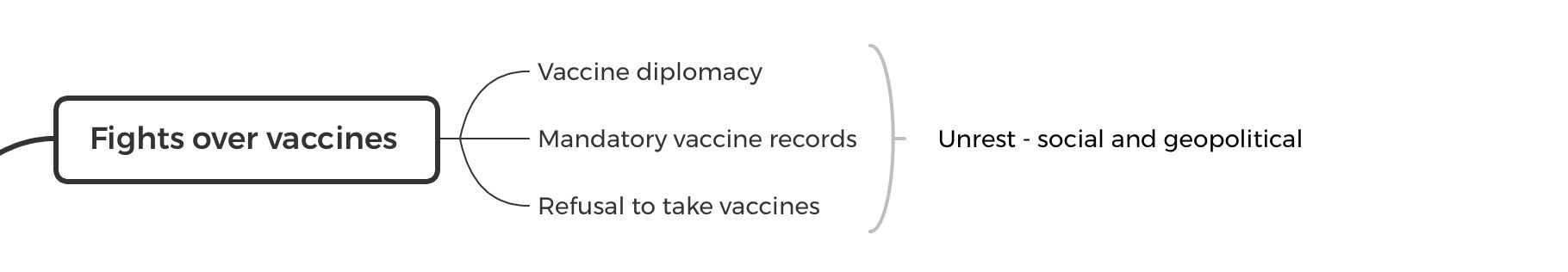

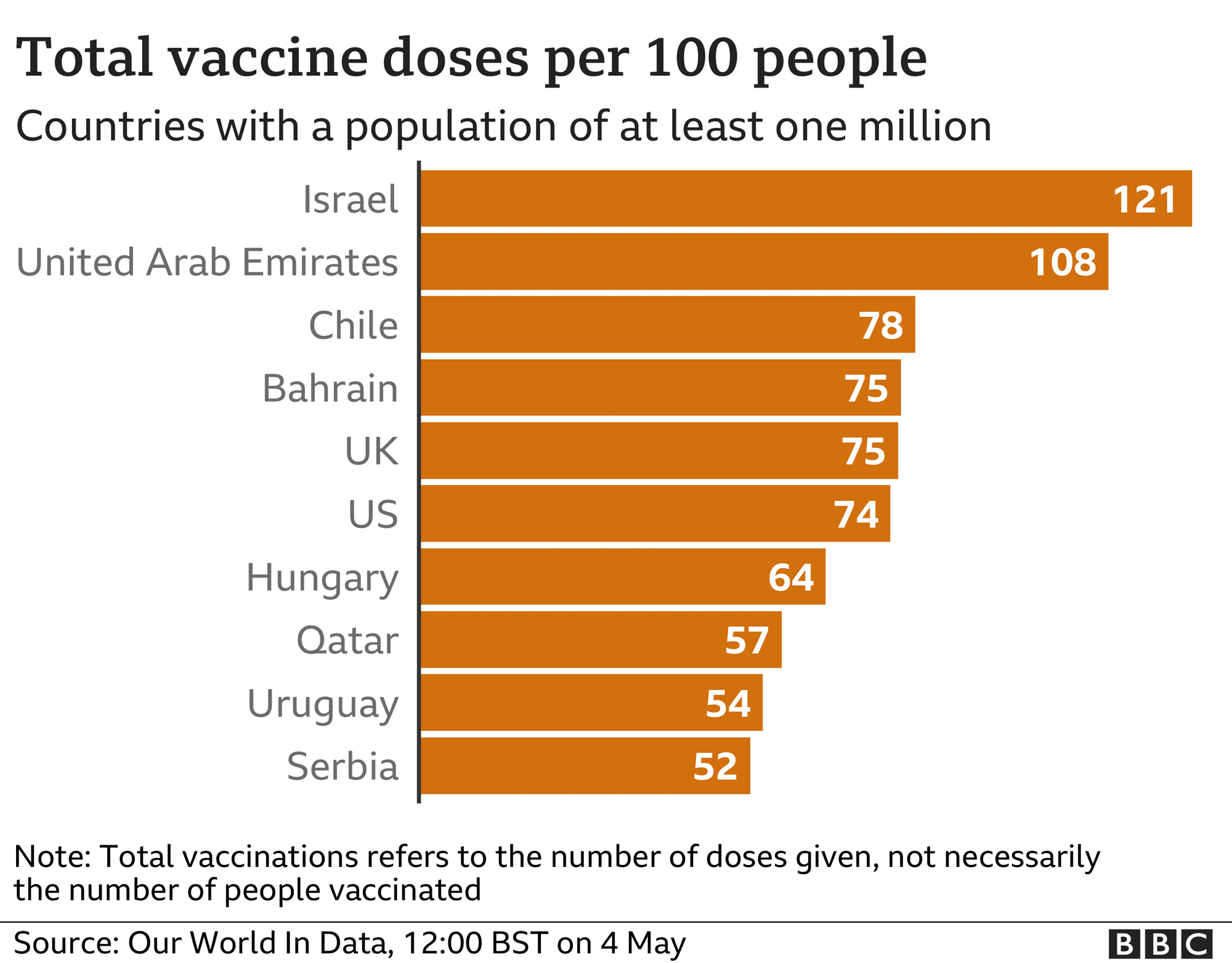

1. Fights over vaccines

Hypothesis:

- As of December 2020, there were five core vaccines which have been through trials and are being approved; those distributed by: Pfizer, Johnson & Johnson, Moderna, Astrazeneca and Sinopharm.

- Wealthy countries had funded their development and would be first to receive the majority of doses. This disparity would lead to potential for conflict and ‘vaccine diplomacy’, which could impact future geographic investment flows and alliances.

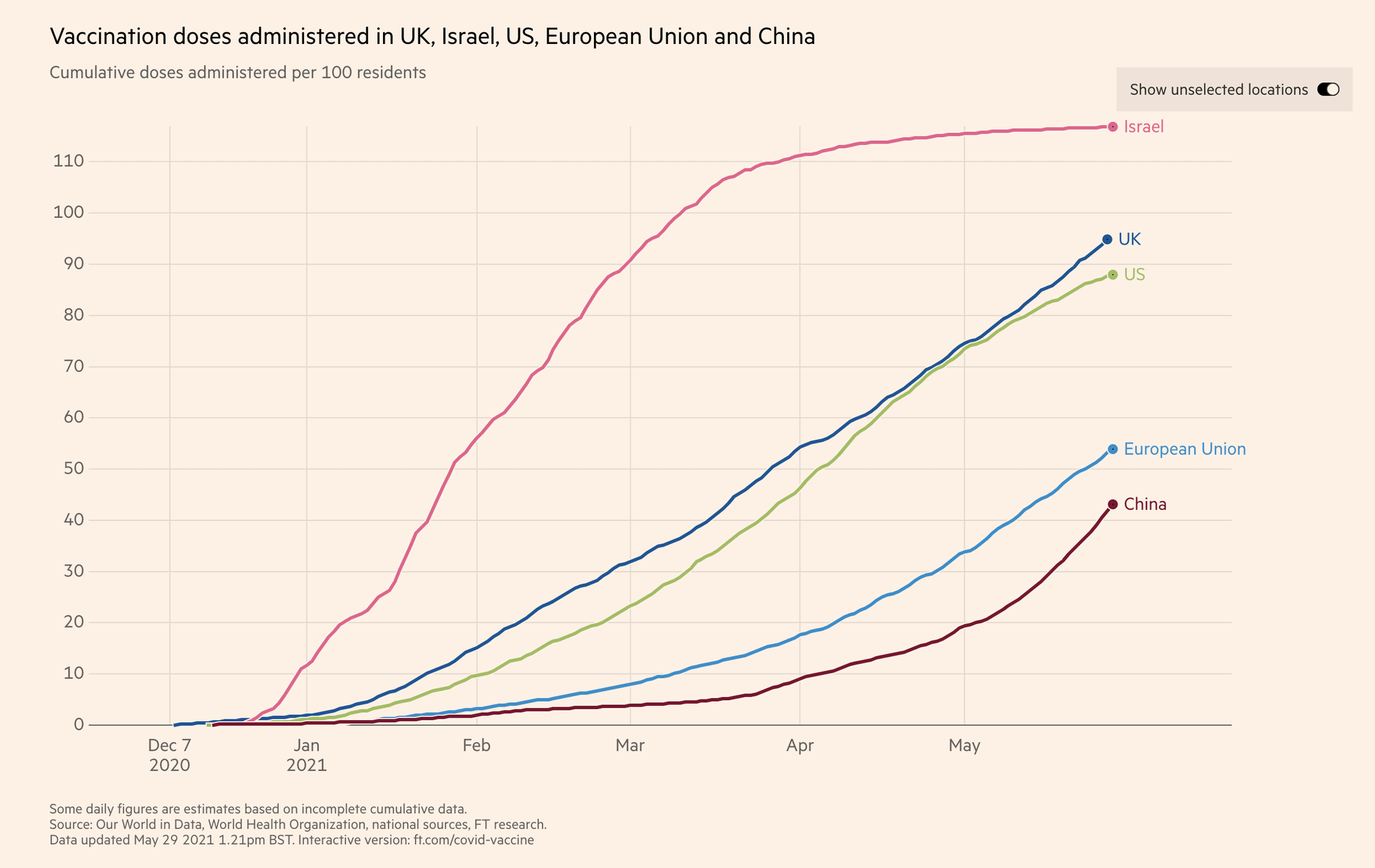

Retrospective – May 2021

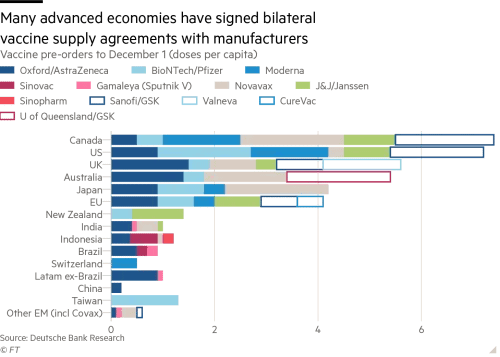

- Low trust in governments, particularly in some territories such as Hong Kong, and fears around long term effects from vaccines contributing to a lack of take-up. Elsewhere, the UK and US have raised ahead of other larger developed economies, with the developing world far behind.

- China’s early lead in vaccine diplomacy appears to be waning, given the growing view that the efficacy of Sinovac is relatively low based on what occurred in the Sychelles and Chile, where 60%+ vaccination rates (mostly with Sinovac) did not prevent virus spikes and travel curbs.

- Key determinants for people being vaccinated include:

(a) vaccine availability,

(b) fear of infection (the stick), and

(c) vaccination providing a pathway to travel/greater freedoms (the Carrot).

- Travel / opening of borders is an interesting conundrum. Because a vaccinated traveller can carry the virus and due to increasing COVID variants, travel bubbles are likely to open up between either:

(a) countries with low virus transmission, or

(b) high rates of vaccination / herd immunity.

- Vaccination seems to be the only path to recovery and with this in mind I had my first vaccine dose in May 2021.

- The PRC seems to have recognised this and accelerated vaccinations in May 2021.

2. Mixed economic recovery

Hypothesis

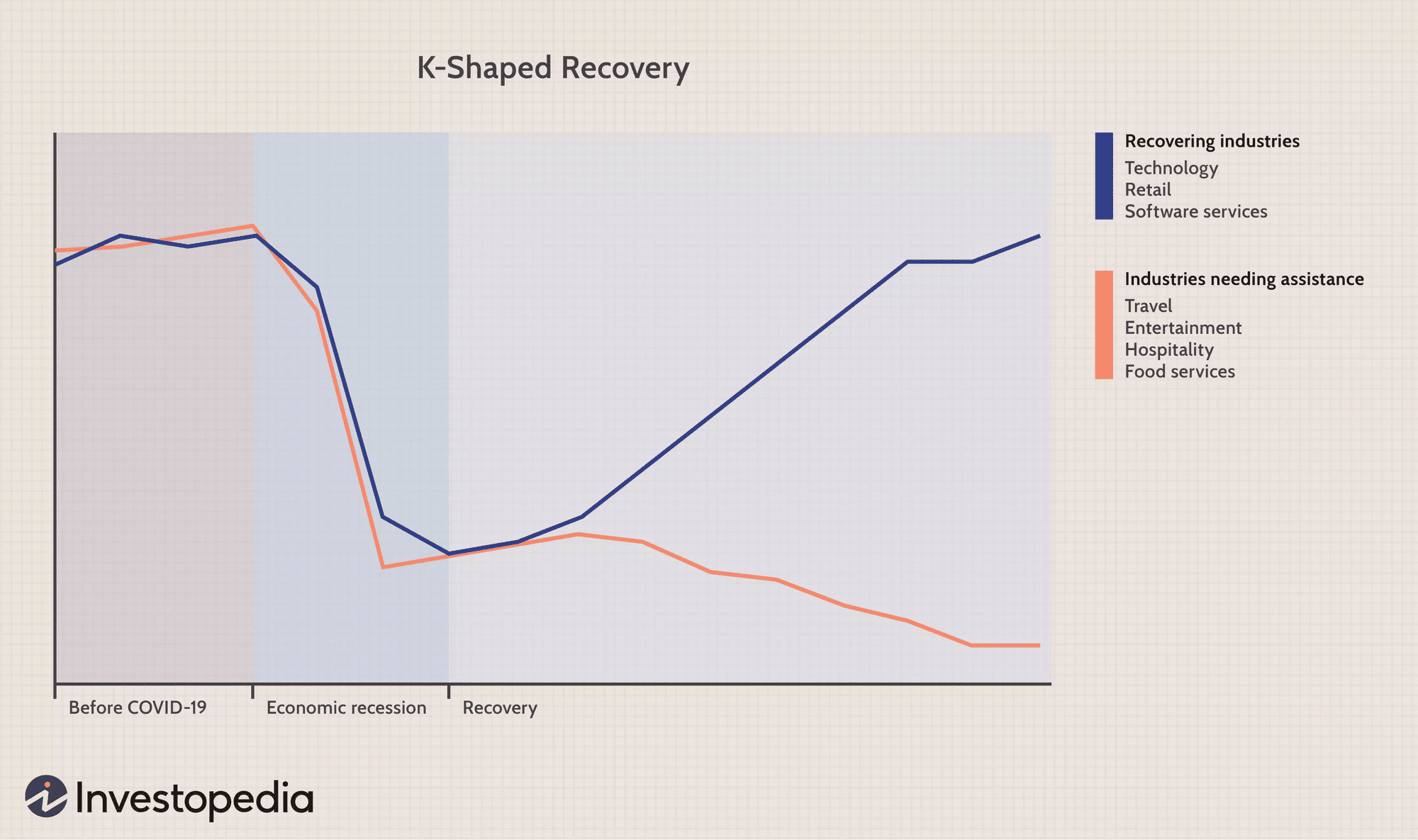

Continued K shaped recovery. I expected:

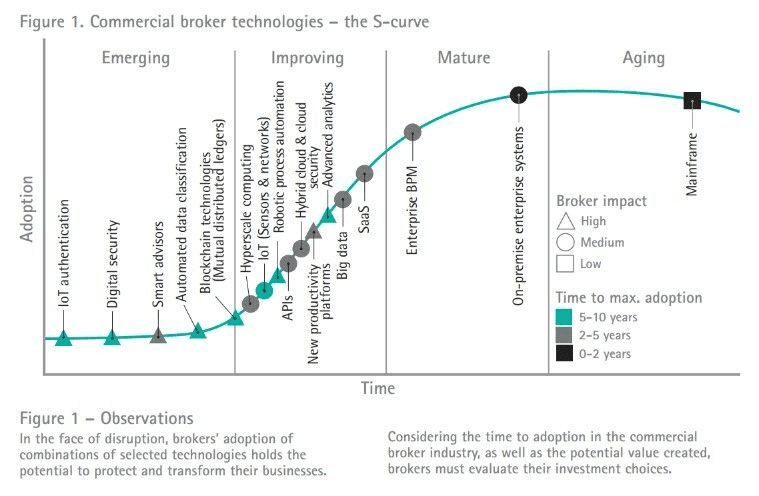

- Tech acceleration to continue in 2021, as Covid driven adoption had driven a proliferation of different tech up their S curves.

- Offline industries to recover in 2022, in line with when I feel vaccinations will have reached sufficient level for a return to normal.

- Government stimulus packages to continue to drive bull markets

- Currency volatility as economies emerged from the crisis and different rates, and due to variances in the amount of QE

“The coronavirus crisis turbo-charged a move towards innovative platforms and there is no moving back”

CATHIE WOOD

Retrospective – May 2021

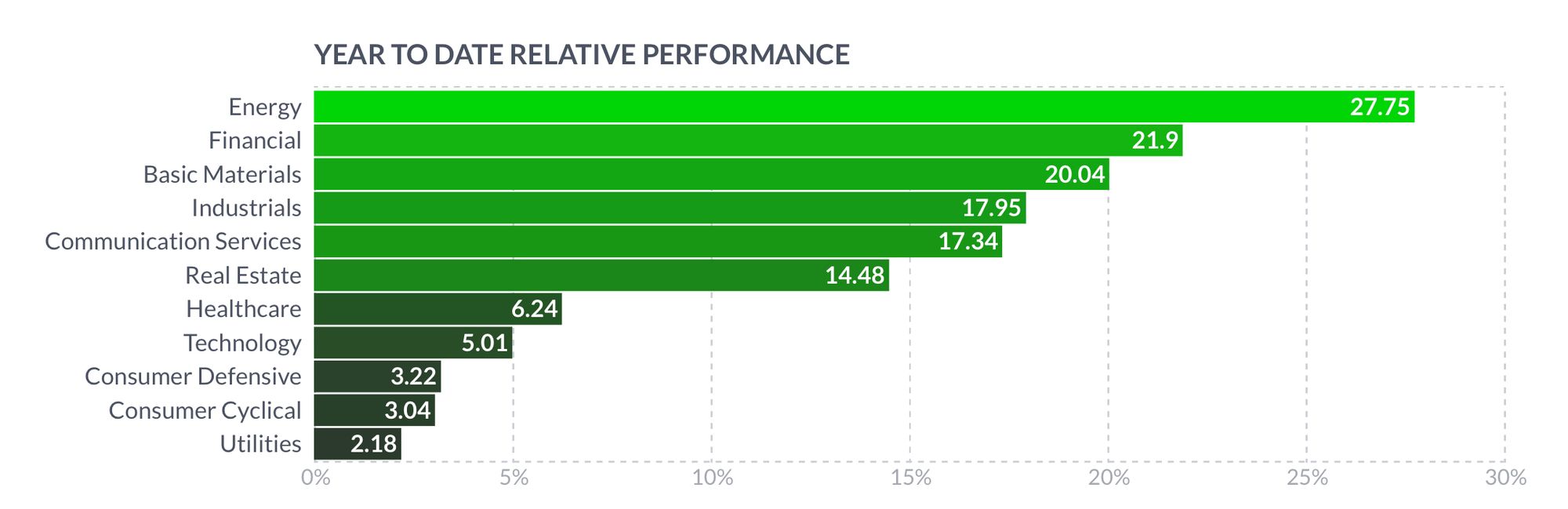

- Energy, Commodities and financials have all outperformed. I didn’t see this happening.

- Emerging tech suffered large set backs from Mid Feb 2021, due to inflation fears (and implications for discount rates etc).

- I believe this pull back was an over-reaction and growth stock performance will pick up in the second half of 2021.

3. Social friction

Hypothesis

- The ramifications of Brexit, #BLM, #metoo, Cancel Culture and the Trump-Biden US 2020 elections will be profound. The role of social media and the deep state is emerging in all these areas of social friction, and leading to distrust in all sides of politics. There are also deep divisions in society as a result of these matters. I believe there was overreach and there will be a backlash.

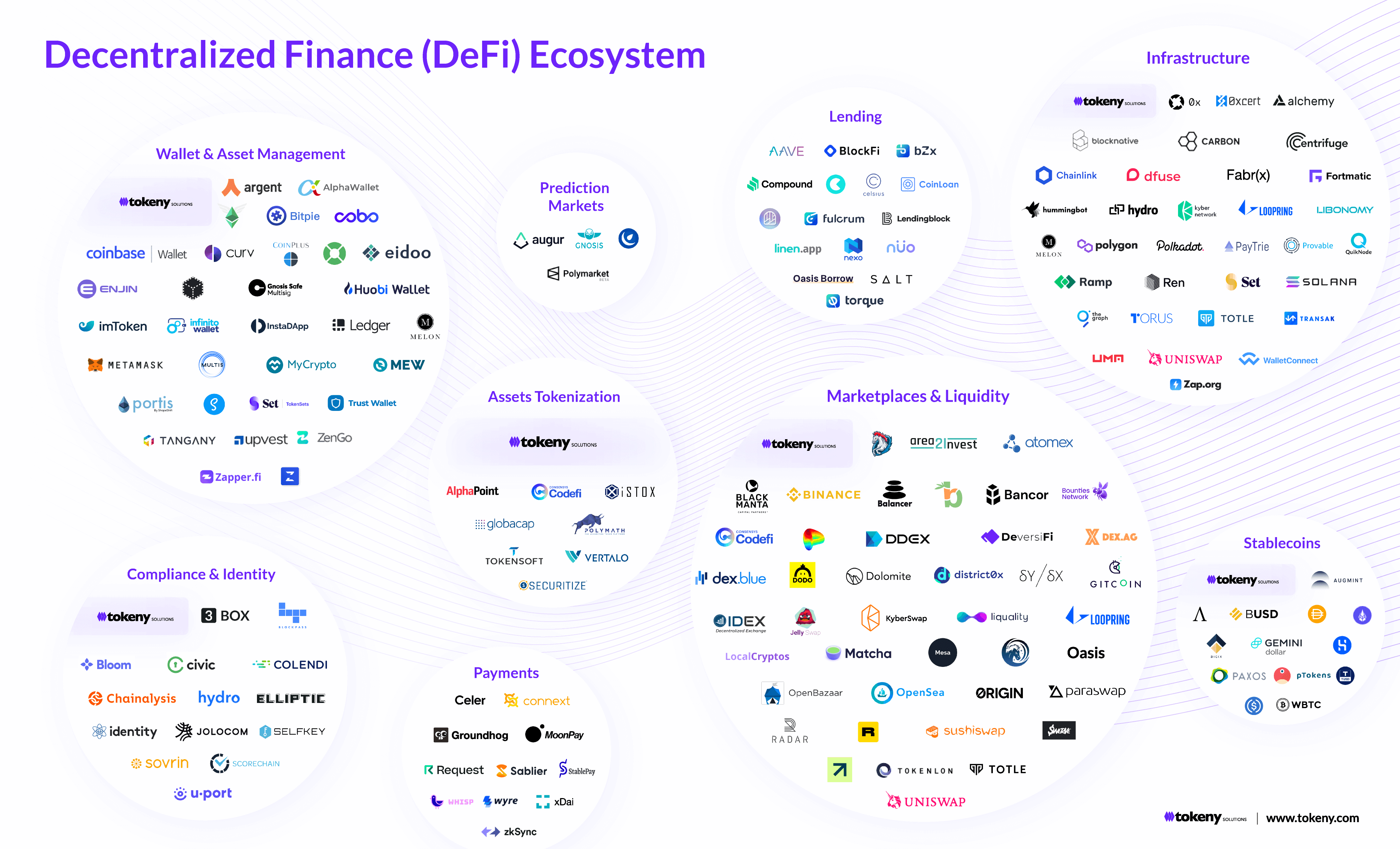

- One of the ways the backlash is manifesting is through the rapid adoption of Cryptocurrencies and decentralised platforms and economies.

- Elsewhere, Coronavirus has led to some deep ethical questions around: (a) health or people versus economic health – decisions adverse to economies have deep second order impacts to those at the bottom of the economic pyramid, so decisions are more nuanced than might first be assumed, (b) inequality (e.g. in vaccine distribution, and as wealth accumulates to an ever smaller % of the population), (c) immigration (role on spread of viruses and the ability to work from different geographies resulting potentially in counter-migration)

The ‘liberals’ are: illiberal in their demand for liberality, exclusive in their demand for inclusivity, homogeneous in their demand for heterogeneity, undiverse in their call for diversity.

STEPHEN FRY

Retrospect May 2021

- I think these themes are all playing out. Crypto-currency valuations and trading volumes surged in the first four months of 2021, before pulling-back in May 2021. Governments are trying to regulate cryptocurrencies.

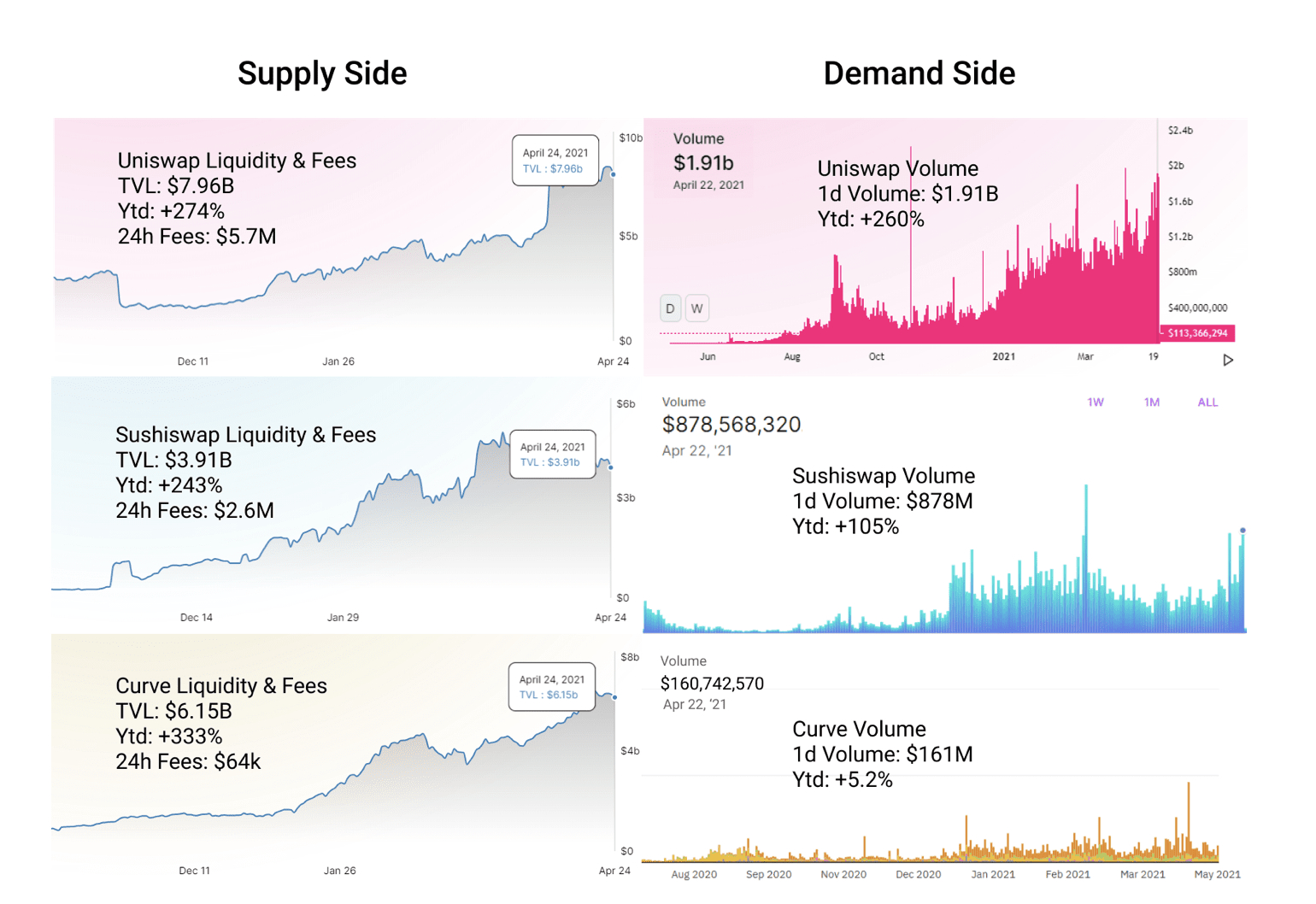

- I think this will lead to an acceleration in growth of Decentralised Finance (“DeFi”). As I write this in May 2021, Uniswap (the largest Decentralised Crypto Exchange) is trading higher volumes than Coinbase (the largest listed centralised crypto exchange).

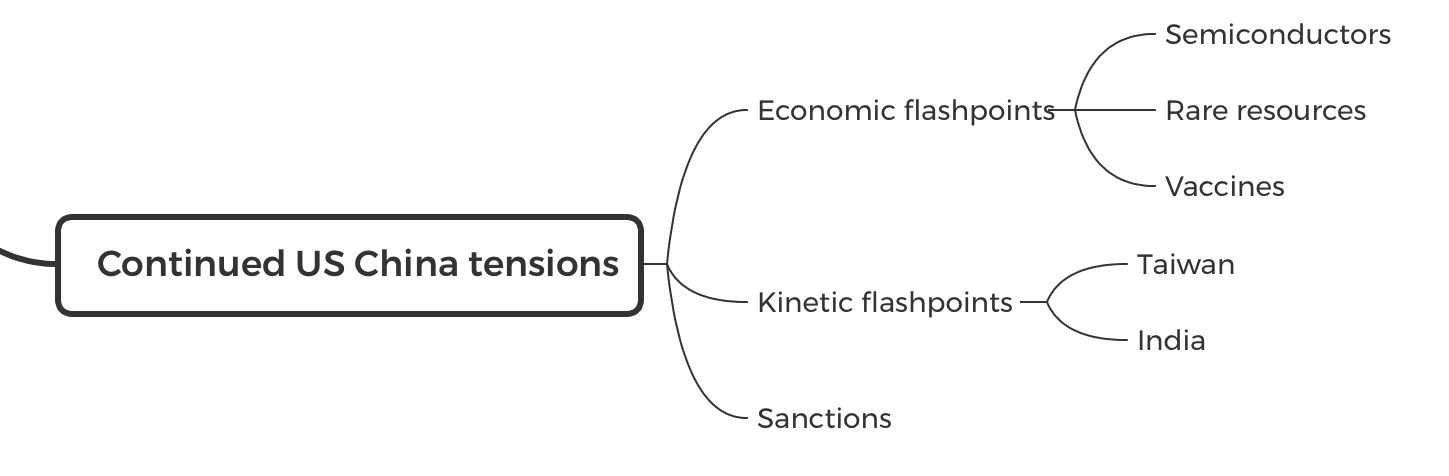

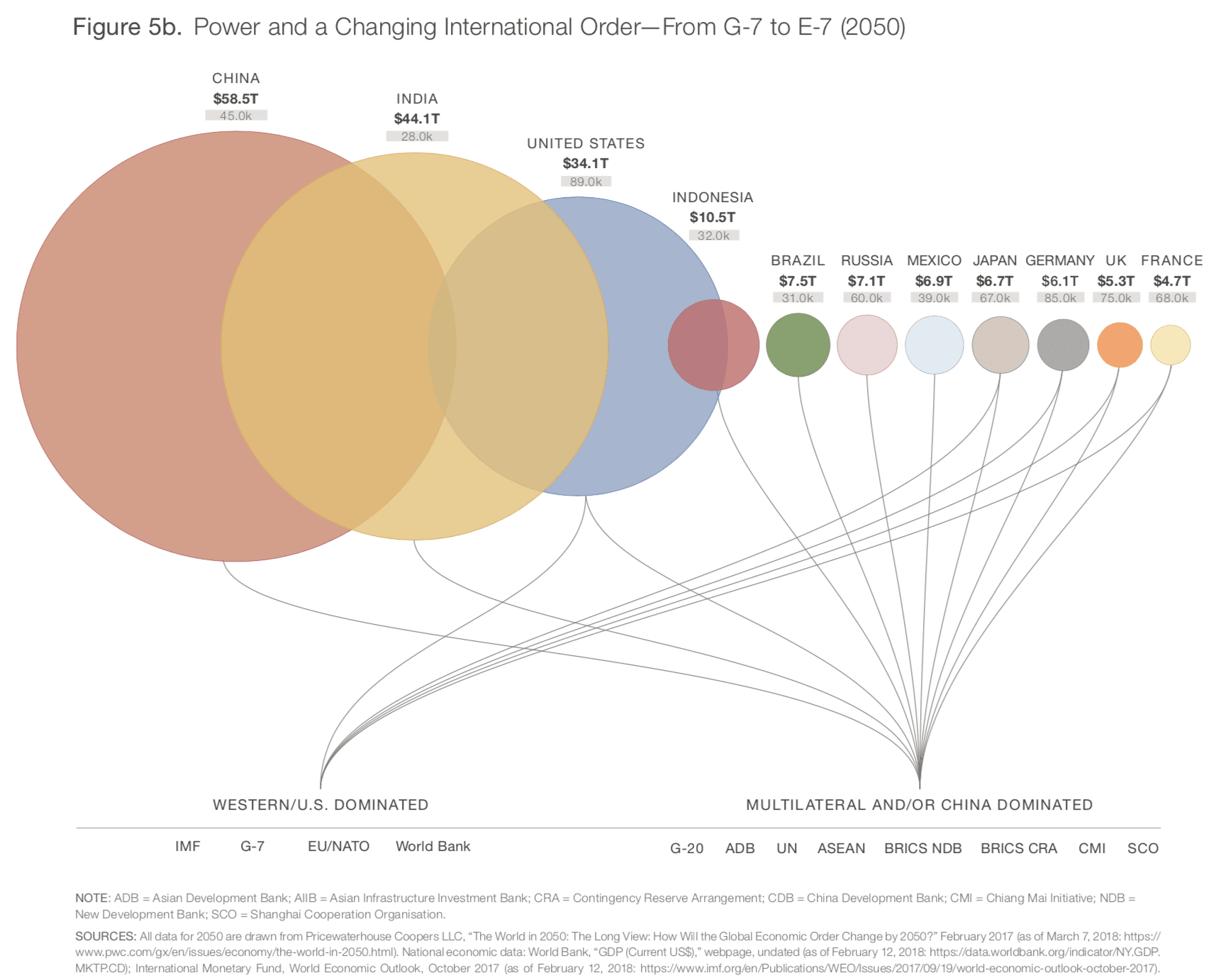

4. Continued US-China tensions

Hypothesis

- The United States is considered by most to be the leading economy with the greatest military strength. However, the rapid emergence of China threatens the U.S. hegemony and the world order. As one superpower rises to compete with another we have in the past frequently seen increased volatility, and given the differences in ideologies between the two nations this feels unavoidable.

- Competition will play out across a number of spheres – currencies, semiconductor, influence, etc. Supply chains will be untangled and brought back onshore for critical resources.

- As China’s economic and military confidence grows, it seems more likely there will be economic flash-points along China’s borders. Kinetic conflict occurred between China and India in 2020. China has built islands in the South China Sea.

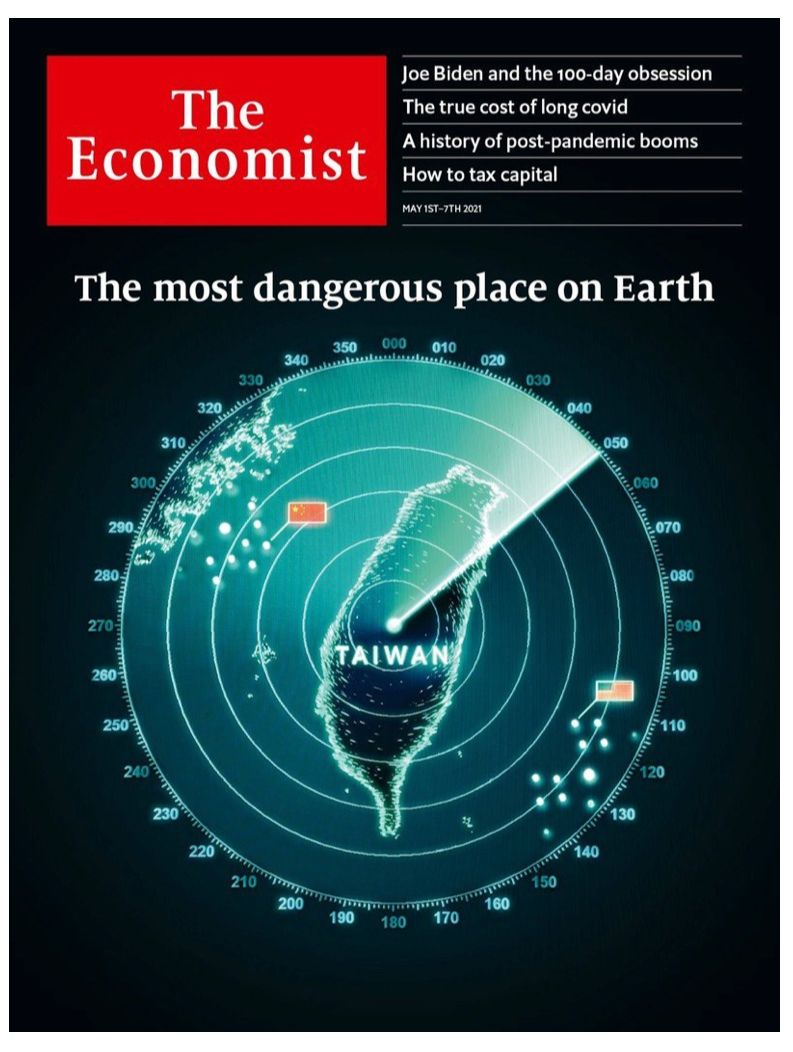

- The manner in which the Hong Kong extradition protests were handled by China in 2019/2020, means a peaceful coming together of China and Taiwan appears highly unlikely. The focus by the PRC leadership on unification of Taiwan and Mainland China makes military conflict depressingly likely.

Retrospect May 2021

- Some analysts believe military superiority in the South China Sea will sooner or later tempt China into using force against Taiwan. Incursions by China into Taiwan airspace are increasing.

- War would be a catastrophe on a human level. There would also be deep economic consequences worldwide as Taiwan is at the heart of the global semiconductor industry through tsmc, the world’s most valuable chipmaker, which produces 84% of the most advanced chips.

5. Deja Vu 2020

Hypothesis

- Not much will change in 2021.

- We’ll get more accustomed to the ‘new-normal’ – of PPE, social distancing, remote work etc.

Retrospect May 2021

- Approaching half way through 2021 these predictions feel accurate.

6. New world order

Hypothesis

- Heading from US hegemony towards a multi-polar world, with geopolitical alliances being re-drawn

Retrospect May 2021

- I didn’t foresee the speed at which the Biden administration would pivot towards conflict with Russia, nor the re-emergence of the Israeli-Palistinan conflict after the relative peace on both fronts during the Trump adminstration. My view is anything that saps US energy from relations with China, will lead to a greater probability of China surpassing the US.

- We have also seen a setback for democracy in Myanmar, with the Junta replacing the democratic government.

- Elsewhere, the UK has agreed trade-deals with Australia, and looks set to do deals with India and other commonwealth countries.

- Meanwhile, the EU has struggled with their vaccine roll-out program; while there is growing support in the UK for the conservative ‘brexit’ government (as evidence in the May 2021 local elections), given the way they have successful handled the vaccination programme, the EU is falling behind China and America because it fails to grapple competently with each successive crisis. I predict long-term the European project will be scaled back.

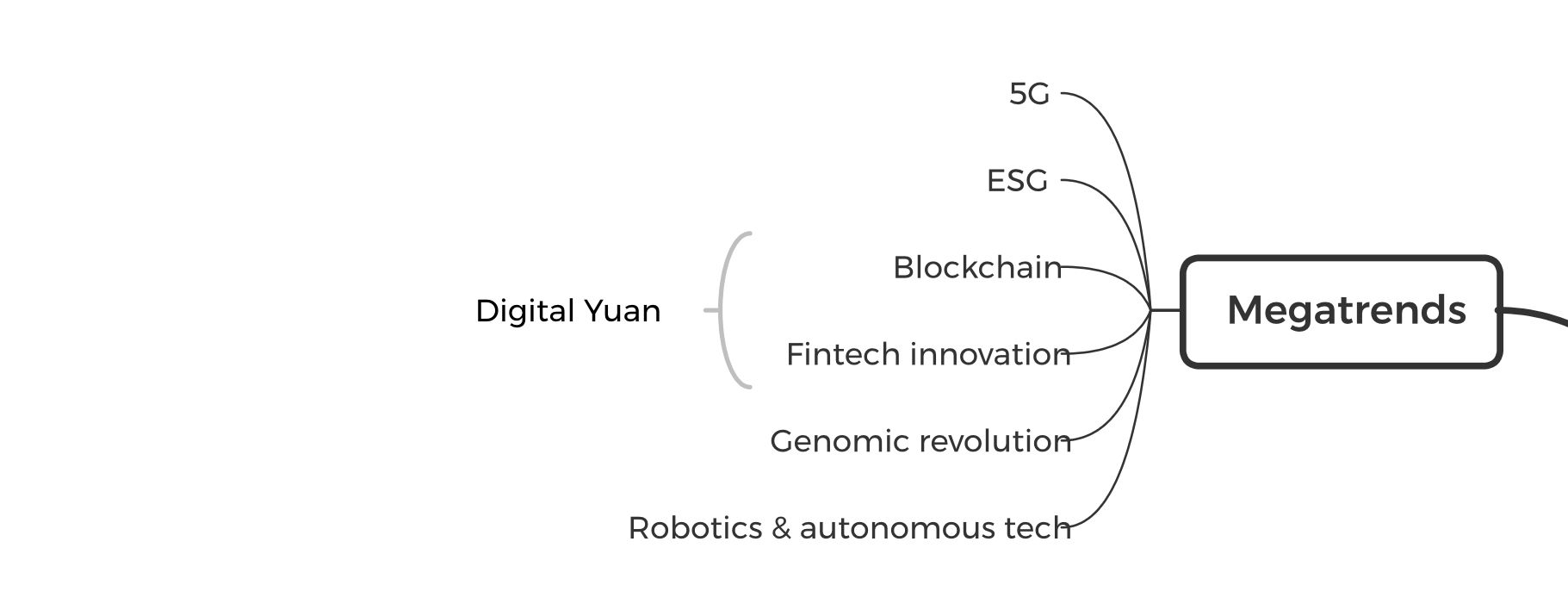

7. Megatrends

Hypothesis

- The major innovation platforms and underlying technologies will change the way the world works, and have fundamental disruptive impact on company business and operating models, and will be crucial to investment performance.

Retrospective May 2021

- While we saw a significant pull-back in valuations of many technology groups in the year to date, I still fundamentally believe in the tech story and their need to allocate capital to the leading companies in these sectors.

- Many are talking of a 1999 tech bubble, but i believe in the valuation multiple expansion is warranted for the leading players (Pinterest, Crowdstrike, Cloudflare, Shopify, etc). These companies are changing the world and deploy capital with a different mindset with focus on growing scale before focussing on profit later in their trajectories, just as we saw with the FAANG.

- Last year I was very excited by 5G and its implications. In retrospect I think I underestimated the implications of Blockchain and it’s offshoots, including Decentralised Finance (DeFi) which have deep implications for the political and legal architecture of societies.